Why invest in real estate?

Key Takeaways:

- Similar to mutual funds, real estate investment trusts (REITs) pool capital from numerous investors to invest in portfolios of real estate. Investing in real estate today offers investors exposure to structural trends driven by the housing shortage, global trade, aging populations and technology real estate.

- The current economic environment presents an excellent opportunity for investors to move capital into real estate investments. Real estate offers a blend of tax-efficient income and inflation-linked growth, making them a staple in diversified investment portfolios.

- Large endowment funds and pension plans have been allocating more capital to global real estate. Canadian retail investors should consider following suit to capture the same risk-adjusted total returns.

Real estate attributes

Real estate assets provide the foundation for economic activity in global economies.

Real estate assets provide the foundation for economic activity in global economies.

Benefits of real estate assets:

Subsectors:

Real Estate Benefits

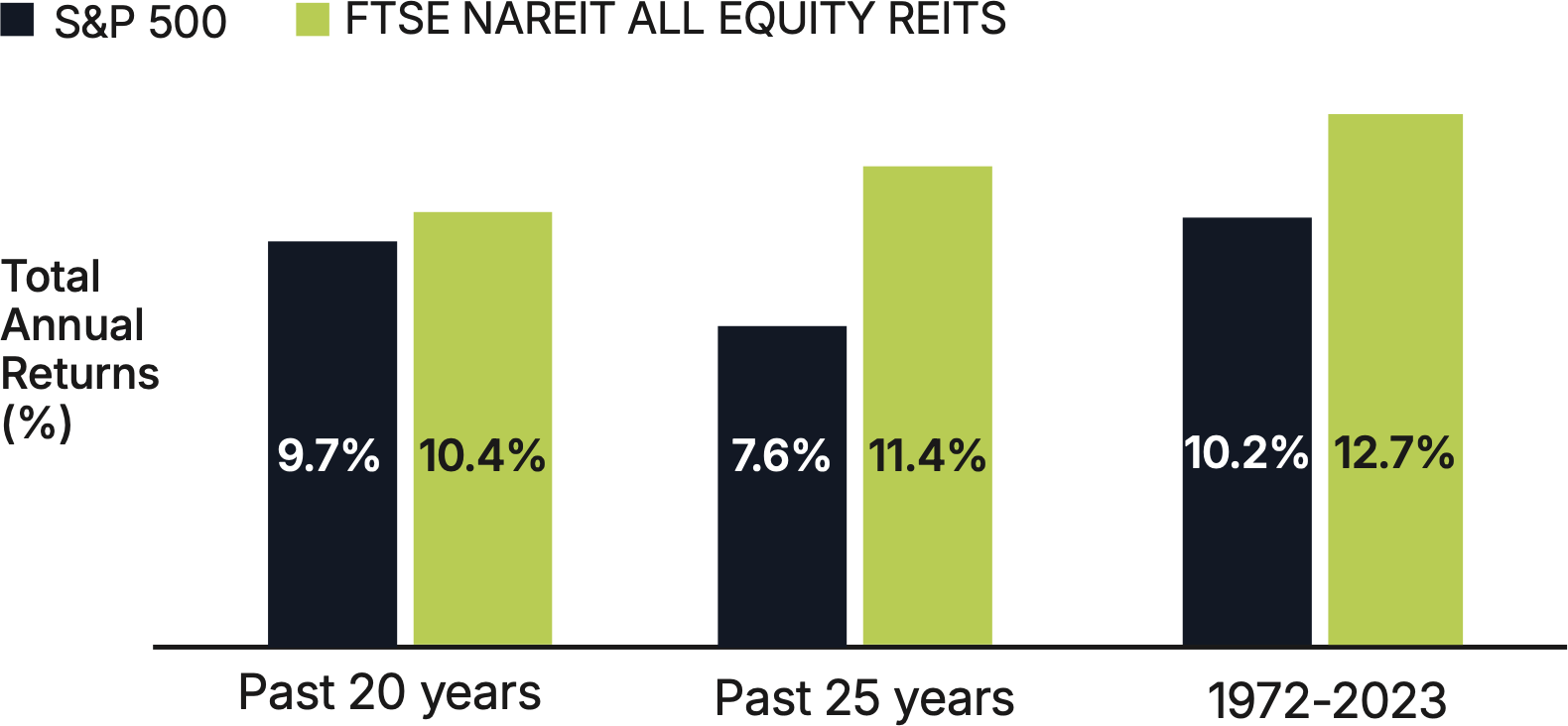

Over the past 20-, 25-, and 50- years, U.S. REITs have outperformed the S&P 500. REITs have generally provided strong total returns comprised of tax-efficient and growing distributions, and long-term capital appreciation driven by Net Operating Income growth.

REITs outperform stocks in the long-term

Source: Nareit and YCharts (2024). Past performance is not indicative of future results. There can be no assurance that past performance will be replicated.

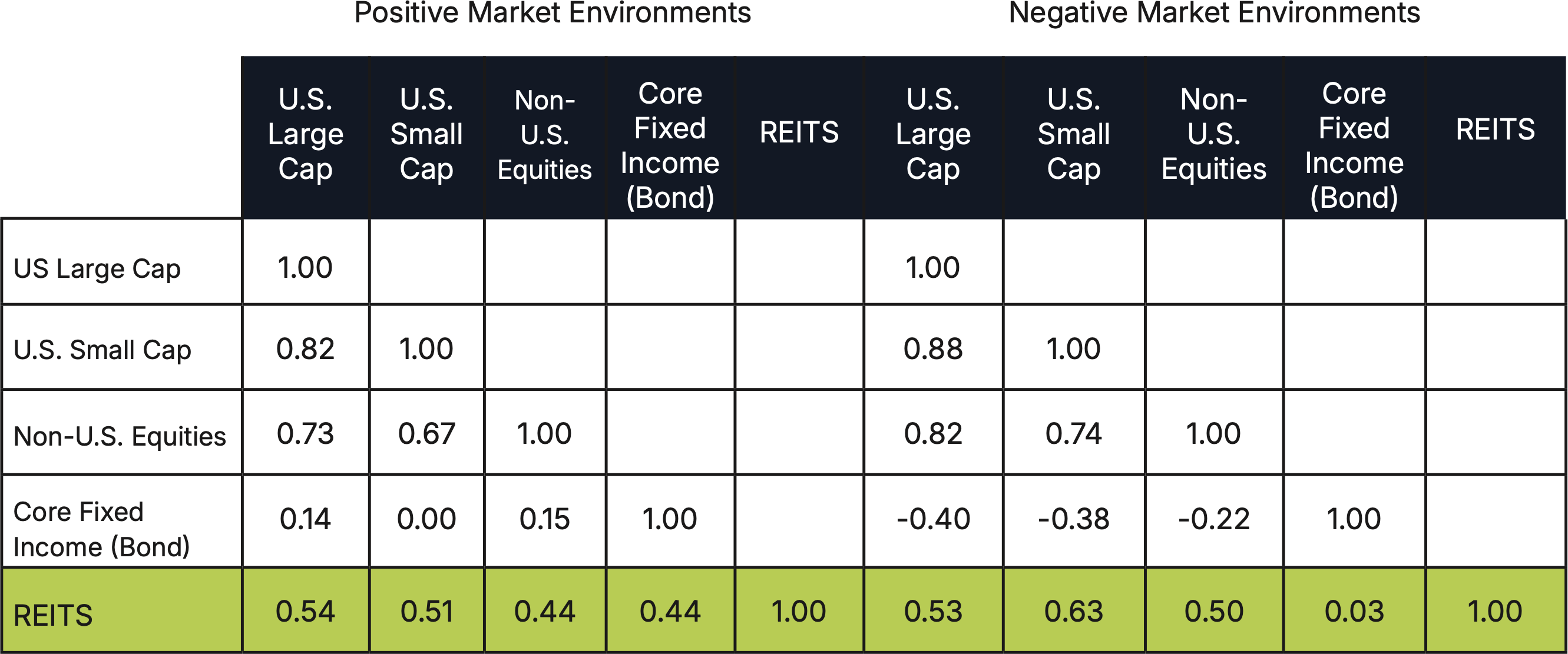

Portfolio diversification

Historically, real estate securities have shown relatively low correlations to stocks and bonds1. This means that adding real estate securities to a portfolio should enhance diversification and result in the portfolio generating higher returns for the same amount of risk.

Historically, real estate securities have shown relatively low correlations to stocks and bonds1. This means that adding real estate securities to a portfolio should enhance diversification and result in the portfolio generating higher returns for the same amount of risk.

Real estate correlations 2000 - 2022

Source: PGIM (2024). Rethinking Resiliency and Risk. Past performance is not indicative of future results. There can be no assurance that past performance will be replicated. 1Correlation measures the extent to which two items move in the same direction. A correlation value of 1 means two items move closely in the same direction, while 0 means they do not move closely at all in either direction, and -1 means the items move closely in opposite directions.

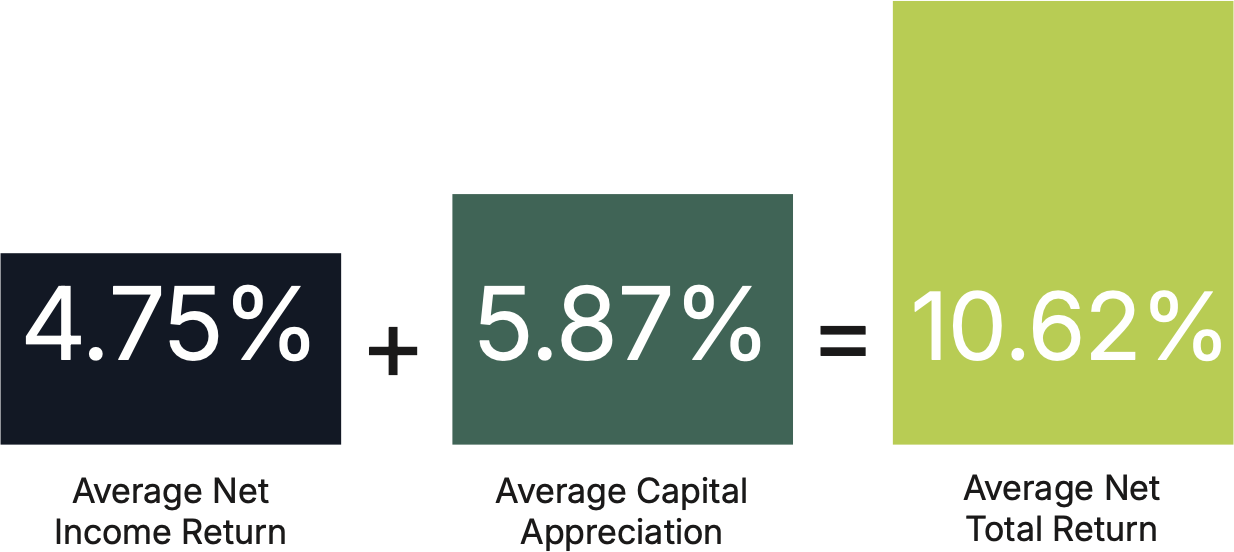

Consistent and rising income

The contractual nature of the revenue streams and the requirement to pay out 90% of pretax income to unitholders means REITs have historically generated consistent income for investors.

The contractual nature of the revenue streams and the requirement to pay out 90% of pretax income to unitholders means REITs have historically generated consistent income for investors.

Income and Capital Appreciation of Listed Equity U.S. REITs, 25-year Period

Source: 25-year period is represented by 1988Q4-2013Q3. Income and Capital Appreciation from Real Estate Investing: The Participation Trophy and the Performance Record, NAREIT Market Commentary, 29 August 2017. Past performance is not indicative of future results. There can be no assurance that past performance will be replicated.

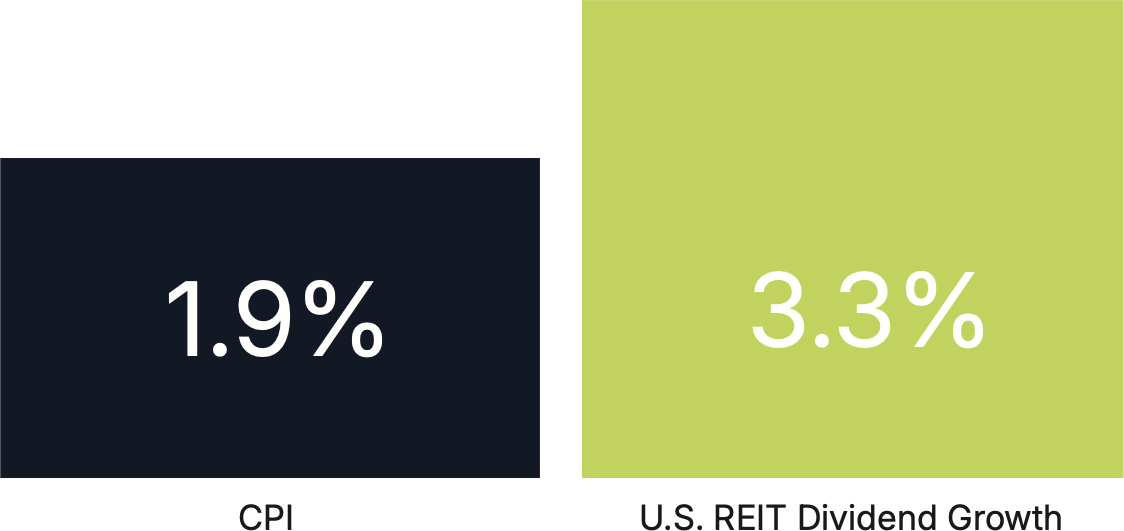

Inflation protection

Many REITs have annual rent increases that are tied to inflation and/or revenues that are sensitive to economic activity. As a result, rising inflation leads to cash flow growth and asset appreciation in these REITs.

Many REITs have annual rent increases that are tied to inflation and/or revenues that are sensitive to economic activity. As a result, rising inflation leads to cash flow growth and asset appreciation in these REITs.

Source: Bloomberg, as at October 22, 2018. Past performance is not indicative of future results. There can be no assurance that past performance will be replicated.

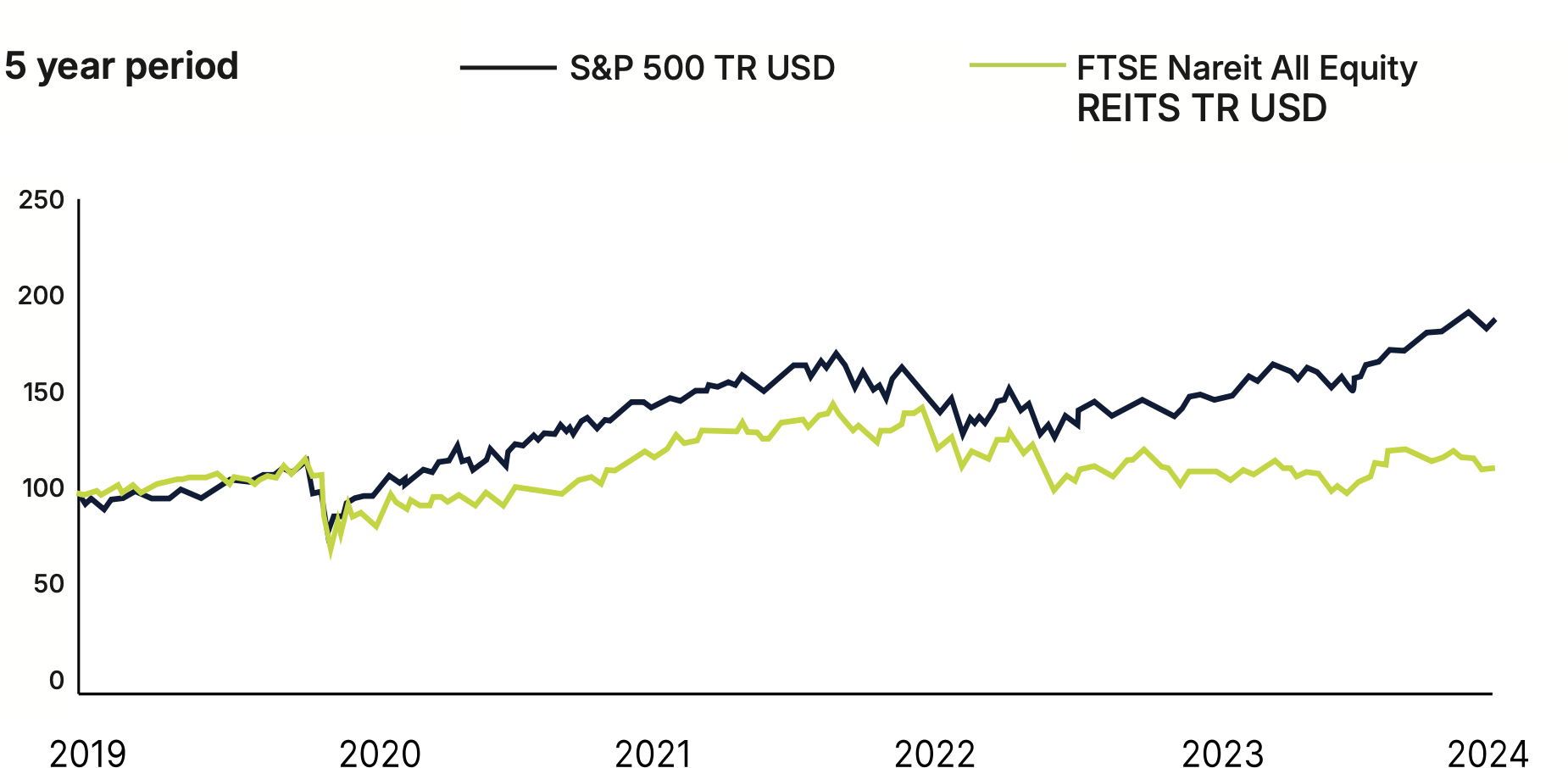

REITs are currently trading at large discounts to Net Asset Value – an excellent buying opportunity

U.S. stocks have outperformed U.S. REITs in recent years, creating a valuation gap that we believe will reverse. Historically, such discounts have been followed by periods of REIT outperformance. With the Federal Reserve Bank commencing an aggressive rate cut cycle, U.S. REITs should continue to outperform U.S. equities.

Stocks have surged away from REITs in recent years

Source: Cohen & Steers. As of April 30, 2024. Past performance is not indicative of future results. There can be no assurance that past performance will be replicated.

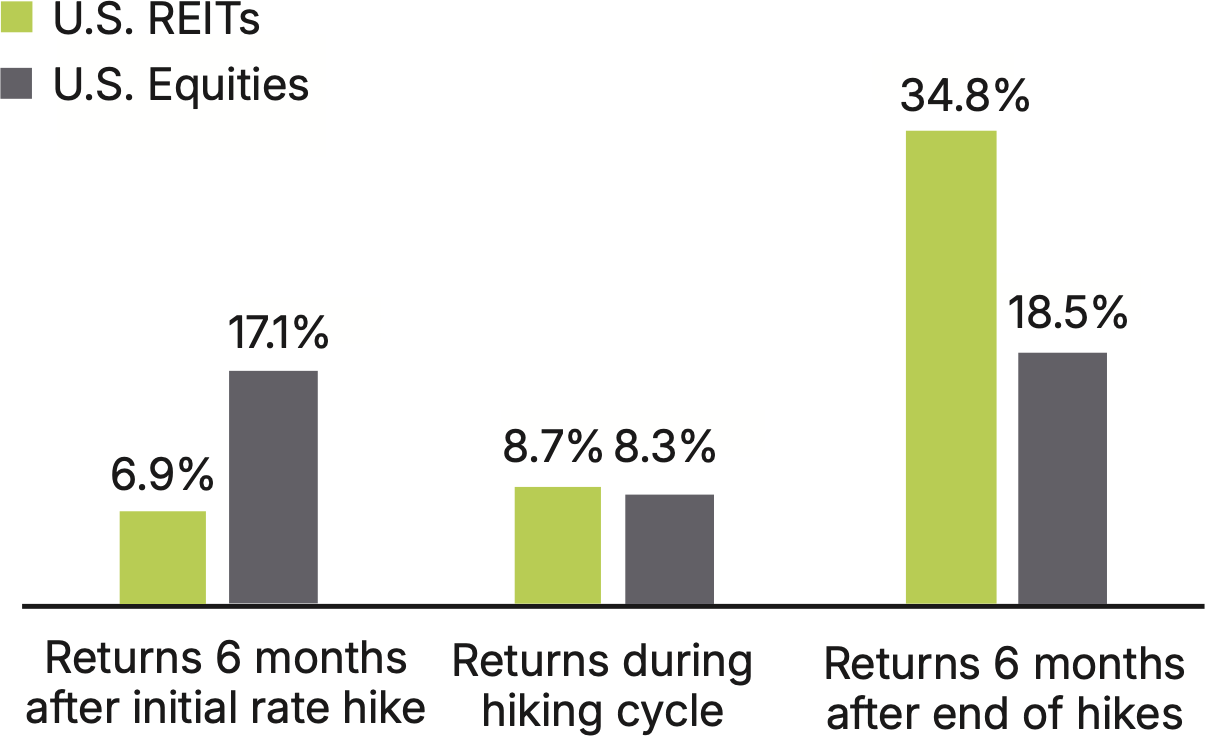

REITs tend to outperform following rate hike cycles

The start of monetary easing (rate cuts) combined with enduring structural tailwinds in the real estate market, positions REITs for long-term outperformance. The graph below shows outperformance of the asset class over periods of six months following a tightening cycle.

Real estate outperformance after rate hike cycles

Source: Cohen & Steers calculations, Bloomberg Finance L.P., and Federal Reserve. As of August 31, 2022. Past performance is not indicative of future results. There can be no assurance that past performance will be replicated.

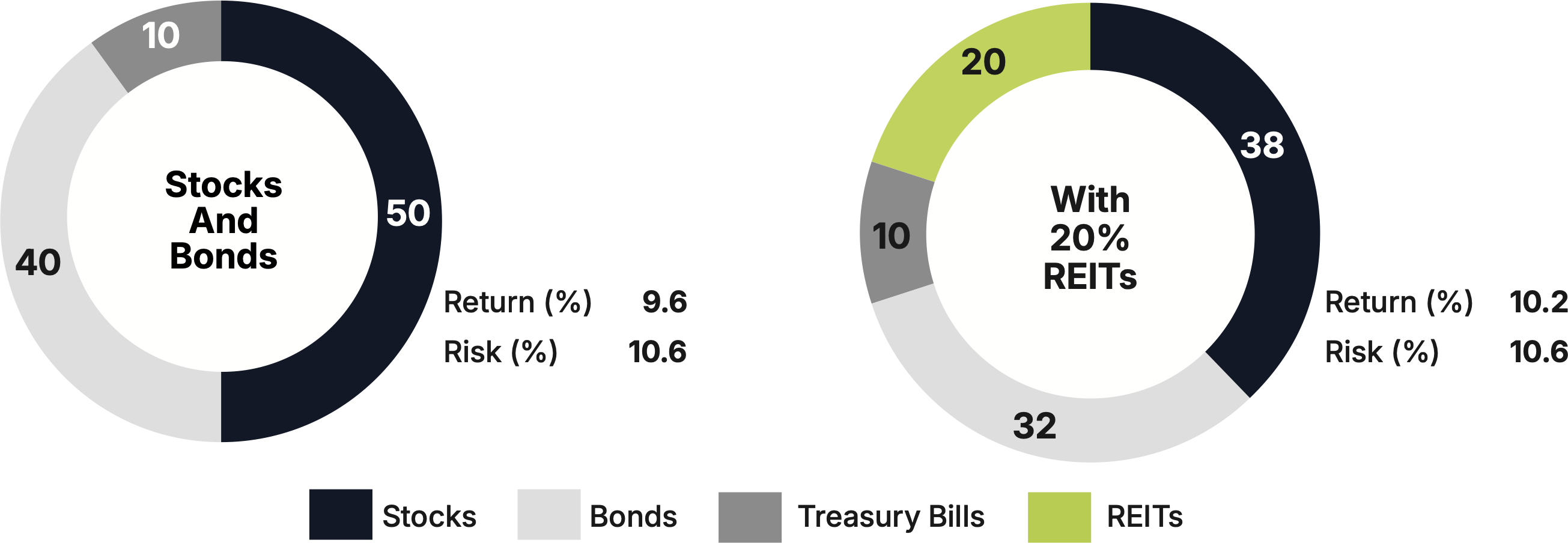

REITs can increase portfolio returns without adding additional risk

Considering the impact on risk-and-return profiles, adding an allocation of REITs to a portfolio can increase returns without increasing risk and can add meaningful diversification—other stocks are subject to the business cycle while REITs represent a separate and unique asset class subject to the real estate market cycle.

Risk and Return: Increased returns without increasing risk (1972-2023)

Source: Nareit. 2024-2025 REIT Quick Facts.

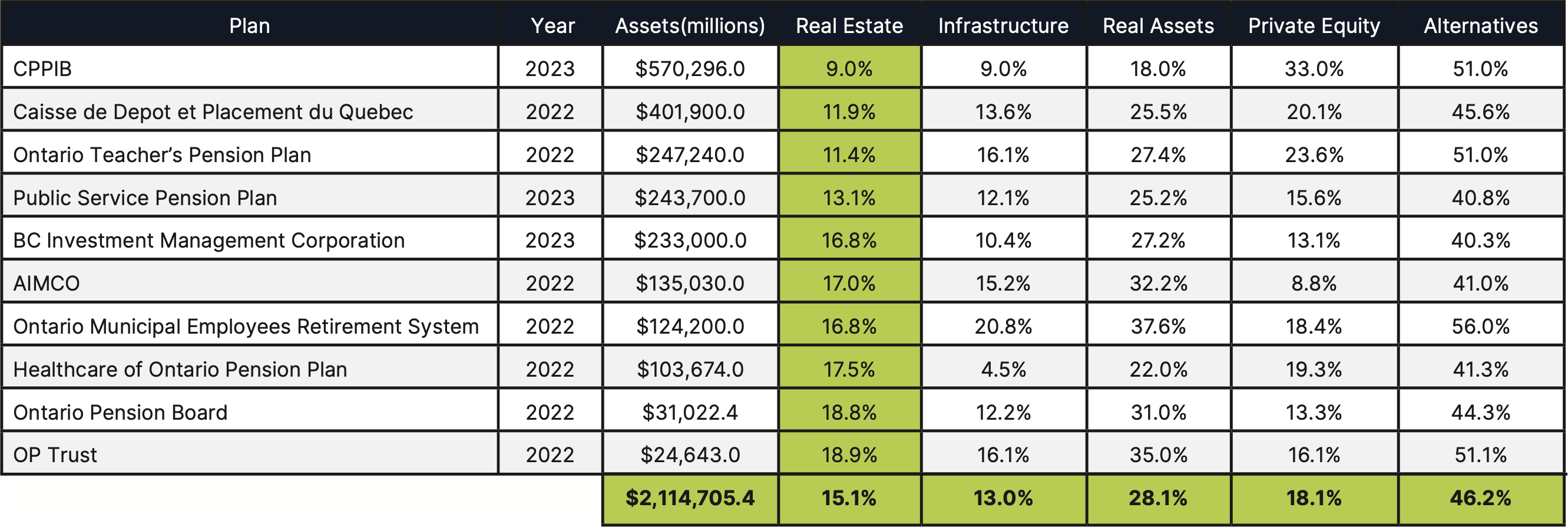

Pension funds increasing real estate investments

“Since 1999 equity allocations have shrunk from 61% to 45% while the allocation to bonds slightly reduced from 30% to 29%. Allocation to other assets (real estate and other alternatives) has increased from 6% in 1999 to an estimated 23% at the end of 2019.” - Thinking Ahead Institute and Pensions & Investments joint research

Source: Pension Plan Annual Reports.

Access global real estate with Starlight Capital

Starlight Capital is an independent Canadian asset management firm with over $1 billion in assets under management. We manage Global and North American diversified private and public equity investments across traditional and alternative asset classes, including real estate, infrastructure and private equity. Our goal is to deliver superior risk-adjusted, total returns to investors through a disciplined investment approach: Focused Business Investing.

Focused Business Investing means we invest in great businesses when they offer us enough return for the risk we are exposed to. Great businesses are characterized by strong recurring cash flow, irreplaceable assets, low leverage, and strong management team. The result is concentrated portfolios of great businesses that reward investors with rising dividends.

Starlight Capital is an independent Canadian asset management firm with over $1 billion in assets under management. We manage Global and North American diversified private and public equity investments across traditional and alternative asset classes, including real estate, infrastructure and private equity. Our goal is to deliver superior risk-adjusted, total returns to investors through a disciplined investment approach: Focused Business Investing.

Focused Business Investing means we invest in great businesses when they offer us enough return for the risk we are exposed to. Great businesses are characterized by strong recurring cash flow, irreplaceable assets, low leverage, and strong management team. The result is concentrated portfolios of great businesses that reward investors with rising dividends.

Starlight Capital approach:

The Starlight Global Real Estate Fund provides investors with income and long-term growth by investing in high-quality real estate assets in markets with strong fundamentals, including growing populations and limited new supply.

1

Disciplined investment approach: We strive to deliver superior, risk-adjusted, long-term returns for investors through our proprietary investment strategy Focused Business Investing. We build concentrated portfolios of high-quality businesses when they offer us sufficient return for the risk incurred.

2

Differentiated investment solutions: Concentrated global portfolios of high-quality real estate or infrastructure businesses offered through mutual funds, exchange-traded funds, structured products, and private investment pools for accredited investors.

3

Deep Expertise: Dennis Mitchell, CEO & CIO of Starlight Capital, has led investment teams of more than 30 people and exercised oversight of more than $18 billion in AUM. He brings over 20 years of experience managing an investment team responsible for more than $2 billion of global real estate and infrastructure securities.

The Starlight Global Real Estate Fund provides investors with income and long-term growth by investing in high-quality real estate assets in markets with strong fundamentals, including growing populations and limited new supply.

1

Disciplined investment approach: We strive to deliver superior, risk-adjusted, long-term returns for investors through our proprietary investment strategy Focused Business Investing. We build concentrated portfolios of high-quality businesses when they offer us sufficient return for the risk incurred.

2

Differentiated investment solutions: Concentrated global portfolios of high-quality real estate or infrastructure businesses offered through mutual funds, exchange-traded funds, structured products, and private investment pools for accredited investors.

3

Deep Expertise: Dennis Mitchell, CEO & CIO of Starlight Capital, has led investment teams of more than 30 people and exercised oversight of more than $18 billion in AUM. He brings over 20 years of experience managing an investment team responsible for more than $2 billion of global real estate and infrastructure securities.

Real Assets

Starlight Global Real Estate Fund

Inception - 2018

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to Real Estate.

Fund Profile:

Starlight Global Real Estate Fund - Series ETF (SCGR)

Starlight Global Real Estate Fund - Series A (SLC101)

Starlight Global Real Estate Fund - Series T6 (SLC151)

Starlight Global Real Estate Fund - Series F (SLC201)

Starlight Global Real Estate Fund - Series FT6 (SLC251)

Distribution Frequency

Fixed Monthly

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to Real Estate.

Fund Profile:

Starlight Global Real Estate Fund - Series ETF (SCGR)

Starlight Global Real Estate Fund - Series A (SLC101)

Starlight Global Real Estate Fund - Series T6 (SLC151)

Starlight Global Real Estate Fund - Series F (SLC201)

Starlight Global Real Estate Fund - Series FT6 (SLC251)

Distribution Frequency

Fixed Monthly

Important Disclaimer.

The views in this update are subject to change at any time based upon market or other conditions and are current as of September 23, 2024. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

The views in this update are subject to change at any time based upon market or other conditions and are current as of September 23, 2024. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.