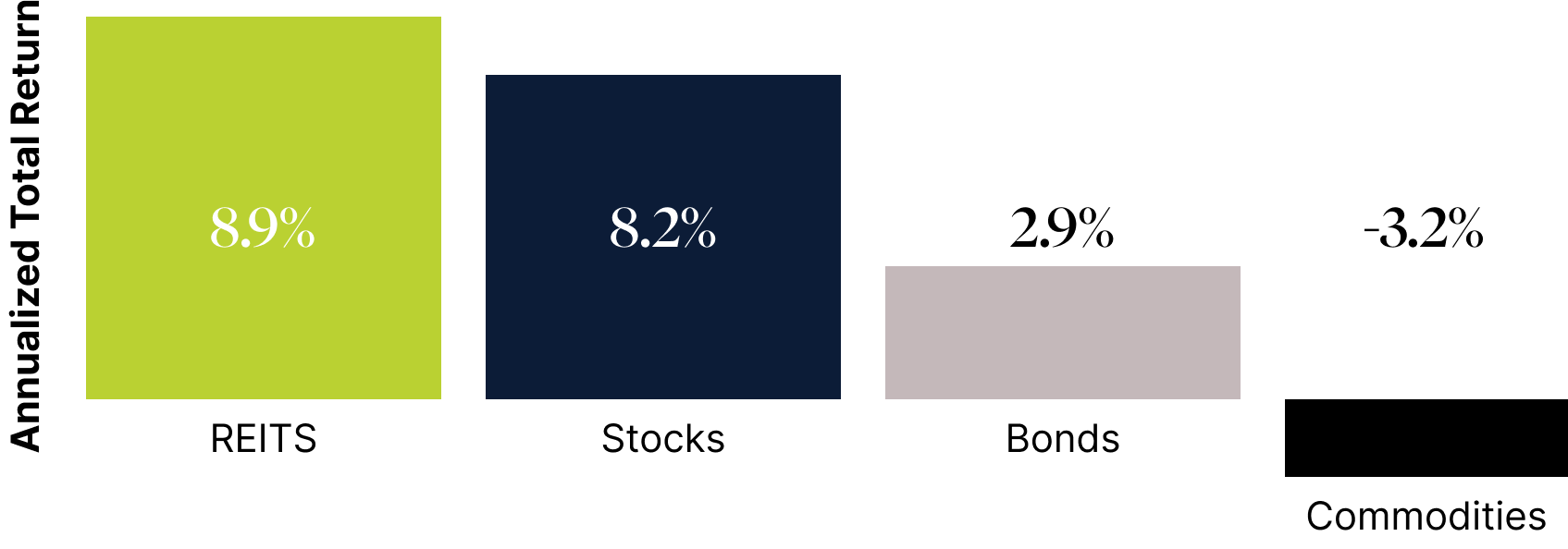

We focus on supply-constrained markets that allow real estate companies to benefit from high occupancy, rising rents and growing distributions.

This disciplined strategy positions Starlight as a leader in the real estate investment landscape, focused on robust performance for our clients.

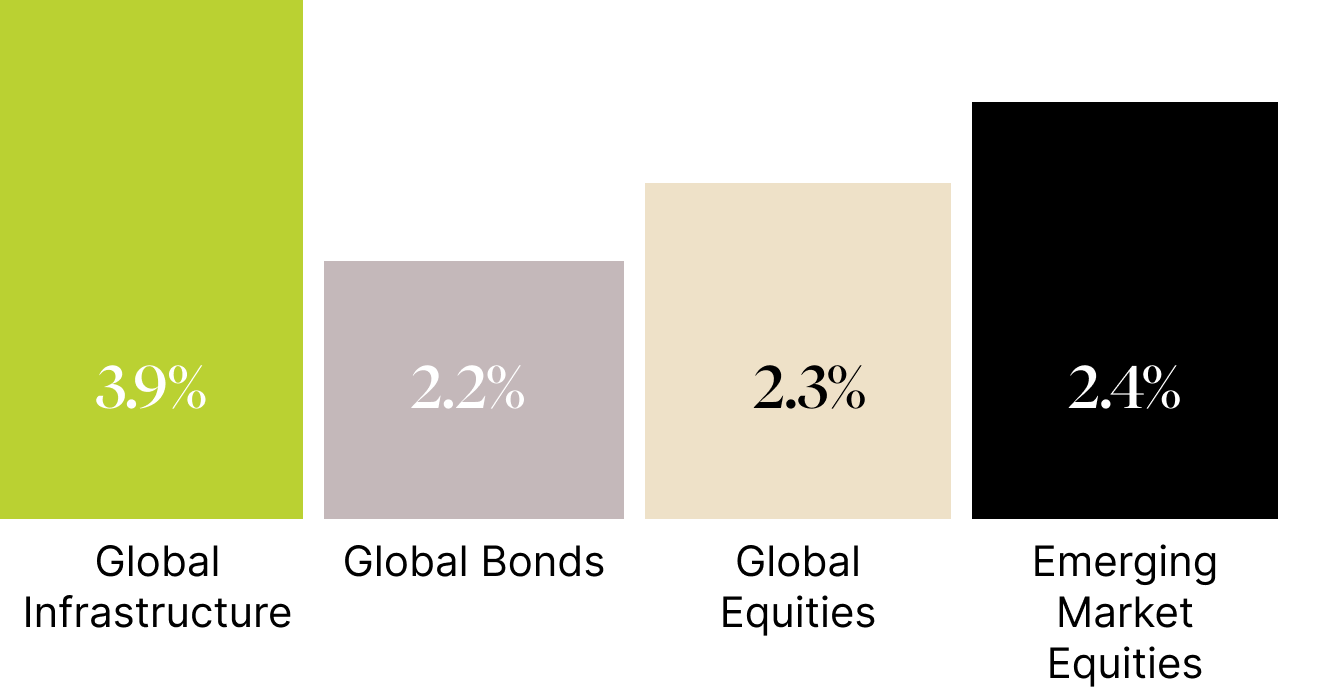

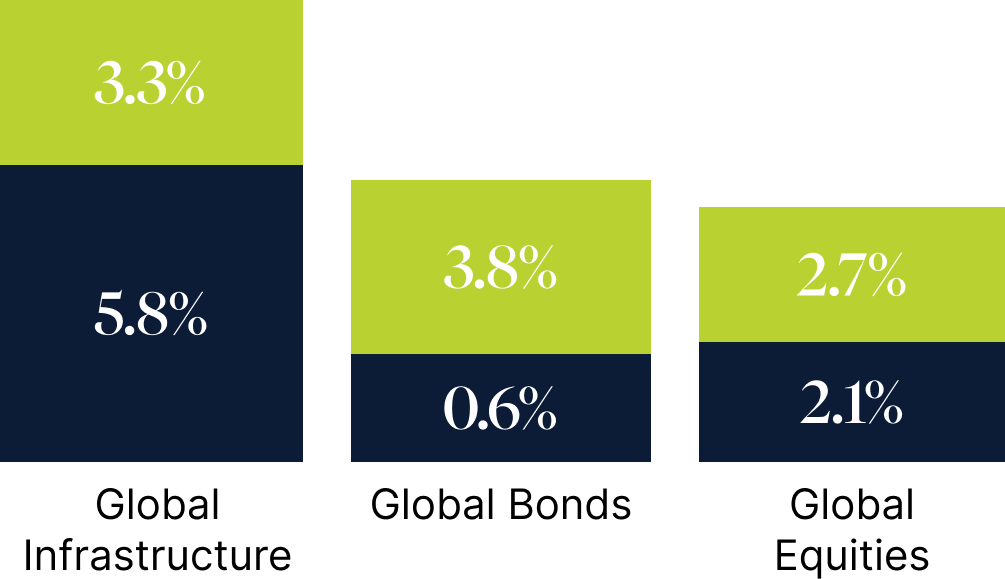

We focus on markets that support infrastructure development and renewal that allow infrastructure companies to benefit from high utilization, rising tolls and fees and growing distributions.

This disciplined strategy positions Starlight as a leader in the infrastructure investment landscape, focused on robust performance for our clients.