Real Assets and Real Income

In a market defined by a desire for stable income, convertible debentures, preferred shares and covered call ETFs have seen increased demand. While these investments are popular, they are proving less effective at generating sustainable income as rates normalize. This market shift highlights a clear need for alternative solutions. For investors seeking income and growth, real assets—specifically real estate and infrastructure—are a compelling and strategic choice.

What are Real Assets?

Investing in real assets means investing in essential assets and businesses that allow an economy to function. Their critical nature provides recession-resistance, a hedge to inflation, recurring tax-efficient income, and long term capital appreciation.

Real assets, specifically real estate and infrastructure, are businesses that provide essential services in a supply-constrained manner to large portions of the population. These services include housing, healthcare, logistics, electricity, water, waste collection, communications, payment processing, data storage, and high-speed internet. Due to their essential nature, these services generate a stable revenue stream, as households, corporations, and municipalities continue to pay for them even during periods of economic weakness.

Real assets, specifically real estate and infrastructure, are businesses that provide essential services in a supply-constrained manner to large portions of the population. These services include housing, healthcare, logistics, electricity, water, waste collection, communications, payment processing, data storage, and high-speed internet. Due to their essential nature, these services generate a stable revenue stream, as households, corporations, and municipalities continue to pay for them even during periods of economic weakness.

Consistent and Rising Income Generation

The traditional view of real assets as purely defensive with limited growth is outdated. Data shows that global real assets have consistently outperformed global equities over the long term (Exhibit 1).

Exhibit 1 – Global Real Assets Total Returns vs. Global Equity Total Returns

Source: Bloomberg Finance L.P., June 30, 2025. Note: Real Estate Total Returns represented by the RUGL Index. Infrastructure Total Returns represented by the SPGTINTR Index. Global Equity Total Returns represented by the MXWO Index.

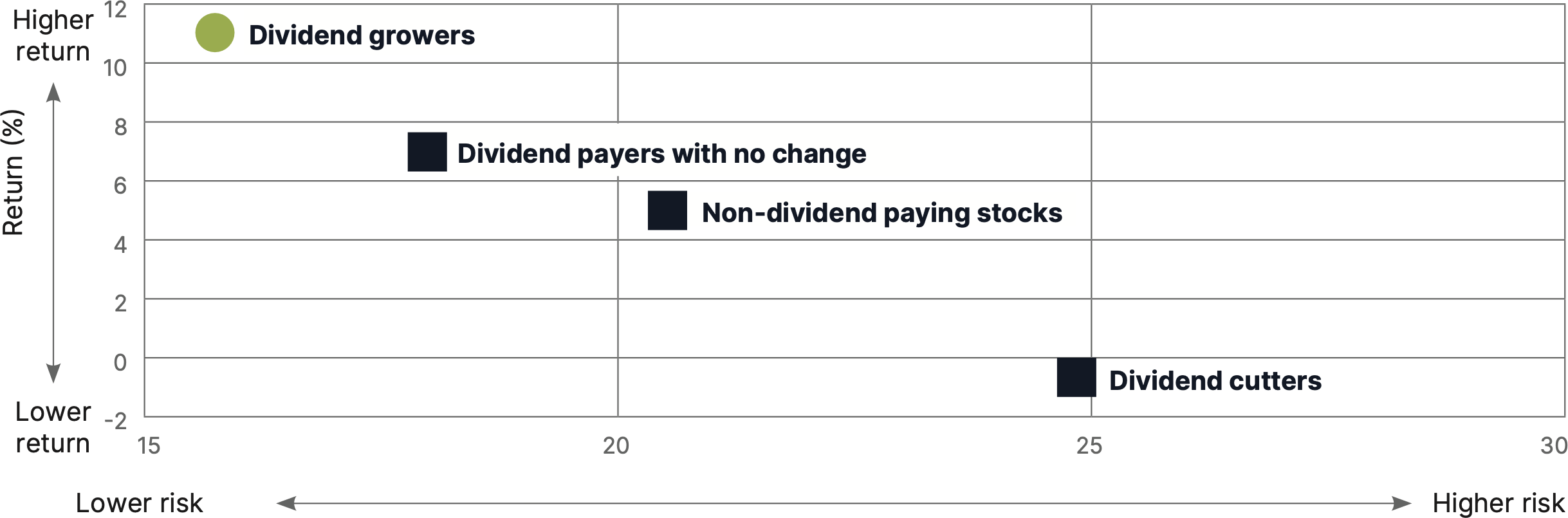

Real assets’ outperformance can largely be attributed to the consistent dividends and distributions paid by real estate and infrastructure companies. Companies that have historically increased their dividends have outperformed on a total return basis with less volatility (Exhibit 2).

Exhibit 2 - Risk-Adjusted Returns of S&P 500 Index Stocks by Dividend Policy

Risk vs return, annualized, 1973 - 2021

Risk vs return, annualized, 1973 - 2021

Source: Ned Davis Research, December 2021.

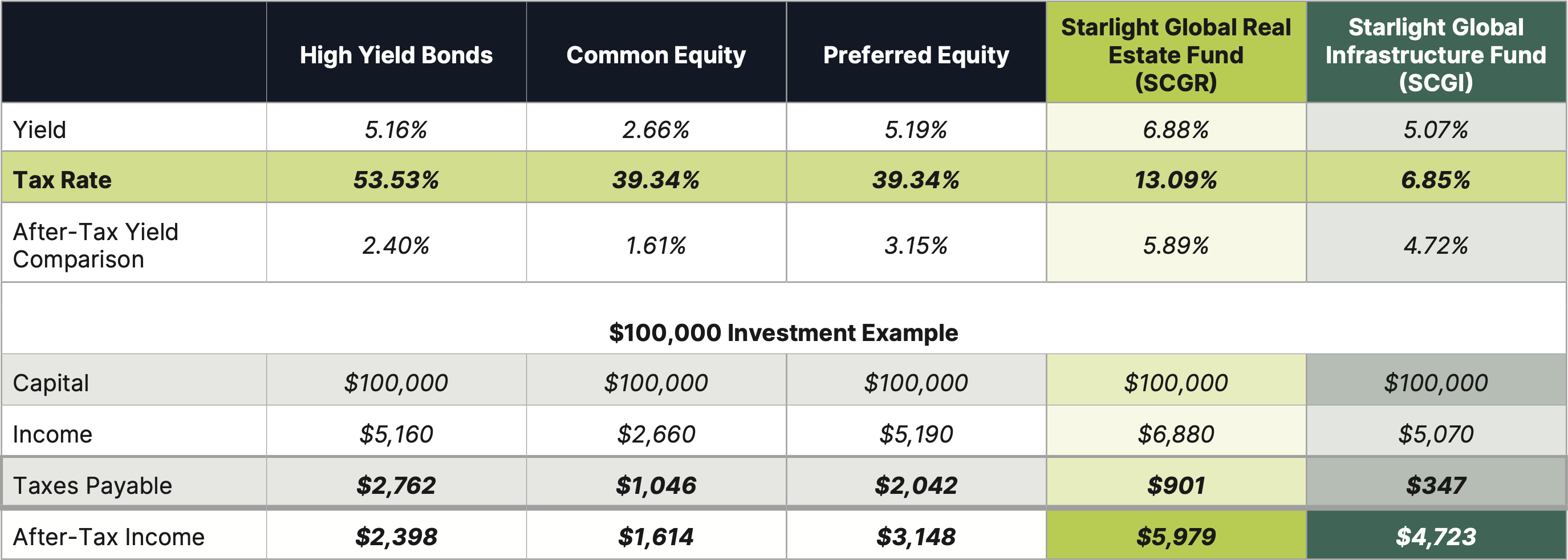

Tax-Efficient Income

A significant portion of real asset distributions have historically been paid as a return of capital. This unique advantage means investors get to keep more of their distributions after-tax.

Investors in the Starlight Global Real Estate Fund (SCGR) and the Starlight Global Infrastructure Fund (SCGI) received most of their distributions in the form of return of capital in 2024. This advantageous tax treatment results in investors retaining more of their Starlight distributions compared to dividends from preferred and common shares or even the higher coupons from high yield and convertible bonds.

Based on our data as of June 30, 2025, for an Ontario resident with a high income, an investor would need exceptionally high yields from other assets to match the after-tax yield of these funds.

The below table illustrates this advantage, showing how Starlight real assets fund can provide more after-tax income from the same initial investment (Exhibit 3).

Investors in the Starlight Global Real Estate Fund (SCGR) and the Starlight Global Infrastructure Fund (SCGI) received most of their distributions in the form of return of capital in 2024. This advantageous tax treatment results in investors retaining more of their Starlight distributions compared to dividends from preferred and common shares or even the higher coupons from high yield and convertible bonds.

Based on our data as of June 30, 2025, for an Ontario resident with a high income, an investor would need exceptionally high yields from other assets to match the after-tax yield of these funds.

- To match the after-tax yields from the Starlight Global Real Estate Fund (SCGR), an investor would typically need equities yielding 9.9%+ or bonds yielding 12.9%+.

- Similarly, to match the after-tax yields from the Starlight Global Infrastructure Fund (SCGI), an investor would need equities yielding 7.8%+ or bonds yielding 10.2%+.

The below table illustrates this advantage, showing how Starlight real assets fund can provide more after-tax income from the same initial investment (Exhibit 3).

Exhibit 3 - Canadian After Tax Yield and Income Comparison

Starlight Real Assets Funds vs. High Yield Bonds vs. Common and Preferred Equity

Starlight Real Assets Funds vs. High Yield Bonds vs. Common and Preferred Equity

Note: High Yield Bonds represented by the Mackenzie Global High Yield Fixed Income ETF, Common Equity represented by the S&P/TSX Composite Index, Preferred Equity represented by BMO Laddered Preferred Share Index ETF, SCGR is the Starlight Global Real Estate Fund (Series ETF), and SCGI is the Starlight Global Infrastructure Fund (Series ETF). Tax rates based on an Ontario resident with taxable income greater than $220,000. SCGR and SCGI tax breakdowns based on 2024 tax year. Source: Bloomberg, E&Y Tax Calculators, Starlight Capital, June 30, 2025. All yields and pricing are as of June 30, 2025.

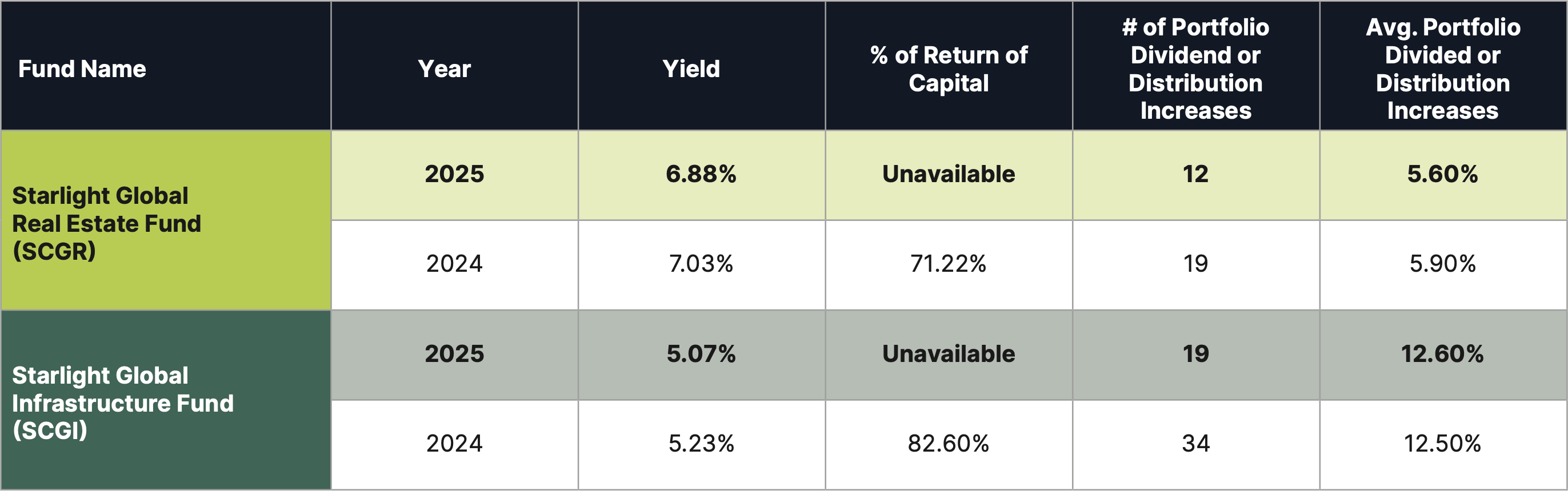

Both the Starlight Global Real Estate Fund and the Starlight Global Infrastructure Fund yield over 5.50% annually and the distributions are paid to investors on a monthly basis. High absolute yields from the Starlight real assets funds are supported by strong dividend and distribution growth from the underlying investments (Exhibit 4).

Exhibit 4 - Starlight Real Assets Funds Yield, ROC and Distribution Increases

Note: SCGR is the Starlight Global Real Estate Fund (Series ETF) and SCGI is the Starlight Global Infrastructure Fund (Series ETF). Source: Starlight Capital as of June 30, 2025 and December 31, 2024.

More After-Tax Cash Flow with Less Capital

Investors can choose to invest in other asset classes to generate income, however, income from some of these asset classes has deteriorated over the last 25 years. In the year 2000 investors could generate a comfortable 6.3% annualized yield by investing in AAA-rated 10-year Canadian government bonds.

Today, to generate a similar income stream out of fixed income, investors are faced with two choices:

Allocating capital to riskier companies or countries during a period of slowing economic growth seems like a poor decision. Allocating more capital to treasuries is feasible, however, in order to generate the same level of after-tax income as offered in the year 2000, investors would have to allocate almost 50% more capital to 10-year bonds or over two times as much capital than the Starlight real assets funds.

The strategy of investing in real assets offers a far more efficient solution. Investors in the Starlight Global Real Estate Fund and the Starlight Global Infrastructure Fund can generate the same absolute level of after-tax cash flow with significantly less capital. This strategy should result in more after-tax cash flow with a lower risk profile for investors (Exhibit 5).

Today, to generate a similar income stream out of fixed income, investors are faced with two choices:

- Take on significantly more risk by investing in high yield or emerging market bonds; or

- Allocate significantly more capital to fixed income.

Allocating capital to riskier companies or countries during a period of slowing economic growth seems like a poor decision. Allocating more capital to treasuries is feasible, however, in order to generate the same level of after-tax income as offered in the year 2000, investors would have to allocate almost 50% more capital to 10-year bonds or over two times as much capital than the Starlight real assets funds.

The strategy of investing in real assets offers a far more efficient solution. Investors in the Starlight Global Real Estate Fund and the Starlight Global Infrastructure Fund can generate the same absolute level of after-tax cash flow with significantly less capital. This strategy should result in more after-tax cash flow with a lower risk profile for investors (Exhibit 5).

Exhibit 5 - Canadian After Tax Income Comparison

Starlight Real Assets Funds vs. 10-Year Bonds

Starlight Real Assets Funds vs. 10-Year Bonds

Source: Bloomberg Finance L.P. U.S. 10-year yield and Starlight Capital as of June 30, 2025.

We invite you to explore how the Starlight Global Real Estate Fund and Starlight Global Infrastructure Fund can provide capital appreciation, with a more tax-efficient income solution for your portfolios.

Real Assets

Starlight Global Real Estate Fund

Inception — 2018

Investment Objective:

To provide regular current income by investing globally primarily in real estate investment trusts (REITs) and equity securities of corporations participating in the residential and commercial real estate sector.

Distribution Frequency

Fixed Monthly

Fund Codes

Series A (SLC101)

Series F (SLC201)

Series FT6 (SLC251)

Series T6 (SLC151)

Series ETF (SCGR)

Investment Objective:

To provide regular current income by investing globally primarily in real estate investment trusts (REITs) and equity securities of corporations participating in the residential and commercial real estate sector.

Distribution Frequency

Fixed Monthly

Fund Codes

Series A (SLC101)

Series F (SLC201)

Series FT6 (SLC251)

Series T6 (SLC151)

Series ETF (SCGR)

Starlight Global Infrastructure Fund

Inception — 2018

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Distribution Frequency

Fixed Monthly

Fund Codes

Series A (SLC102)

Series F (SLC202)

Series FT6 (SLC252)

Series T6 (SLC152)

Series ETF (SCGI)

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Distribution Frequency

Fixed Monthly

Fund Codes

Series A (SLC102)

Series F (SLC202)

Series FT6 (SLC252)

Series T6 (SLC152)

Series ETF (SCGI)

The views in this update are subject to change at any time based upon market or other conditions and are current as of August 8, 2025. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.