The Current Opportunity in Infrastructure Part 3: Digital Connectivity

Digital infrastructure may be invisible but it is everywhere

Digital infrastructure consists of the equipment that transmits, processes and stores data, the facilities that house that equipment, and the networks that connect them all. It includes but is not limited to cellular towers, small cells, fiber-to-the-node, fiber-to-the-home, coaxial cable, twisted pair, satellite, subsea cables, data centres and cloud service providers.

Digital infrastructure consists of the equipment that transmits, processes and stores data, the facilities that house that equipment, and the networks that connect them all. It includes but is not limited to cellular towers, small cells, fiber-to-the-node, fiber-to-the-home, coaxial cable, twisted pair, satellite, subsea cables, data centres and cloud service providers.

This “plumbing” for data is an enormous system that hides in plain sight. There were 142,100 cell towers and 452,200 outdoor small cell nodes across the U.S. at the end of 2022.1 Cellular equipment mounted atop multi- story buildings and on cellular communication towers collect data transmitted in the form of radio waves and translate them into pulses of light, which are then transmitted through over five billion kilometers of fibre-optic cable across the globe. Eventually most data inevitably passes through one of the more than 8,000 data centres globally. Data centres are optimally built to run high-performance computing equipment and keep them powered, connected, cool and secure. Post-processing, data is relayed back to the edge user. This entire process occurs almost seamlessly with every swipe of a screen or press of a key.

Did You Know?

RURAL CONNECTIVITY

Even in advanced economies, not everyone is digitally connected. In Canada, a priority of the federal government is to close the digital divide and to leave no one behind. Approximately 62% of people in rural communities are unable to subscribe to a service offering with speeds of at least 50 megabits per second (Mbps) download and 10 Mbps upload. To address this deficit, the CRTC has established the Broadband Fund to invest up to $675 million over the next five years in digital infrastructure projects to enable the delivery of internet access services to underserved areas across Canada.2

THE NEWEST HUMAN RIGHT

The Syrian civil war forcibly displaced 12 million people. It was one of the largest mass migrations in modern history, and certainly the largest since the advent of the smartphone. The media reports of refugees with no more than a backpack and a smartphone in hand confounded many observers.

The refugee experience has dramatically changed in the era of digital connectivity. The smartphone is the source of everything from basic survival info when living in a war zone to travel directions to sourcing living arrangements upon arrival in a safe country. Digital connectivity is now quintessential, irrespective of circumstance. Aid groups now setup wi-fi access at refugee camps just as quickly as they distribute food.

Even in advanced economies, not everyone is digitally connected. In Canada, a priority of the federal government is to close the digital divide and to leave no one behind. Approximately 62% of people in rural communities are unable to subscribe to a service offering with speeds of at least 50 megabits per second (Mbps) download and 10 Mbps upload. To address this deficit, the CRTC has established the Broadband Fund to invest up to $675 million over the next five years in digital infrastructure projects to enable the delivery of internet access services to underserved areas across Canada.2

THE NEWEST HUMAN RIGHT

The Syrian civil war forcibly displaced 12 million people. It was one of the largest mass migrations in modern history, and certainly the largest since the advent of the smartphone. The media reports of refugees with no more than a backpack and a smartphone in hand confounded many observers.

The refugee experience has dramatically changed in the era of digital connectivity. The smartphone is the source of everything from basic survival info when living in a war zone to travel directions to sourcing living arrangements upon arrival in a safe country. Digital connectivity is now quintessential, irrespective of circumstance. Aid groups now setup wi-fi access at refugee camps just as quickly as they distribute food.

Is it Infrastructure?

For most people in developed economies, a world without an internet connection is unimaginable. We use the internet all day, every day, in our places of work, for communicating via email or video communication and online research, and at home, for navigating household responsibilities and entertainment. It is ubiquitous to every aspect of our daily lives.

Consider what would have been our collective economic and social reality if the pandemic hit in the late 1990s or early 2000s. It is indisputable that digital connectivity enabled us to ward off a worst-case scenario. The negative impacts of COVID-19 were mitigated by allowing us to continue work, study, socialize and access vital health information remotely.

And yet, companies that provide digital connectivity are not universally accepted as core infrastructure. For example, the S&P Global Infrastructure index, which is the bellwether for the asset class, is limited to the Energy, Transportation, and Utilities sectors. Whereas other fund managers may begin with the index and construct a portfolio by selecting companies from holdings in the index, Starlight is index-agnostic. We start with the underlying characteristics of infrastructure and rely on our own internally developed inclusion criteria to determine whether a company is suitable for the infrastructure mandate. This process not only permits greater control of the investment decision-making process, but also allows allocation to unconventional sectors to drive incremental return. The first inclusion criteria in our process is:

Consider what would have been our collective economic and social reality if the pandemic hit in the late 1990s or early 2000s. It is indisputable that digital connectivity enabled us to ward off a worst-case scenario. The negative impacts of COVID-19 were mitigated by allowing us to continue work, study, socialize and access vital health information remotely.

And yet, companies that provide digital connectivity are not universally accepted as core infrastructure. For example, the S&P Global Infrastructure index, which is the bellwether for the asset class, is limited to the Energy, Transportation, and Utilities sectors. Whereas other fund managers may begin with the index and construct a portfolio by selecting companies from holdings in the index, Starlight is index-agnostic. We start with the underlying characteristics of infrastructure and rely on our own internally developed inclusion criteria to determine whether a company is suitable for the infrastructure mandate. This process not only permits greater control of the investment decision-making process, but also allows allocation to unconventional sectors to drive incremental return. The first inclusion criteria in our process is:

Is the service provided essential and foundational for societal well-being and the functioning of the economy?

Nearly all aspects of business have now been digitized, with layers of redundancy and business continuity planning built-in to maintain connectivity. Combined with the examples presented in the sidebar, we believe it is unquestionable that digital connectivity is essential to the functioning of modern society. Further, we find that companies in the sector meet our other inclusion criteria as well as elaborated in the table below.

Criteria |

Digital Connectivity |

|---|---|

| Low Correlation to the Economic Cycle |

|

| High Operating Leverage |

|

| High Visibility of Future Cash Flows |

|

| Stable and Recurring Free Cash Flow: Businesses with Low Demand Elasticity |

|

| Irreplaceable Assets |

|

| Ample Reinvestment Opportunities |

|

Cell Towers

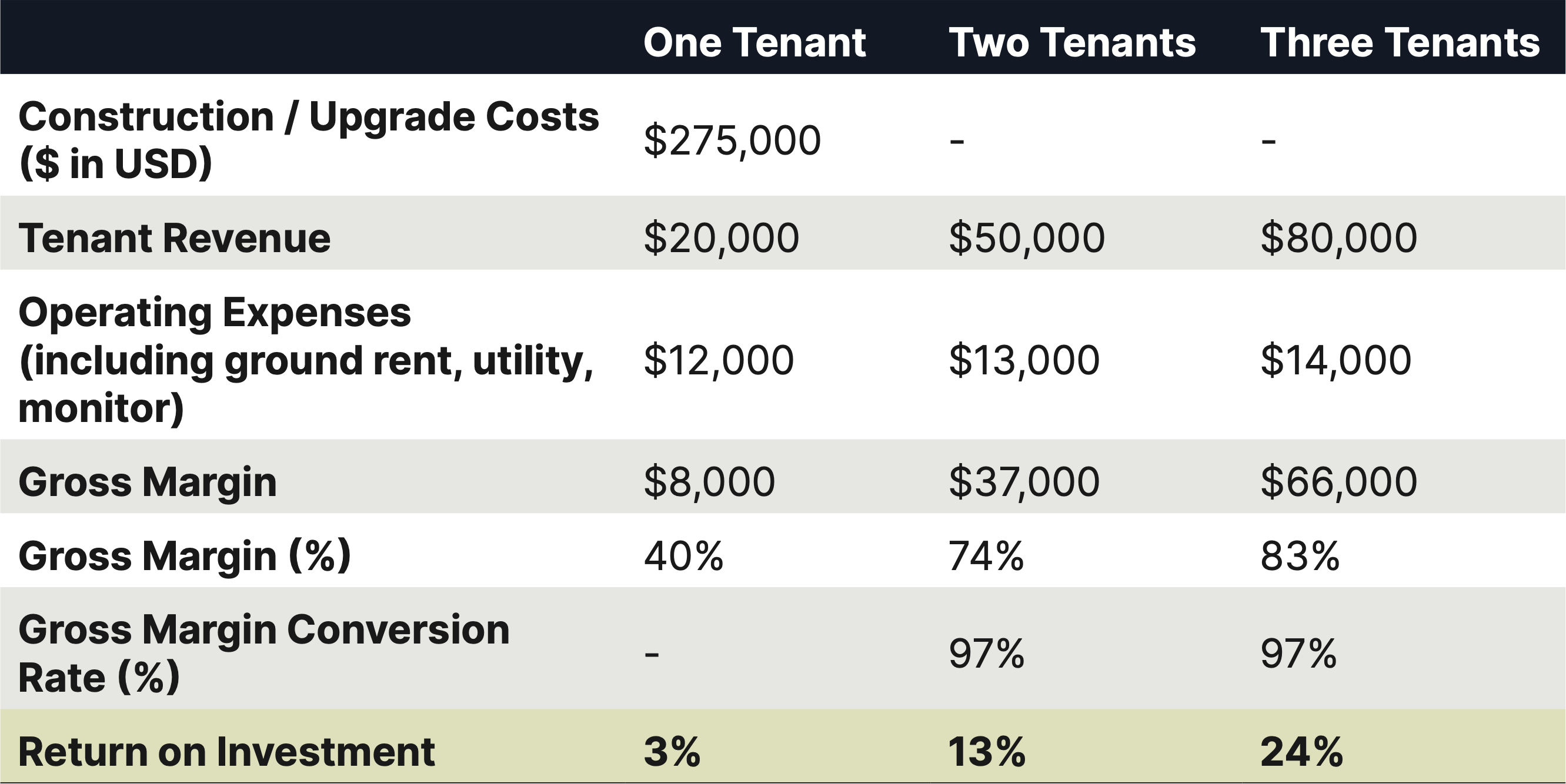

Outside of Canada, cellular network operators do not own the towers that house their network equipment. Towers are shared infrastructure in most of the world. Dedicated tower owners lease space on their towers to mobile network operators. The business model allows wireless network operators to co-locate their equipment and thereby reduce costs, because leasing space on a shared tower is cheaper than operating one that is independently owned. While co-location reduces costs for customers, the tremendous operating leverage in the business model results in it being a goldmine for tower operators.

As shown in Exhibit 1, increasing tenancy on a tower from one to three results in return on invested capital increasing from just over break-even to 24%. These attractive economics on a per tower basis can be scaled up with no dilution of returns. American Tower is the largest player in the industry with nearly 225,000 towers across the world. Besides the potential for high returns, the business enjoys other attractive characteristics: a high percentage of recurring/contracted revenues, high visibility of earnings, scalability, a sticky customer base, high switching costs of customers and durable barriers to entry, just to name a few.

As shown in Exhibit 1, increasing tenancy on a tower from one to three results in return on invested capital increasing from just over break-even to 24%. These attractive economics on a per tower basis can be scaled up with no dilution of returns. American Tower is the largest player in the industry with nearly 225,000 towers across the world. Besides the potential for high returns, the business enjoys other attractive characteristics: a high percentage of recurring/contracted revenues, high visibility of earnings, scalability, a sticky customer base, high switching costs of customers and durable barriers to entry, just to name a few.

Exhibit 1: U.S. new macro tower build economics drive strong ROI

Source: American Tower. Introduction to the Tower Industry and American Tower. As of June 30, 2023.

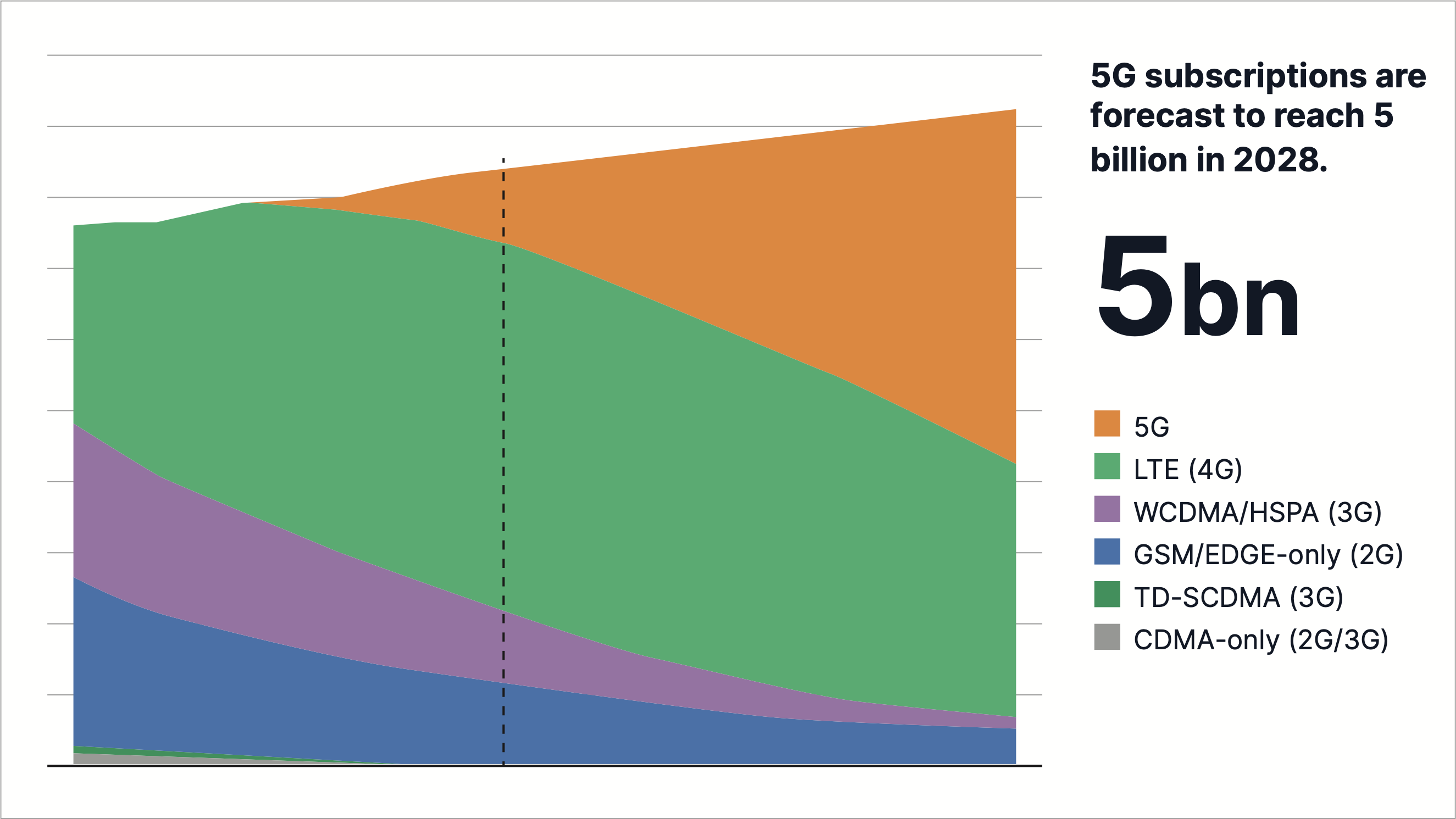

Despite being the largest player in a relatively mature industry, American Tower has increased revenue at an average annual rate of 14% over the last 10 years. Growth has been driven by the 5G investment cycle which began in 2019, as shown in Exhibit 2. We are still in the first phase of the 5G deployment and over the next five years, two additional phases are expected to play out that represent discrete business cases for cellular network operators. Ultimately, greater investment to drive up network densification will bring down costs on a per gigabyte basis and unlock better network quality, higher speeds and lower latency. More devices will be connected, and digital connectivity will become more integral to our daily lives. As this proliferation unfolds, tower operators will be beneficiaries of investment spending as it allows them to sell more tenancies to network operators across a broader and denser footprint of tower sites.

Exhibit 2: Mobile subscription by technology (billion)

Source: Ericsson Group. Mobile Data Traffic Outlook. 2023.

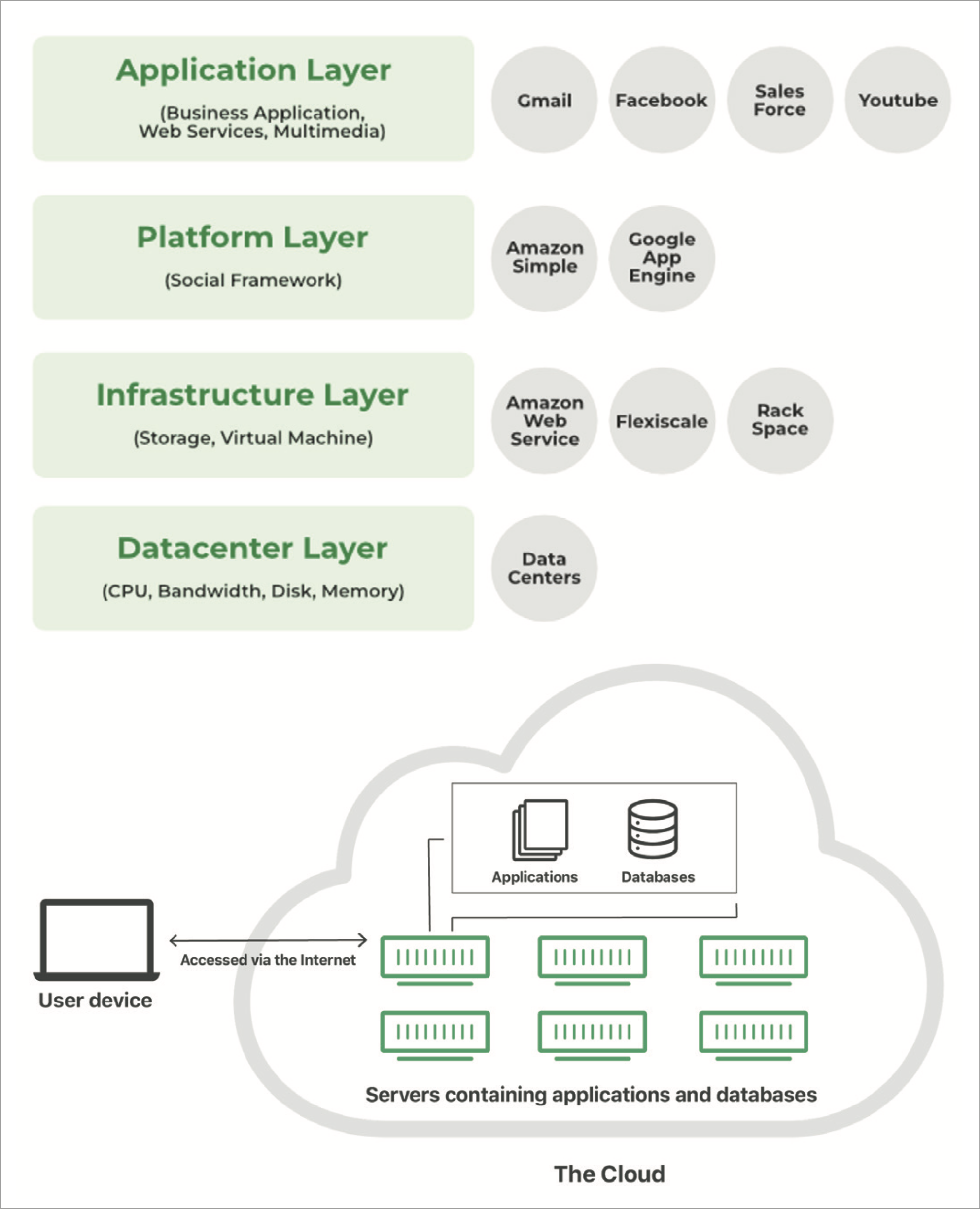

Data Centres

If we think of digital connectivity as a stack with networks (fiber, broadband and cellular) at the bottom, hardware in the middle and applications at the top, the data centres that facilitate cloud computing is one layer up from the bottom (network layer). Data centre infrastructure is the provisioning of space and power to run the computing hardware stack that facilitates the cloud.

Before the cloud existed as it does today, users and companies had to manage physical servers themselves or run software applications on their own machines, housed on their own premises. The cloud eased that burden by centralizing the administration of information systems. Companies and their users now access the files and applications remotely, from almost any device, because the computing and storage takes place on servers in a data centre, instead of locally on the user device or a server managed on company premises.

The cloud is now ubiquitious - we use it throughout our daily lives without even realizing it. Users log into their work environments or social media accounts from anywhere, and from any device. The cloud stores and backs up all documents, photos, videos, and conversation history.

Cloud computing significantly reduces operating costs and administrative workload for companies and users. Companies no longer need to purchase, administer, update and maintain their own servers, as the cloud vendors now do all of that. IT departments are now unconstrained by the burden of administering computing environments and can focus on making tangible contributions to the mission of their respective enterprises.

The cloud is shared infrastructure that turns what was previously capital expenditure for individual companies into an operating expense, not dissimilar to a transnational railroad network or any other form of physical infrastructure. The cloud fits our definition of infrastructure because it provides an essential service to a large portion of the population in a supply-constrained manner.

Before the cloud existed as it does today, users and companies had to manage physical servers themselves or run software applications on their own machines, housed on their own premises. The cloud eased that burden by centralizing the administration of information systems. Companies and their users now access the files and applications remotely, from almost any device, because the computing and storage takes place on servers in a data centre, instead of locally on the user device or a server managed on company premises.

The cloud is now ubiquitious - we use it throughout our daily lives without even realizing it. Users log into their work environments or social media accounts from anywhere, and from any device. The cloud stores and backs up all documents, photos, videos, and conversation history.

Cloud computing significantly reduces operating costs and administrative workload for companies and users. Companies no longer need to purchase, administer, update and maintain their own servers, as the cloud vendors now do all of that. IT departments are now unconstrained by the burden of administering computing environments and can focus on making tangible contributions to the mission of their respective enterprises.

The cloud is shared infrastructure that turns what was previously capital expenditure for individual companies into an operating expense, not dissimilar to a transnational railroad network or any other form of physical infrastructure. The cloud fits our definition of infrastructure because it provides an essential service to a large portion of the population in a supply-constrained manner.

Exhibit 3: Cloud Architecture

Source: Amplework Software Pvt. Ltd. Full-Stack Development and the Impact of Cloud Computing. 2023.

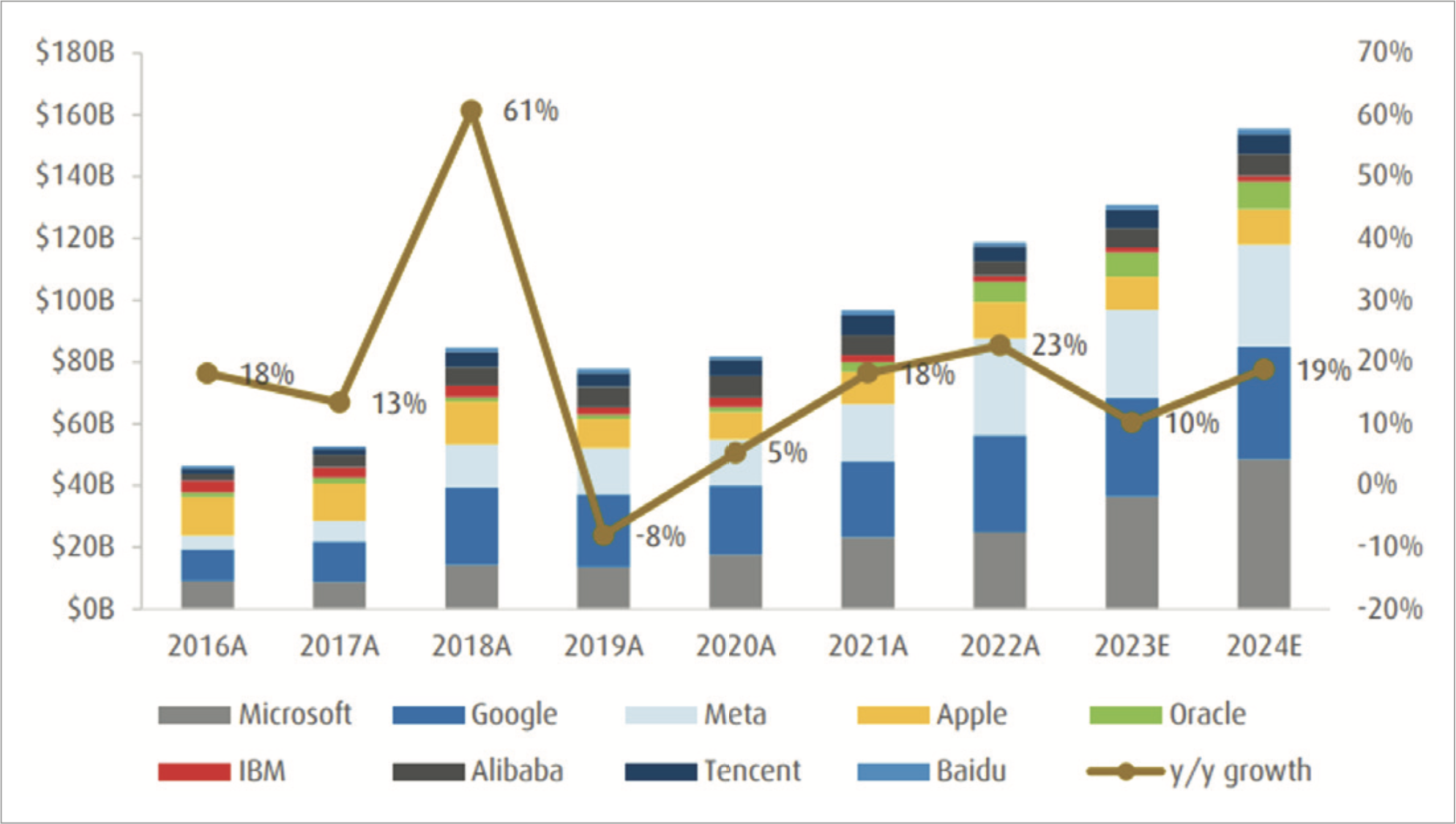

Building out a global cloud platform is exorbitantly expensive. There are only a few technology companies (Amazon, Microsoft, Google, Meta Platforms, Alibaba and Tencent) with the combination of balance sheet capacity and operational expertise, to build out a global data centre footprint to host a reliable cloud service. These companies are collectively known as the hyperscalers and collectively they account for more than half of all the data centres in the world. Spending across the industry is expected to exceed $140 billion next year and grow 19% year-over-year. Microsoft, a holding in the Starlight Global Infrastructure Fund, has disclosed that it plans to spend $50 billion every year for the foreseeable future to build out its global data centre platform. This is an astounding amount of money by any standard. Compared to other megaprojects, it ranks among the largest buildouts of infrastructure ever.3 Microsoft has taken this on not only to facilitate the commercial cloud, but also to drive forward the next paradigm shift in computing. ChatGPT is just the beginning. Artificial intelligence will soon be pervasive across every facet of life, spanning everything from productivity applications to leisure.

Exhibit 4: Hyperscale Capex poised for ~$25B increase in 2024

Source: FactSet, BMO Capital Markets.

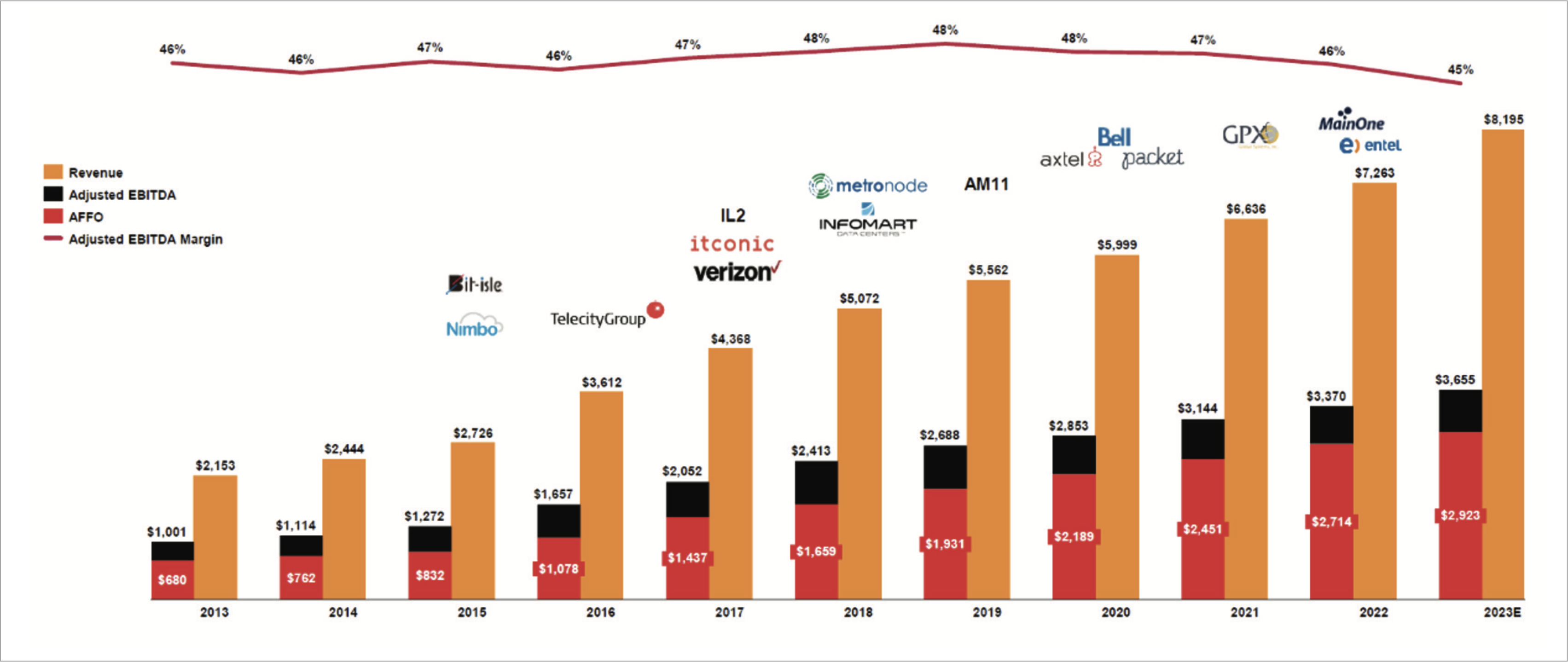

The data centre business has exhibited incredibly resilient growth and profitability. The track record below belongs to Equinix, a provider of multi-tenant data centres with 248 locations across 32 countries. The company was founded in 1998 and has grown through acquisition. The logos on each bar from 2015 to 2022 denote data centre portfolios acquired from the respective sellers. Equinix has raised its dividend every year since it was initiated in 2015 and delivered 80 consecutive quarters of revenue growth, which is longer than any other company in the S&P 500. With migration from on-premise environments to the cloud continuing unabated, the rollout of AI and the increased requirements for data processing, growth is expected to continue unabated for the foreseeable future. Equinix expects $3 billion of capital expenditures per year to drive revenue growth of 8-10% per year through 2027.

Exhibit 5: Equinix - Proven Track Record of Growth and Profitability

Source: Equinix 2023 Investor Presentation.

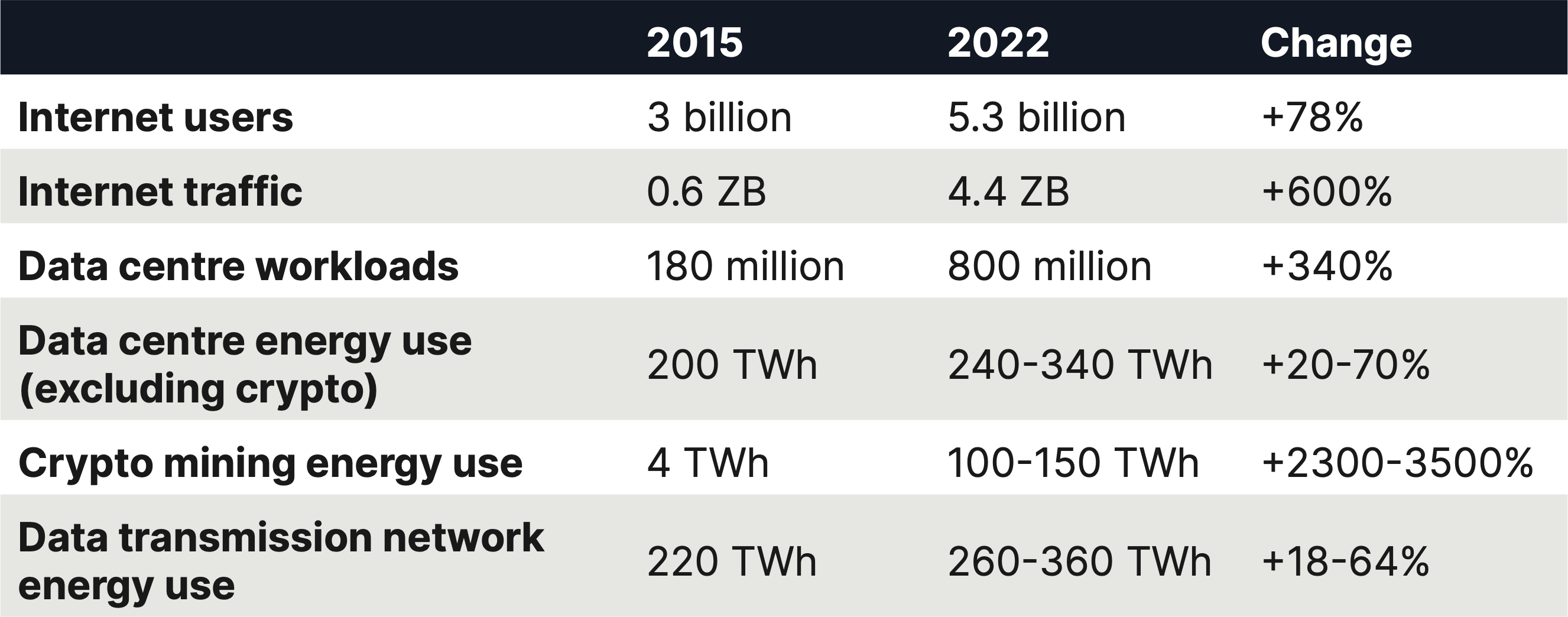

Data Growth is Exponential

Digital connectivity trends have grown rapidly over the last seven years, as shown in Exhibit 6. With the shift to the cloud well underway and with technology now on the precipice of artificial intelligence (AI), expectations for future data transmission capacity are more optimistic than ever before. Ericsson forecasts that mobile data traffic globally will increase by a factor of 3.5 by the end of 2028. Global data centre capacity is expected to grow from 1.58 billion square feet in 2022 to 2.13 billion square feet in 2027 as large-scale service providers grow at a 15% compounded annual growth rate, while on-premise deployments decline. In addition to square footage growth, many data centres will be rebuilt in the coming years as companies look to refurbish their infrastructure with more up-to-date technology.

Exhibit 6: Global trends in digital and energy indicators, 2015-2022

Source: IEA. Data Centres and Data Transmission Networks. 2023.

Errors of Omission are Often Worse Than Errors of Commission

The best businesses can sustain high growth rates and high returns on invested capital over a long period of time. Their growth is value accretive and returns on incremental invested capital remain attractive with the passage of time. Investment opportunities bearing these characteristics are rare. Driven by capital inflows, competition, price pressure, business disruption or some other natural force at play in markets, returns tend to regress toward the average over time.

The same holds true in investing. Track records of sustained outperformance are rare. Unforced errors that deliver poor returns account for some underperformance, but pales in comparison to the underperformance resulting from foregone opportunities. Despite his incredibly long track record of outperformance, Warren Buffett has expressed regret about his errors of omission. He has said on more than a few occasions that Berkshire shareholders would have been much better off had he pulled the trigger on opportunities that were within his circle of competence and identified as attractive. Although opportunity cost does not show up in the profit/loss figures, errors of omission are costlier than errors of commission.

Within the infrastructure category, funds that mimic the index and ignore digital connectivity do so at their own peril. Driven by the secular tailwind of exponential data growth, cell tower and data centre operators can grow at above-market rates while sustaining high returns on invested capital.

The Starlight Global Infrastructure Fund is a concentrated portfolio of companies that provides essential and foundational services in a supply-constrained manner for the basic functioning of society. We see the fundamental characteristics of infrastructure assets in companies that operate in the digital connectivity space: capital intensive assets with low correlation to the economic cycle and high operating leverage that produce stable and consistent cash flows over a long period of time. Although these companies may trade at higher valuation multiples than core infrastructure, we believe the premium is more than justified by attractive return profiles and highly certain future growth. We plan to remain patient and rely on the underlying fundamentals to drive returns as the secular growth tailwinds play out.

The Starlight Global Infrastructure Fund targets a 5.0% distribution paid to unitholders on a monthly basis. The distribution is supported by strong dividend growth from the underlying portfolio holdings. Over the last twelve months through the end of November 2023, the fund experienced 26 dividend increases with an average increase of +10.7%. Since inception through the end of November 2023, the fund experienced 155 dividend increases with an average increase of +9.5%.

The same holds true in investing. Track records of sustained outperformance are rare. Unforced errors that deliver poor returns account for some underperformance, but pales in comparison to the underperformance resulting from foregone opportunities. Despite his incredibly long track record of outperformance, Warren Buffett has expressed regret about his errors of omission. He has said on more than a few occasions that Berkshire shareholders would have been much better off had he pulled the trigger on opportunities that were within his circle of competence and identified as attractive. Although opportunity cost does not show up in the profit/loss figures, errors of omission are costlier than errors of commission.

Within the infrastructure category, funds that mimic the index and ignore digital connectivity do so at their own peril. Driven by the secular tailwind of exponential data growth, cell tower and data centre operators can grow at above-market rates while sustaining high returns on invested capital.

The Starlight Global Infrastructure Fund is a concentrated portfolio of companies that provides essential and foundational services in a supply-constrained manner for the basic functioning of society. We see the fundamental characteristics of infrastructure assets in companies that operate in the digital connectivity space: capital intensive assets with low correlation to the economic cycle and high operating leverage that produce stable and consistent cash flows over a long period of time. Although these companies may trade at higher valuation multiples than core infrastructure, we believe the premium is more than justified by attractive return profiles and highly certain future growth. We plan to remain patient and rely on the underlying fundamentals to drive returns as the secular growth tailwinds play out.

The Starlight Global Infrastructure Fund targets a 5.0% distribution paid to unitholders on a monthly basis. The distribution is supported by strong dividend growth from the underlying portfolio holdings. Over the last twelve months through the end of November 2023, the fund experienced 26 dividend increases with an average increase of +10.7%. Since inception through the end of November 2023, the fund experienced 155 dividend increases with an average increase of +9.5%.

We invite you to partner with us.

Starlight Real Assets Mutual Fund & ETF

Starlight Real Assets Mutual Fund & ETF

Real Assets

Starlight Global Infrastructure Fund

Inception—2018

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Fund Profile:

Starlight Global Infrastructure Fund - Series ETF (SCGI)

Starlight Global Infrastructure Fund - Series A (SLC102)

Starlight Global Infrastructure Fund - Series T6 (SLC152)

Starlight Global Infrastructure Fund - Series F (SLC202)

Starlight Global Infrastructure Fund - Series FT6 (SLC252)

Starlight Global Infrastructure Fund - Series O (SLC402)

Starlight Global Infrastructure Fund - Series O6 (SLC452)

Starlight Global Infrastructure Fund - Series I (SLC902)

Distribution Frequency

Fixed Monthly

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Fund Profile:

Starlight Global Infrastructure Fund - Series ETF (SCGI)

Starlight Global Infrastructure Fund - Series A (SLC102)

Starlight Global Infrastructure Fund - Series T6 (SLC152)

Starlight Global Infrastructure Fund - Series F (SLC202)

Starlight Global Infrastructure Fund - Series FT6 (SLC252)

Starlight Global Infrastructure Fund - Series O (SLC402)

Starlight Global Infrastructure Fund - Series O6 (SLC452)

Starlight Global Infrastructure Fund - Series I (SLC902)

Distribution Frequency

Fixed Monthly

1WIA Wireless Infrastructure Association. Wireless Infrastructure By the Numbers: 2022 Key Statistics. Mar 15, 2023.

2Canadian Radio-television and Telecommunications Commission. BROADBAND FUND Closing the digital divide in Canada. Date modified: Dec 20, 2023.

3Statista. The World’s Megaprojects. April 4, 2023.

Important Disclaimer.

The views in this update are subject to change at any time based upon market or other conditions and are current as of December 31, 2023. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

The views in this update are subject to change at any time based upon market or other conditions and are current as of December 31, 2023. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.