The Case for Cell Tower REITs

Cell tower REITs lease antenna space on thousands of towers to major wireless communication providers. These REITs combine predictable long-term revenues with significant long-term cash flow growth. Annual three percent rent escalators provide inflation protection and the ability to add multiple tenants to the same tower provides significant cash flow growth. Demand for new cell towers is driven by population growth, technology innovation and data proliferation.

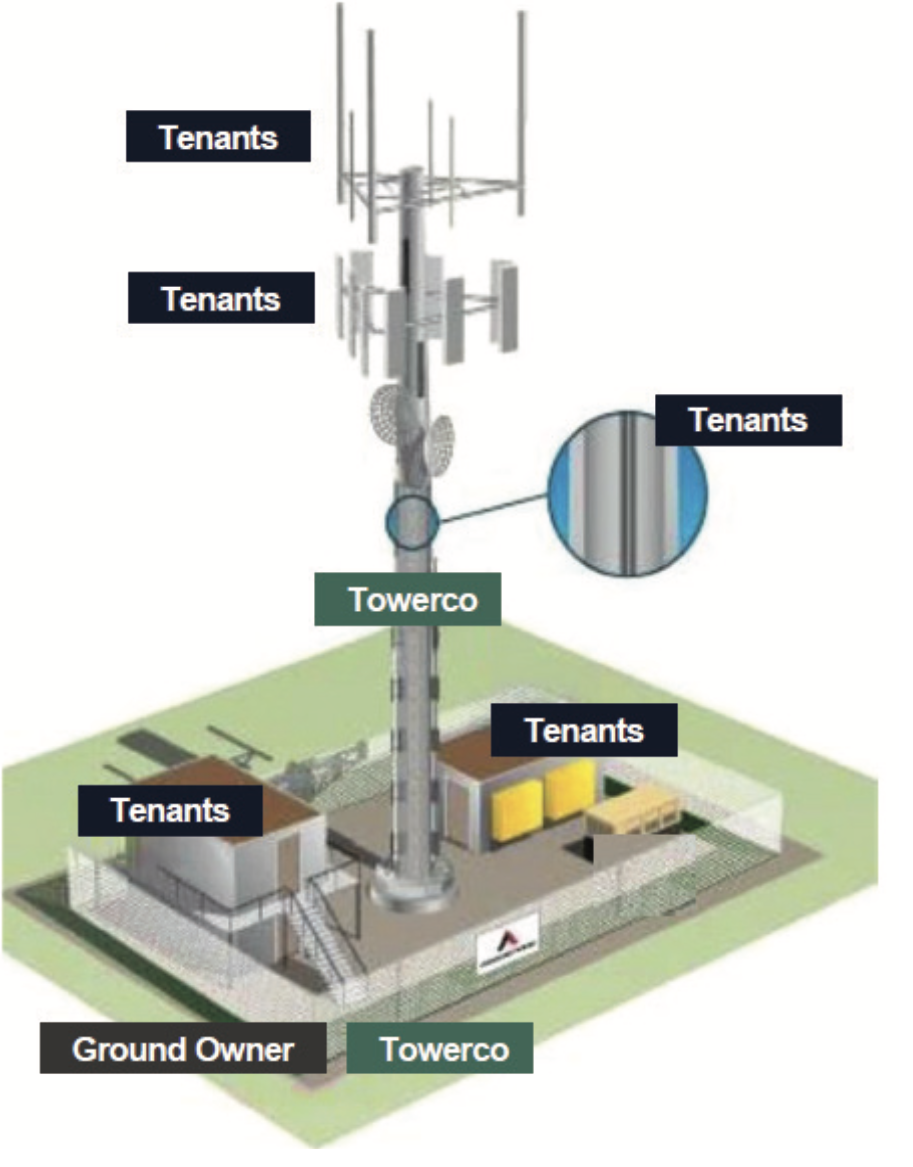

Tower Ownership Model

Tower REITs own a network of vertical tower structures upon which their tenants place their communications equipment. Their tenants are large telecommunications firms (i.e. AT&T, Verizon, T-Mobile/Sprint, Dish Wireless) that provide cellular phone service to consumers and businesses. These telecommunications firms enter into long term leases with the Tower REITs to host their equipment on the REIT’s towers.

What is a tower?

- A vertical structure

- The tower does not transmit or receive

- Wireless tenants lease space on the tower

- Typical capacity for 4 - 5 tenants

Owned by Towerco

Owned by Tenants

- Towerco owns vertical steel structure

- Towerco typically enters into a long-term lease for land parcel, but may buy it

Owned by Tenants

- Wireless tenants lease space on the tower

- Wireless tenants pay for, own, install, insure and maintain all equipment:

- Antennas and cables

- Shelters

- Base station (electronics)

Source: American Tower.

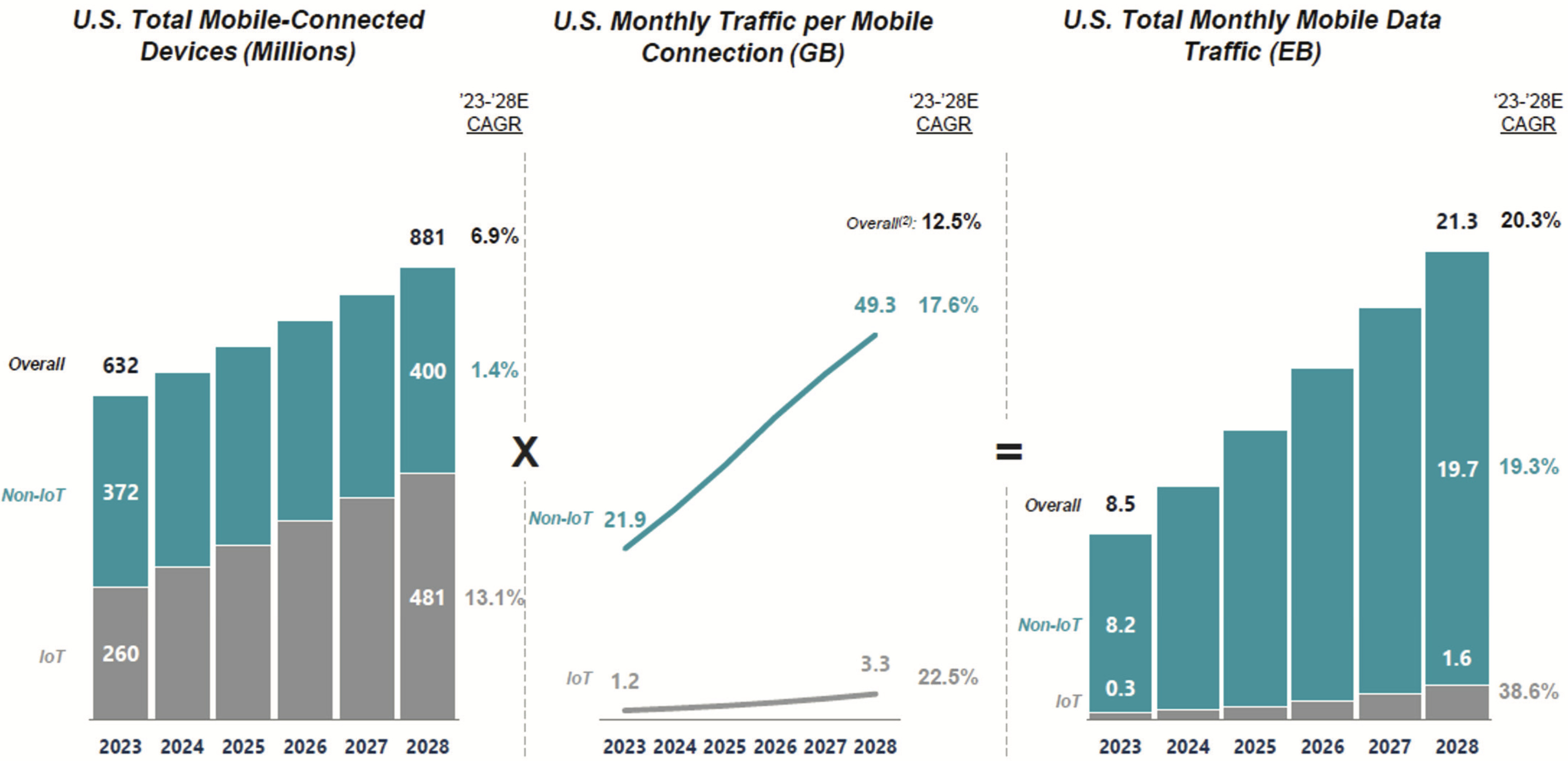

Tower Demand Drivers

Demand for the towers is driven by several macro trends, including population growth, technology innovation and data proliferation. Population and smartphone growth increases the utilization of cell towers and necessitates the development of more towers to improve call quality and down/upload speeds. Technology innovation refers to the network that the telecommunications firm tenants create (i.e. 4G, 5G and one day 6G). The move from 4G networks to 5G will result in a higher quality signal that travels over a shorter distance. This will necessitate building a denser network (more towers) to handle the new, higher quality signal. Finally, data proliferation is driven by the creation of more applications that utilize cell tower capacity (streaming, social media, e-commerce, AI, crypto, video conferencing). The increased utilization of the cell tower network with data-intensive applications drives the demand for more towers to increase network capacity. The tower networks are mission critical infrastructure for the telecommunications firms without which, they cannot operate their businesses.

Data & Device Growth1

(1) Forward-looking data points reflect research estimates.

(2) Overall average data traffic CAGR lower than both non-IoT and IoT CAGR due to mix shift from higher usage non-IoT devices to lower usage IoT devices.

Notes: IoT based on M2M module connections, traffic and data usage; Non-IoT includes everything other than M2M modules (e.g., smartphones, tablets, laptops and feature phones).

Source: American Tower Corporation: Financial and Operational Update. Second Quarter 2023.

(2) Overall average data traffic CAGR lower than both non-IoT and IoT CAGR due to mix shift from higher usage non-IoT devices to lower usage IoT devices.

Notes: IoT based on M2M module connections, traffic and data usage; Non-IoT includes everything other than M2M modules (e.g., smartphones, tablets, laptops and feature phones).

Source: American Tower Corporation: Financial and Operational Update. Second Quarter 2023.

The Internet in 2023 Every Minute

Source: eDiscovery Today and LTMG.

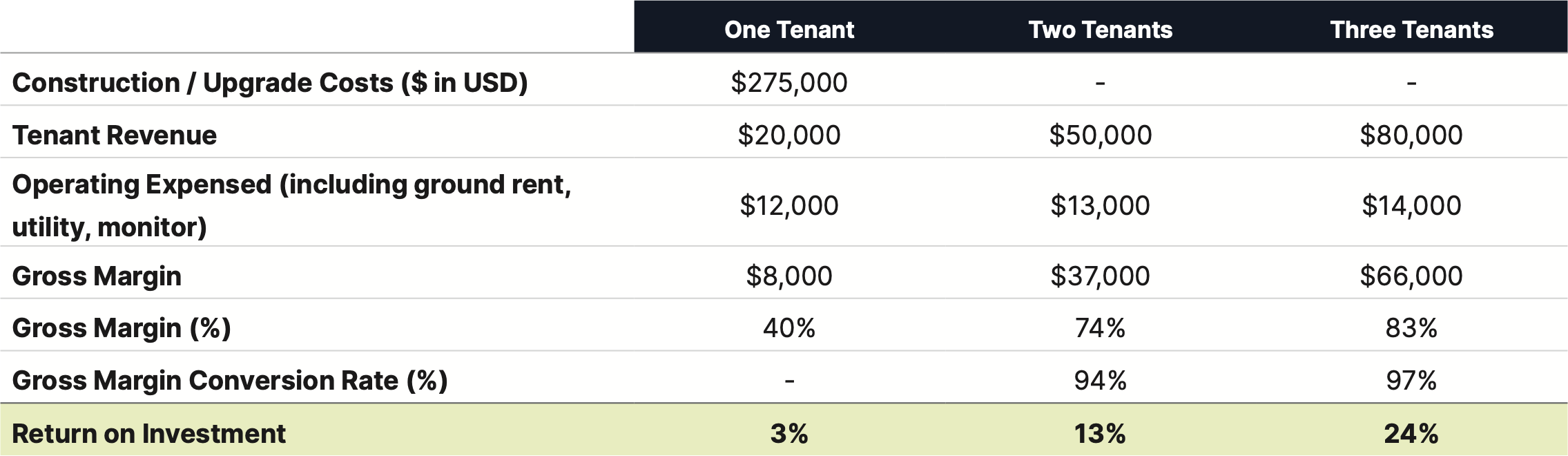

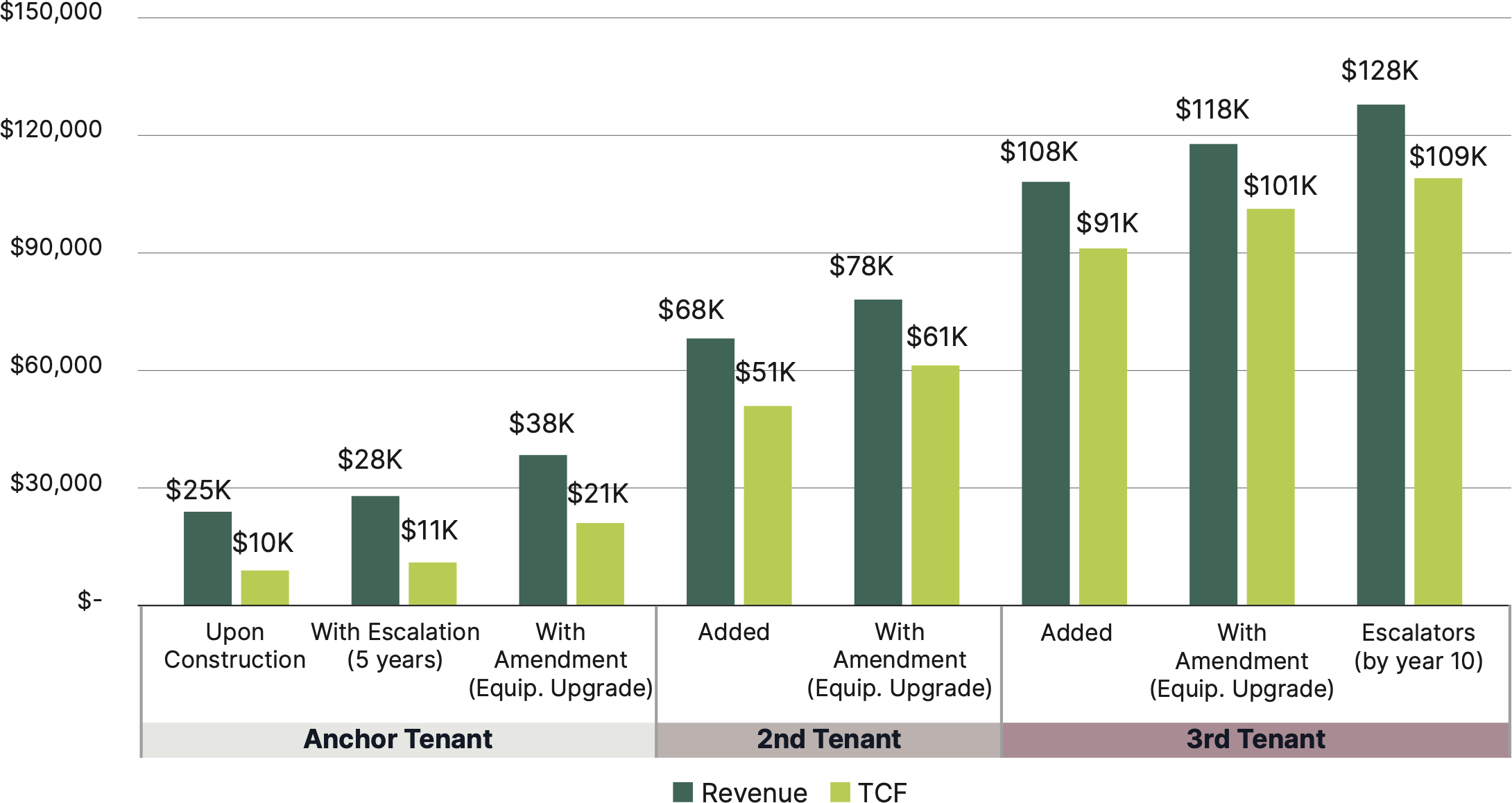

Tower Economics

Competing telecommunications firms often host their equipment on the same towers to leverage the capital investment of the Tower REITs. As the table below demonstrates, owning a tower that you are the sole tenant on is not a lucrative investment. This is why the telecoms sold their towers to the Tower REITs in the first place. A Tower REIT with two or three tenants on each tower generates significantly higher returns on investment. This is because adding a second or third tenant does not materially increase the operating costs and does not require an additional capital investment. Adding additional tenants to an existing tower drives significant margin expansion and return on investment.

In the U.S., cell towers can generally be built for $275,000 and the initial tenant usually pays a discounted level of rent. Cell towers with one tenant generate Gross Margins of ~40% and an ROI of ~3%. However, the addition of the second and third tenants drives margin expansion and return on investment growth. This tower can now be sold for a ~30x to ~40x multiple of its cash flows, creating significant value for the tower developer and eventually the tower owner (Tower REITs).

In the U.S., cell towers can generally be built for $275,000 and the initial tenant usually pays a discounted level of rent. Cell towers with one tenant generate Gross Margins of ~40% and an ROI of ~3%. However, the addition of the second and third tenants drives margin expansion and return on investment growth. This tower can now be sold for a ~30x to ~40x multiple of its cash flows, creating significant value for the tower developer and eventually the tower owner (Tower REITs).

U.S. New Macro Tower Build Economics Drive Strong ROI

Source: American Tower.

This arrangement benefits both parties as the telecommunication firms can offer similar national coverage networks without having to fund large capital expenditures. The Tower REIT benefits from increased utilization of their tower network, which drives margins and return on capital.

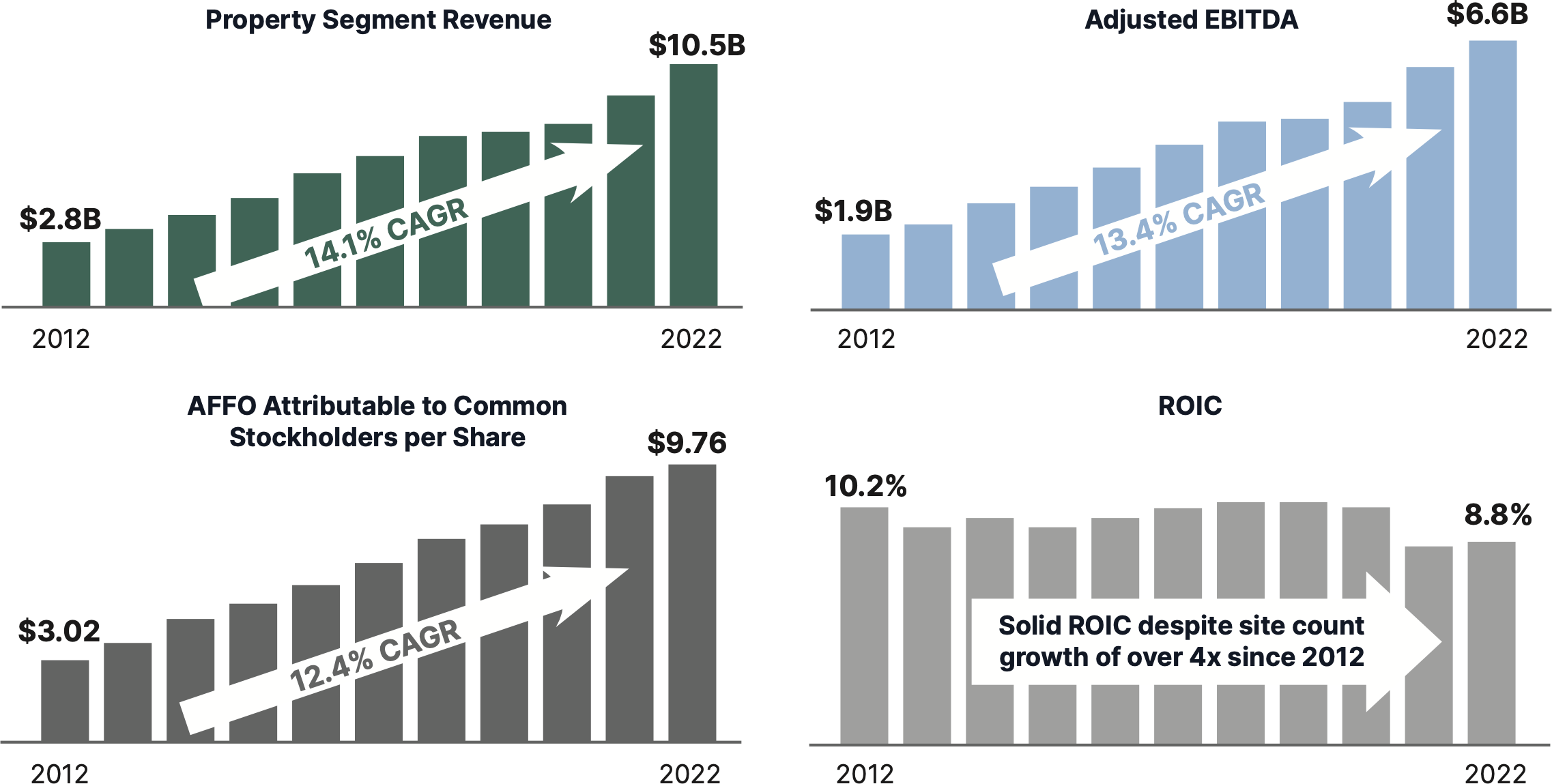

American Tower Results

Complemented by average annual dividend per share growth of >20% since 2012

Source: American Tower.

Tower cash flow multiples are elevated because of the transparent long-term cash flow growth each tower possesses. First, tower leases contain annual three percent rent escalators that provide built-in cash flow growth. Second, when telecommunications firms upgrade their equipment on the towers (i.e. 4G to 5G) they pay additional rent. Finally, adding new tenants to the tower drives strong revenue and cash flow growth. The ability to grow cash flows by 100%+ is what keeps acquisition multiples elevated.

Example of Modeled TCF Growth Over Extended Time Period

Tenant adds and equipment upgrades drive TCF and value creation

Source: Peppertree Capital.

Why Invest in Cell Tower REITs

Cell Tower REITs provide essential services to society by enabling wireless communications. Population growth, technology innovation and data proliferation all drive the demand for more towers. Long-term lease agreements with wireless telecommunications providers ensure reliable cash flow with inflation protection and significant growth potential.

The success of Cell Tower REITs is rooted in the growing demand for increased data at faster speeds, leading to the need for more towers and periodic equipment upgrades. Investing in Cell Tower REITs offers investors a unique opportunity to diversify their portfolio and enhance returns within the realm of infrastructure-related real estate. Cell Tower REITs provide rising dividends and the potential for long-term growth, making them an attractive option for Canadian investors.

The success of Cell Tower REITs is rooted in the growing demand for increased data at faster speeds, leading to the need for more towers and periodic equipment upgrades. Investing in Cell Tower REITs offers investors a unique opportunity to diversify their portfolio and enhance returns within the realm of infrastructure-related real estate. Cell Tower REITs provide rising dividends and the potential for long-term growth, making them an attractive option for Canadian investors.

We invite you to partner with us.

Starlight Real Assets Mutual Funds & ETFs

Starlight Real Assets Mutual Funds & ETFs

Real Assets

Starlight Global Real Estate Fund (SCGR)

Inception—2018

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to Real Estate.

Fund Profile:

Starlight Global Real Estate Fund - Series ETF (SCGR)

Starlight Global Real Estate Fund - Series A (SLC101)

Starlight Global Real Estate Fund - Series T6 (SLC151)

Starlight Global Real Estate Fund - Series F (SLC201)

Starlight Global Real Estate Fund - Series FT6 (SLC251)

Starlight Global Real Estate Fund - Series O (SLC401)

Starlight Global Real Estate Fund - Series O6 (SLC451)

Distribution Frequency

Fixed Monthly

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to Real Estate.

Fund Profile:

Starlight Global Real Estate Fund - Series ETF (SCGR)

Starlight Global Real Estate Fund - Series A (SLC101)

Starlight Global Real Estate Fund - Series T6 (SLC151)

Starlight Global Real Estate Fund - Series F (SLC201)

Starlight Global Real Estate Fund - Series FT6 (SLC251)

Starlight Global Real Estate Fund - Series O (SLC401)

Starlight Global Real Estate Fund - Series O6 (SLC451)

Distribution Frequency

Fixed Monthly

Starlight Global Infrastructure Fund (SCGI)

Inception—2018

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Fund Profile:

Starlight Global Infrastructure Fund - Series ETF (SCGI)

Starlight Global Infrastructure Fund - Series A (SLC102)

Starlight Global Infrastructure Fund - Series T6 (SLC152)

Starlight Global Infrastructure Fund - Series F (SLC202)

Starlight Global Infrastructure Fund - Series FT6 (SLC252)

Starlight Global Infrastructure Fund - Series O (SLC402)

Starlight Global Infrastructure Fund - Series O6 (SLC452)

Distribution Frequency

Fixed Monthly

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Fund Profile:

Starlight Global Infrastructure Fund - Series ETF (SCGI)

Starlight Global Infrastructure Fund - Series A (SLC102)

Starlight Global Infrastructure Fund - Series T6 (SLC152)

Starlight Global Infrastructure Fund - Series F (SLC202)

Starlight Global Infrastructure Fund - Series FT6 (SLC252)

Starlight Global Infrastructure Fund - Series O (SLC402)

Starlight Global Infrastructure Fund - Series O6 (SLC452)

Distribution Frequency

Fixed Monthly

Important disclaimer.

The views in this update are subject to change at any time based upon market or other conditions and are current as of January 5, 2024. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.