Private Alternative Investments

Starlight Private Investment Pools

- Starlight Private Global Real Estate Pool

- Starlight Private Global Infrastructure Pool

- Starlight Global Private Equity Pool

Invest like an Institution with Starlight Capital

Canadian Pension Plan Private Alternative Investment Allocations

| Plan | Year | Assets (millions) | Real Estate | Infrastructure | Real Assets | Private Equity | Alternatives |

|---|---|---|---|---|---|---|---|

| CPPIB | 2023 | $570,296.0 | 9.0% | 9.0% | 18.0% | 33.0% | 51.0% |

| Caisse de dépôt et placement du Québec | 2022 | $401,900.0 | 11.9% | 13.6% | 25.5% | 20.1% | 45.6% |

| Ontario Teachers' Pension Plan | 2022 | $247,240.0 | 11.4% | 16.1% | 27.4% | 23.6% | 51.0% |

| Public Service Pension Plan | 2023 | $243,700.0 | 13.1% | 12.1% | 25.2% | 15.6% | 40.8% |

| BC Investment Management Corporation | 2023 | $233,000.0 | 16.8% | 10.4% | 27.2% | 13.1% | 40.3% |

| AIMCO | 2022 | $135,030.0 | 17.0% | 15.2% | 32.2% | 8.8% | 41.0% |

| Ontario Municipal Employees Retirement System | 2022 | $124,200.0 | 16.8% | 20.8% | 37.6% | 18.4% | 56.0% |

| Healthcare of Ontario Pension Plan | 2022 | $103,674.0 | 17.5% | 4.5% | 22.0% | 19.3% | 41.3% |

| Ontario Pension Board | 2022 | $31,022.4 | 18.8% | 12.2% | 31.0% | 13.3% | 44.3% |

| OP Trust | 2022 | $24,643.0 | 18.9% | 16.1% | 35.0% | 16.1% | 51.1% |

| $2,114,705.4 | 15.1% | 13.0% | 28.1% | 18.1% | 46.2% |

Why Private Alternatives

Uncorrelated returns

Cash flow growth

Outcome

Private Alternative Investments: Starlight Capital Advantage

Institutional-Calibre Due Diligence

Innovative Private Pool Structure

Best-in-Class Private Investment Partners

Canadian accredited investors are just beginning to allocate to private alternatives. However, at Starlight Capital, we've been positioning ourselves to capture private market opportunities for years. Starlight Capital has decades of experience investing in global markets and businesses, and with our institutional-calibre due diligence process and ongoing oversight, Starlight Capital is your trusted partner.

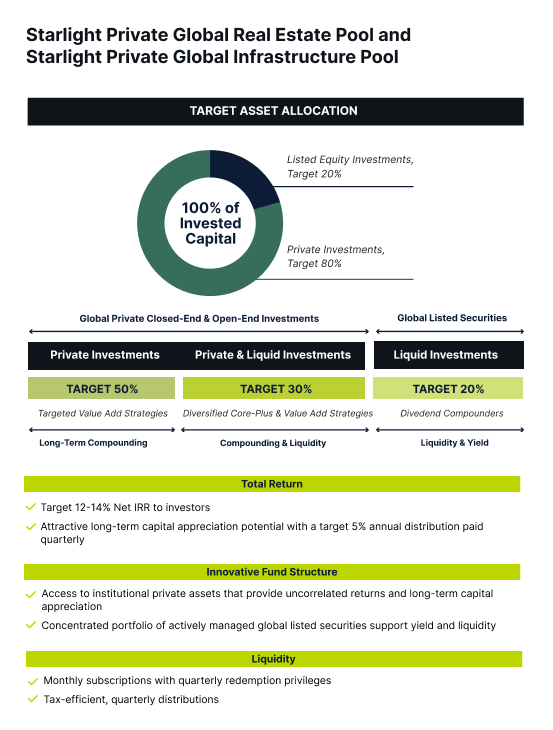

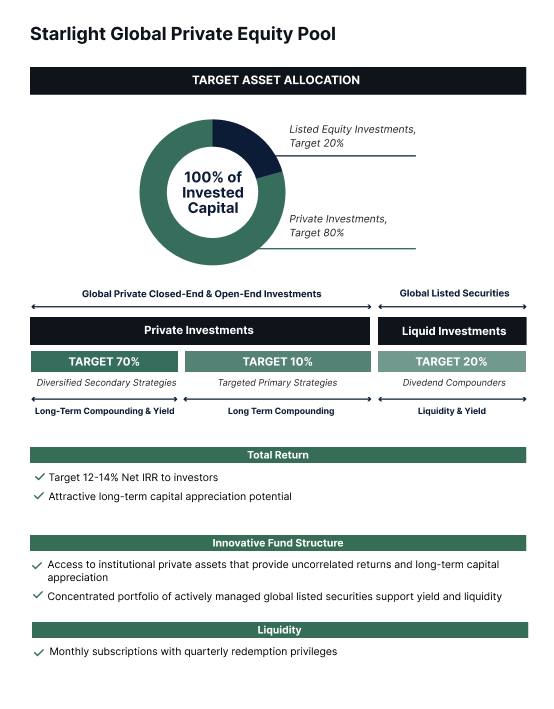

Starlight private investment pools are investor-focused. We target an 80% allocation to private assets for growth potential and target a 20% allocation to listed securities for diversification and liquidity. Canadian accredited investors can benefit from a targeted Net IRR of 12-14%, including a 5% annual distribution* paid quarterly. Monthly subscription and quarterly redemption privileges provide additional flexibility. *Excludes Starlight Global Private Equity Pool.

Each Starlight private investment pool plays a specific role in enhancing risk-reward within a portfolio, achieved through private partnerships with best-in-class private investment partners.

Within each Starlight private investment pool, Canadian accredited investors gain access to a diversified portfolio of private investments, with each private partner contributing distinct and complementary strategies to the overall pool.

Due Dilligence - Idea Generation

Our due diligence process assesses our private investment partners according to predefined criteria, which include:

- Sponsors with at least $1B of AUM, track records over 10 years.

- Sponsors that materially invest in their own strategies.

- Strong short- and long-term track records of success driven by active management and value creation.

- Institutional funds to provide retail investors with access to new strategies.

Due Dilligence - Private Investments

- Each potential private partner is vetted for politically-exposed persons, adverse media, financial impropriety and material litigation.

- Each potential private partner completes our proprietary operational due diligence questionnaire which covers seven areas of their business.

- We interview the executive, investment, and operations teams and consult with existing investors.

- We conduct property and asset tours to verify and evaluate the operating assets or potential investments.

- External Investment Committee review for final approval and on-going oversight after capital deployment.

Due Dilligence - Valuation

- The Starlight Private Pools are allocated to institutional private funds with due diligence performed by other large institutional investors.

- Valuation methodologies follow IFRS accounting and are asset and strategy specific.

- All underlying assets are valued on a periodic basis (monthly or quarterly) and audited annually.

- Underlying investments have independent advisory committees that review the investments and valuations.

- Starlight Capital has reviewed the valuation processes of each institutional private partner, receives regular updates, investor reporting and conducts on-going reviews of the process and its application.

Featured Private Investment Pools

Starlight Private Global Real Estate Pool

Starlight Private Global Infrastructure Pool

Starlight Global Private Equity Pool

Portfolio Managers

Dennis Mitchell

Chief Executive Officer and Chief Investment Officer

Dennis Mitchell

Chief Executive Officer and Chief Investment Officer

Dennis Mitchell joined Starlight Capital in March 2018 as Chief Executive Officer and Chief Investment Officer. He has over 20 years of experience in the investment industry and has held executive positions with Sprott Asset Management, serving as Senior Vice-President and Senior Portfolio Manager, and Sentry Investments, serving as Executive Vice-President and Chief Investment Officer.

Mr. Mitchell received the Brendan Wood International Canadian TopGun Award in 2009, 2010, and 2011 and the Brendan Wood International 2012 Canadian TopGun Team Leader Award. He also received the Afroglobal Television Excellence Award for Enterprise in 2020 and the Black Business and Professionals Association’s Harry Jerome President’s Award in 2021.

Mr. Mitchell holds the Chartered Financial Analyst and Chartered Business Valuator designations and earned a Master of Business Administration from the Schulich School of Business at York University in 2002 and an Honors Bachelor of Business Administration degree from Wilfrid Laurier University in 1998.

Mr. Mitchell currently sits on the Board of the Toronto Foundation and is Co-Founder and Director of the Black Opportunity Fund.

Starlight Private Global Real Estate Pool

Starlight Private Global Infrastructure Pool

Starlight Global Private Equity Pool

Sean Tascatan

Senior Portfolio Manager

Sean Tascatan

Senior Portfolio Manager

Sean Tascatan joined Starlight Capital in January 2023 as Senior Portfolio Manager. He has over 10 years of experience in the investment industry.

Mr. Tascatan most recently held a position at a Canadian independent asset management firm as the lead portfolio manager of numerous dividend funds, including a U.S. Dividend Growth Fund where he specialized in high-quality, dividend paying U.S. equities. Prior to that, he worked at Sentry Investments where he was a key member of an award-winning Equity Income team that garnered multiple Lipper Fund and Morningstar Investment Awards. There, he was the co-manager of a $3B U.S. Growth and Income Fund and a $500MM Diversified Equity Fund.

Mr. Tascatan holds the Chartered Financial Analyst designation and has completed the Options Licensing Course and has an Honours Bachelor of Arts degree in Economics and Financial Management from Wilfrid Laurier University.

Starlight Global Private Equity Pool

Hisham Yakub

Senior Portfolio Manager

Hisham Yakub

Senior Portfolio Manager

Hisham Yakub joined Starlight Capital in February 2023 as Senior Portfolio Manager. He has over 10 years of experience in the investment industry.

Mr. Yakub most recently held a position with a boutique Toronto-based investment management firm as an Investment Analyst and Portfolio Manager. He also spent the first six years of his business career focused on developing software tools for portfolio management applications. He progressed through several roles across the industry and finished his pre-MBA career at CPP Investment Board.

Mr. Yakub holds the Chartered Financial Analyst and Financial Risk Manager designations and earned a Master of Business Administration from the Rotman School of Management at the University of Toronto in 2013 and an Honours Bachelor of Business Administration degree with a specialization in Information Systems from York University.

Starlight Private Global Infrastructure Pool

Speak to your advisor

This material is for informational and educational purposes only. The information contained herein is not an offer to sell nor a solicitation to buy any security. Such an offer can only be made by prospectus or other applicable offering document.

There are ongoing fees and expenses associated with owning units of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents.

Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Are you an accredited investor?

Starlight Private Pools are offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement. By clicking “Accept”, you confirm that you are an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions, and in Ontario, within the meaning of Section 73.3 of the Securities Act (Ontario) as supplemented by the definition in National Instrument 45-106, on the basis that you fit within the category of an “accredited investor” as defined therein.

You may be an “accredited investor” if:

- your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level of income this year;

- you, alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities (cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets); or

- you, alone or together with a spouse, have net assets of at least $5 million (for the purposes of the net asset test, the calculation of total assets would include the value of a purchaser’s personal residence and the calculation of total liabilities would include the amount of any liability (such as a mortgage) in respect of the purchaser’s personal residence).

It is your obligation to consult with your financial advisor and/or such other advisors as you deem necessary in making the determination that you meet the definition of “accredited investor”.

Disclaimer

Information pertaining to the Starlight Private Pools is not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of the Starlight Private Pools are made pursuant to their respective offering memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Important information about the Starlight Private Pools including a statement of each fund’s fundamental investment objective, is contained in their respective offering memorandum, a copy of which may be obtained from your dealer. Read the applicable offering memorandum carefully before investing. Unit values and investment returns will fluctuate.