The Current Opportunity in Infrastructure - Part 1: Decarbonization

We live in an era of significant and lasting change. Former Bank of Canada governor Mark Carney describes the events of the past few years as “a hinge moment in history.” The pandemic and the war in Ukraine were a shock to the global economy that reversed prior trends of lower borrowing costs, globalization and deregulation. The course of the next decade and beyond is unlikely to resemble the prior few decades and the implications for infrastructure, which is the foundational layer that facilitates economic activity, cannot be overstated.

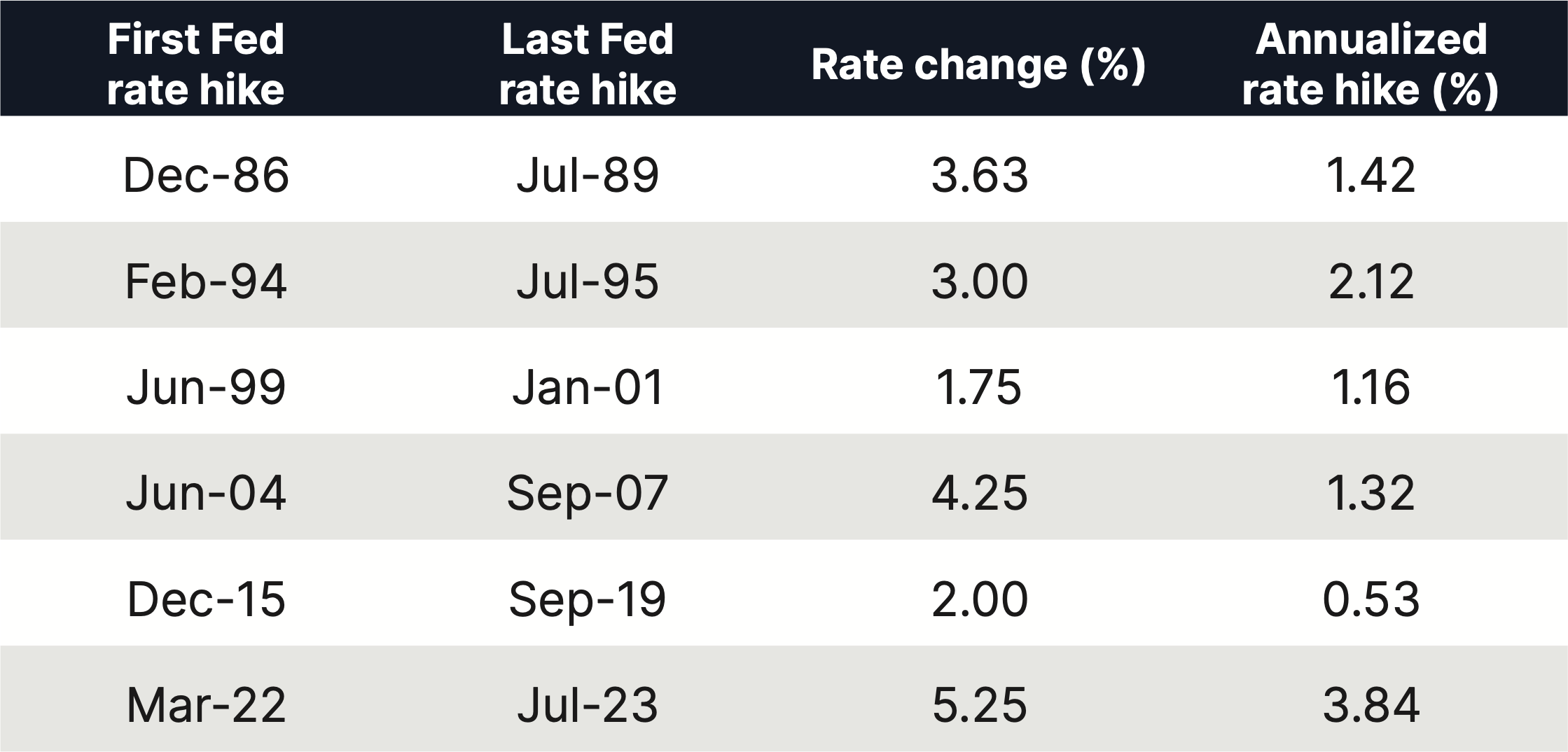

Steadily declining borrowing costs over the course of the prior three decades were a wind in the sails of the global economy that spurred on GDP growth and economic prosperity. Conversely, the current hiking cycle is among the most aggressive seen historically and has been a headwind to economic growth and market valuations (Exhibit 1). While Central banks may be close to the end of their respective hiking cycles, rate increases have a lagged effect, meaning that the implications of recent rate increases will likely still be playing out over the next 12-18 months.

Exhibit 1 - Fed rate hiking cycles

Source: J.P. Morgan. July ‘23 is the most recent Fed hike, there may be more hikes in the current cycle.

Prior to the pandemic and before Russia invaded Ukraine, the global economy converged as governments reduced barriers to global trade and deregulated industries. Companies prioritized efficiency and cost reduction, seemingly above all else. All of that has now changed. The global pandemic accelerated digitization as distributed work became the norm. Consumer spending shifted to eCommerce and capital goods, resulting in unprecedented freight volumes that caused bottlenecks at ports, rail terminals and air cargo facilities exposing underinvestment in global supply chains. As the pandemic has subsided, the pendulum has swung the other way. Consumers shifted spending from goods to experiences. Airports and toll roads that were deserted during the pandemic are now experiencing unprecedented levels of passenger traffic.

A broad paradigm shift is now underway towards greater supply chain resilience, deglobalization and digitization. Energy security and decarbonization are also at the top of the list of global priorities. To facilitate the new paradigm, the world is experiencing an enormous buildout of global infrastructure. It is often cited that 75 percent of the infrastructure that will be in place in 2050 doesn’t exist today, and the infrastructure of 2050 won’t just be new, it will be transformative and enable the value chains of the future. This reorientation is a catalyst for a long-duration investment opportunity that is not without risk but, we believe, should provide investment returns above historical levels for the infrastructure asset class. In recognition of this opportunity, large institutional investors have abandoned the 60/40 stock/bond asset allocation framework and instead have been increasing their allocations to real assets in general and infrastructure in particular.

Three key themes encapsulate the current investment opportunity in infrastructure: decarbonization, data connectivity and renewal of physical infrastructure. In this piece we will address the theme of decarbonization. Part two and three will address data connectivity and infrastructure renewal respectively.

Electricity Demand

Demand for electricity in the US was approximately flat over the last two decades1. Several broad trends are underway that are driving demand growth above historical levels out to 2050.

A broad paradigm shift is now underway towards greater supply chain resilience, deglobalization and digitization. Energy security and decarbonization are also at the top of the list of global priorities. To facilitate the new paradigm, the world is experiencing an enormous buildout of global infrastructure. It is often cited that 75 percent of the infrastructure that will be in place in 2050 doesn’t exist today, and the infrastructure of 2050 won’t just be new, it will be transformative and enable the value chains of the future. This reorientation is a catalyst for a long-duration investment opportunity that is not without risk but, we believe, should provide investment returns above historical levels for the infrastructure asset class. In recognition of this opportunity, large institutional investors have abandoned the 60/40 stock/bond asset allocation framework and instead have been increasing their allocations to real assets in general and infrastructure in particular.

Three key themes encapsulate the current investment opportunity in infrastructure: decarbonization, data connectivity and renewal of physical infrastructure. In this piece we will address the theme of decarbonization. Part two and three will address data connectivity and infrastructure renewal respectively.

Electricity Demand

Demand for electricity in the US was approximately flat over the last two decades1. Several broad trends are underway that are driving demand growth above historical levels out to 2050.

- Reshoring of manufacturing and industrial activity: The US is undergoing an industrial renaissance driven by greater awareness of its competitiveness on the global stage. In 2022, President Biden passed The CHIPS and Science Act to incentivize the domestic manufacturing of semiconductors. The act includes $39 billion in subsidies for chip manufacturing on US soil along with 25% investment tax credits for manufacturing equipment and $13 billion for semiconductor research and workforce training. In 2022, President Biden also passed the Inflation Reduction Act that included bonus tax credits for clean energy technologies that meet domestic content requirements. Production of solar panels, batteries, wind turbines and related components qualify for these incentives and are driving domestic investment decisions of manufacturers in these industries.

- Electrification: Transportation is projected to see the fastest transition to electrification due to EVs reaching cost parity with internal combustion engine (“ICE”) cars in the mid-2020s – and broad adoption is well underway. The drive for efficiency and better overall performance is driving electrification of household appliances and space cooling, bringing the building sector to approximately 60% electrification in 2050 from around 30% today. Further, green hydrogen production through the process of electrolysis is projected to be the biggest driver of additional power demand (42% of the growth between 2035–2050), with hydrogen playing a key role for hard- to-abate sectors such as iron and steel2.

- Artificial Intelligence: Datacenters account for roughly 1% of global electricity use3 and the large cloud computing providers (Microsoft, Amazon, Google) are already the largest corporate procurers of green power globally. The energy demand from just one of these companies to operate their infrastructure is roughly equal to the current energy demand of the entire United Kingdom. Artificial intelligence is driving a “fourth industrial revolution” which will no doubt push the envelope of our capabilities but will also require a step change in the amount of power we consume. As artificial intelligence becomes more widely adopted across the set of possible use cases, annual demand from large technology companies is projected to accelerate meaningfully, increasing by more than 3x by the latter part of this decade4.

Power Generation Mix

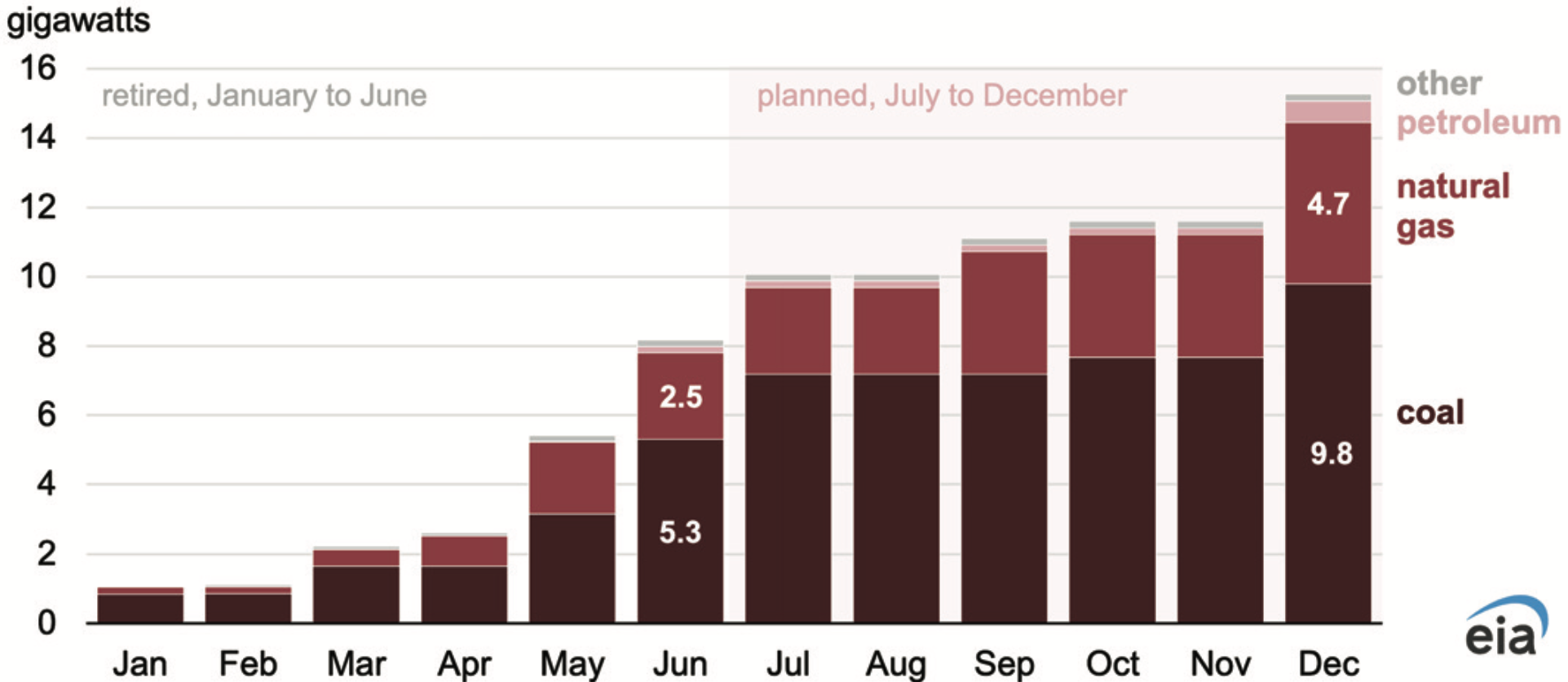

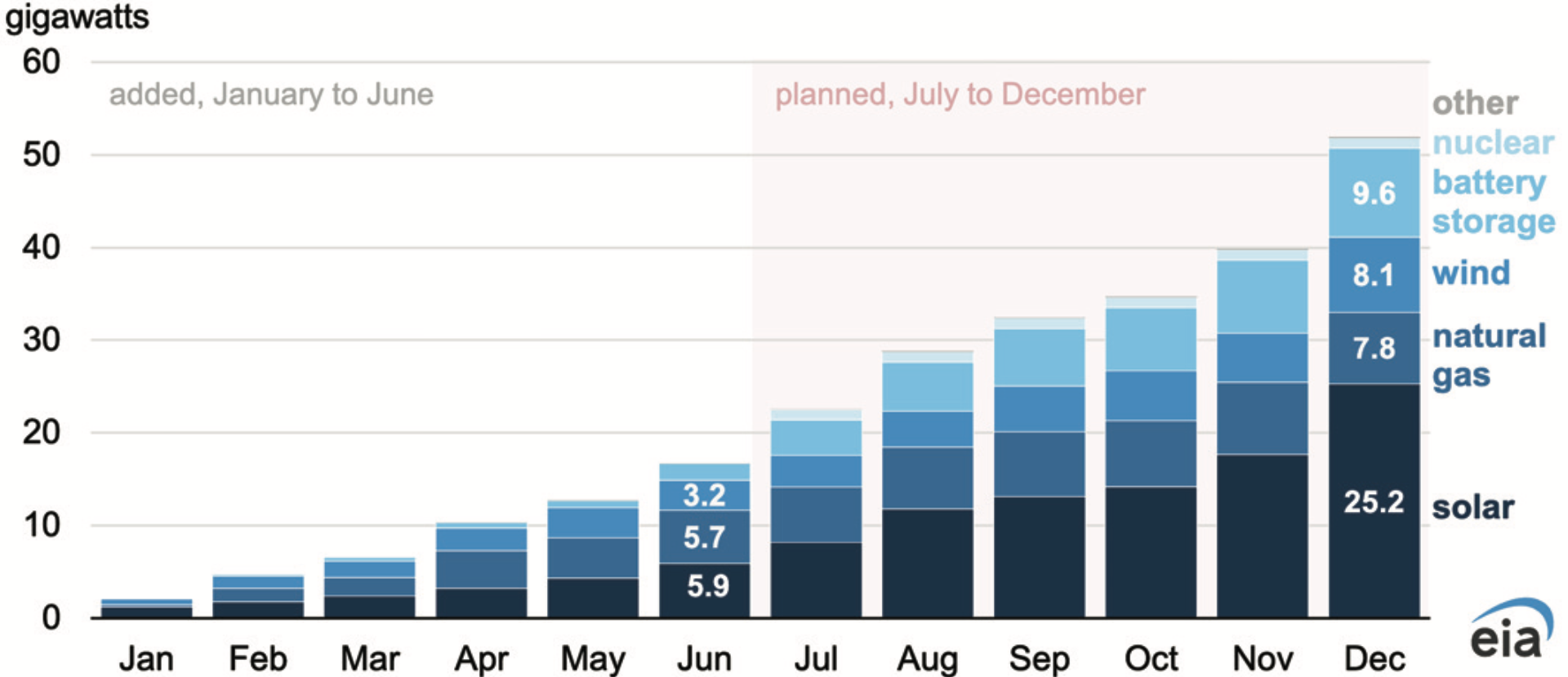

These three secular demand drivers are expected to approximately triple power consumption by 2050. Simultaneously, the effects of climate change have required consumers to be more thoughtful about the carbon intensity of their energy mix. While the old paradigm was based on units of power that were undifferentiated – where one electron was the same as any other – companies are increasingly adopting net-zero carbon emission targets and governments around the world have passed legislation that incentivizes renewable energy investment and production. The need to rapidly decarbonize the energy mix is having a compounding effect on demand growth and the buildout of renewable energy generation capabilities is now occurring at an unprecedented rate. According to the BloombergNEF 2022 Energy Outlook5, substantially all the new power generation capacity additions through 2050 will be renewables going forward while all the capacity retirements will be fossil fuel-based sources. Exhibits 2 and 3 show additions and retirements just this year.

These three secular demand drivers are expected to approximately triple power consumption by 2050. Simultaneously, the effects of climate change have required consumers to be more thoughtful about the carbon intensity of their energy mix. While the old paradigm was based on units of power that were undifferentiated – where one electron was the same as any other – companies are increasingly adopting net-zero carbon emission targets and governments around the world have passed legislation that incentivizes renewable energy investment and production. The need to rapidly decarbonize the energy mix is having a compounding effect on demand growth and the buildout of renewable energy generation capabilities is now occurring at an unprecedented rate. According to the BloombergNEF 2022 Energy Outlook5, substantially all the new power generation capacity additions through 2050 will be renewables going forward while all the capacity retirements will be fossil fuel-based sources. Exhibits 2 and 3 show additions and retirements just this year.

Exhibit 2 - Cumulative utility-scale electric generating capacity retirements, United States (2023)

Source: U.S. Energy Information Administration, Preliminary Monthly Electric Generator Inventory, June 2023.

Exhibit 3 - Cumulative utility-scale electric generating additions, United States (2023)

Source: U.S. Energy Information Administration, Preliminary Monthly Electric Generator Inventory, June 2023.

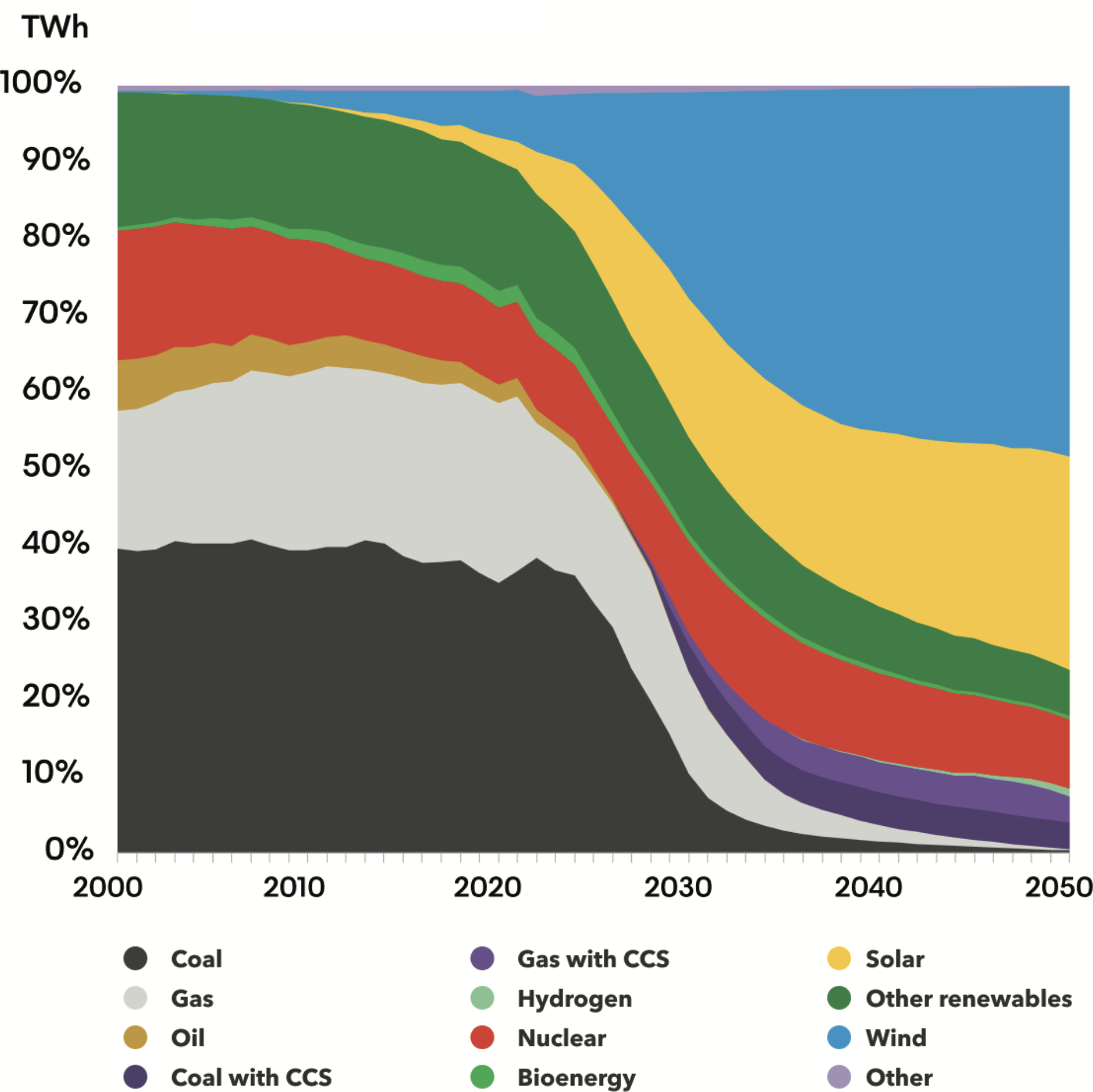

Longer-term, the global imperative to decarbonize the energy system will result in clean energy accounting for approximately 90% of electricity generation by 2050 (Exhibit 4).

Exhibit 4 - Electricity generation by technology, net zero scenario

Source: BloombergNEF. New Energy Outlook 2022

Electricity Supply

The immediate impact of these rapid changes is that utilities are unable to meet near-term demand. For example, Dominion Energy has informed customers in Northern Virginia that it is not be able to meet power delivery requirements for new data center developments until 2025 or 20266. The demand-supply imbalance is causing disintermediation in the power supply chain. Corporate customers are bypassing utilities and contracting directly with renewable power producers and procuring their own distributed power generation capabilities. In response to constrained power supply from the grid, Amazon is deploying solid oxide fuel cells supplied by our portfolio holding, Bloom Energy, as baseload to supply power to three newly-built datacenters in Oregon. Fuel cells are more reliable than the grid as they convert natural gas to electricity without combustion, with a 99 percent decrease in pollutants and water use and 50 percent lower carbon emissions than the displaced grid power in the region. Another Starlight portfolio holding, Altus Power, serves its commercial and industrial customers by offering power generated by large- scale locally-sited (rooftop, carport or on-ground) solar installations. Altus is enabled by premier sponsorship from The Blackstone Group (13% interest in Altus), which provides an efficient capital source and access to a network of portfolio companies, and CBRE Group (15% interest in Altus), which provides direct access to its portfolio of owned and managed properties. Altus leases space for its solar installation from its sponsor and customers enter into long- term power purchase agreements with Altus, thereby reducing their dependence on the grid. The end result is a highly symbiotic business arrangement that benefits all parties involved.

It’s All About Cash Flows

Rising demand is motivating renewable power developers to continue investing in large, capital-intensive power generation projects, which depresses current period and near-term results but ensures significant cash flows far out into the future with a high degree of certainty. They have made these investment decisions in spite of the current interest rate environment which disincentivizes higher cash flow duration investment and therefore, depresses market valuations in the renewable energy sector. Conversely, current market valuations for midstream energy companies imply a relatively short cash flow duration. The assets that produce cash flows at midstream energy companies (pipelines, storage facilities, etc.) are already in-place and maintenance investment requirements are relatively minimal. An inevitable question is whether to keep portfolio duration short and buy businesses with a shorter implied asset life, or to endure some short-term pain and look further out for long-duration cash flow. We believe that is a false dichotomy. In the Starlight Global Infrastructure Fund, we maintain material exposure to both energy sub-sectors. It is our belief that facilitating the energy transition and achieving net-zero targets will require not only new generation capacity to produce green electrons, but also the repurposing of existing infrastructure to produce and transport green molecules such as hydrogen and captured carbon. Carbon dioxide is already being captured not only from industrial smokestacks but also directly from the air, and it is increasingly flowing back through pipelines into the empty caverns from which fossil fuels were once extracted. The recent acquisitions by Exxon Mobil and Occidental Petroleum of Denbury Resources and Carbon Engineering, respectively, are poignant examples of investments to scale up carbon capture and sequestration efforts.

The immediate impact of these rapid changes is that utilities are unable to meet near-term demand. For example, Dominion Energy has informed customers in Northern Virginia that it is not be able to meet power delivery requirements for new data center developments until 2025 or 20266. The demand-supply imbalance is causing disintermediation in the power supply chain. Corporate customers are bypassing utilities and contracting directly with renewable power producers and procuring their own distributed power generation capabilities. In response to constrained power supply from the grid, Amazon is deploying solid oxide fuel cells supplied by our portfolio holding, Bloom Energy, as baseload to supply power to three newly-built datacenters in Oregon. Fuel cells are more reliable than the grid as they convert natural gas to electricity without combustion, with a 99 percent decrease in pollutants and water use and 50 percent lower carbon emissions than the displaced grid power in the region. Another Starlight portfolio holding, Altus Power, serves its commercial and industrial customers by offering power generated by large- scale locally-sited (rooftop, carport or on-ground) solar installations. Altus is enabled by premier sponsorship from The Blackstone Group (13% interest in Altus), which provides an efficient capital source and access to a network of portfolio companies, and CBRE Group (15% interest in Altus), which provides direct access to its portfolio of owned and managed properties. Altus leases space for its solar installation from its sponsor and customers enter into long- term power purchase agreements with Altus, thereby reducing their dependence on the grid. The end result is a highly symbiotic business arrangement that benefits all parties involved.

It’s All About Cash Flows

Rising demand is motivating renewable power developers to continue investing in large, capital-intensive power generation projects, which depresses current period and near-term results but ensures significant cash flows far out into the future with a high degree of certainty. They have made these investment decisions in spite of the current interest rate environment which disincentivizes higher cash flow duration investment and therefore, depresses market valuations in the renewable energy sector. Conversely, current market valuations for midstream energy companies imply a relatively short cash flow duration. The assets that produce cash flows at midstream energy companies (pipelines, storage facilities, etc.) are already in-place and maintenance investment requirements are relatively minimal. An inevitable question is whether to keep portfolio duration short and buy businesses with a shorter implied asset life, or to endure some short-term pain and look further out for long-duration cash flow. We believe that is a false dichotomy. In the Starlight Global Infrastructure Fund, we maintain material exposure to both energy sub-sectors. It is our belief that facilitating the energy transition and achieving net-zero targets will require not only new generation capacity to produce green electrons, but also the repurposing of existing infrastructure to produce and transport green molecules such as hydrogen and captured carbon. Carbon dioxide is already being captured not only from industrial smokestacks but also directly from the air, and it is increasingly flowing back through pipelines into the empty caverns from which fossil fuels were once extracted. The recent acquisitions by Exxon Mobil and Occidental Petroleum of Denbury Resources and Carbon Engineering, respectively, are poignant examples of investments to scale up carbon capture and sequestration efforts.

“Risk means more things can happen than will happen.” — Elroy Dimson

The trajectory of the economy and interest rates is inherently uncertain. Over the next few years, we could have a hard landing, mild recession, stagflation, a soft landing, or some combination of the above. It is impossible to come to a definitive conclusion on the macroeconomy as the tools to do so do not exist. However, regardless of whether one is managing a household, business or investment fund, it is important to remain prepared for a range of possibilities.

The Starlight Global Infrastructure Fund is a concentrated portfolio of companies that provides essential and foundational services in a supply-constrained manner for the basic functioning of society. The culmination of our bottom-up investment process is a selection of resilient business models in the energy sector managed by skilled operators that have exposure to the broad secular trend of decarbonization. The energy holdings in the Starlight Global Infrastructure Fund comprise companies that produce cash flows in excess of their internal funding needs from the operation of irreplaceable assets and laddered out over the near-, medium-, and long-term. This structure not only manages interest rate risk and reduces volatility, it also preserves growth optionality to the upside and provides dividend income to shareholders. The Starlight Global Infrastructure Fund yields over 5.50% annually and the distributions are paid to unitholders on a monthly basis. The distribution is supported by strong dividend growth from the underlying portfolio holdings. Over the last twelve months through the end of June 2023, the fund experienced 23 dividend increases with an average increase of +12.1%.

The Starlight Global Infrastructure Fund is a concentrated portfolio of companies that provides essential and foundational services in a supply-constrained manner for the basic functioning of society. The culmination of our bottom-up investment process is a selection of resilient business models in the energy sector managed by skilled operators that have exposure to the broad secular trend of decarbonization. The energy holdings in the Starlight Global Infrastructure Fund comprise companies that produce cash flows in excess of their internal funding needs from the operation of irreplaceable assets and laddered out over the near-, medium-, and long-term. This structure not only manages interest rate risk and reduces volatility, it also preserves growth optionality to the upside and provides dividend income to shareholders. The Starlight Global Infrastructure Fund yields over 5.50% annually and the distributions are paid to unitholders on a monthly basis. The distribution is supported by strong dividend growth from the underlying portfolio holdings. Over the last twelve months through the end of June 2023, the fund experienced 23 dividend increases with an average increase of +12.1%.

We invite you to partner with us.

Starlight Real Assets Mutual Fund & ETF

Starlight Real Assets Mutual Fund & ETF

Real Assets

Starlight Global Infrastructure Fund (SCGI)

Inception—2018

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Fund Codes

Series ETF

Series A

Series T6

Series F

Series FT6

Series O

Series O6

Series I

Distribution Frequency

Fixed Monthly

Investment Objective:

To provide regular current income by investing globally in companies with either direct or indirect exposure to infrastructure.

Fund Codes

Series ETF

Series A

Series T6

Series F

Series FT6

Series O

Series O6

Series I

Distribution Frequency

Fixed Monthly

Fund Profile:

Starlight Global Infrastructure Fund - Series ETF (SCGI)

Starlight Global Infrastructure Fund - Series A (SLC102)

Starlight Global Infrastructure Fund - Series T6 (SLC152)

Starlight Global Infrastructure Fund - Series F (SLC202)

Starlight Global Infrastructure Fund - Series FT6 (SLC252)

Starlight Global Infrastructure Fund - Series O (SLC402)

Starlight Global Infrastructure Fund - Series O6 (SLC452)

Starlight Global Infrastructure Fund - Series I (SLC902)

Starlight Global Infrastructure Fund - Series ETF (SCGI)

Starlight Global Infrastructure Fund - Series A (SLC102)

Starlight Global Infrastructure Fund - Series T6 (SLC152)

Starlight Global Infrastructure Fund - Series F (SLC202)

Starlight Global Infrastructure Fund - Series FT6 (SLC252)

Starlight Global Infrastructure Fund - Series O (SLC402)

Starlight Global Infrastructure Fund - Series O6 (SLC452)

Starlight Global Infrastructure Fund - Series I (SLC902)

1U.S. Energy Information Administration.

2McKinsey & Company. Global Energy Perspective 2022.

3IEA. 5 ways Big Tech could have big impacts on clean energy transitions. March 25, 2021.

4Bloomberg. Artificial Intelligence Is Booming—So Is Its Carbon Footprint. March 9, 2023.

5BloombergNEF. New Energy Outlook 2022.

6DatacenterDynamics. Dominion Energy admits it can’t meet data center power demands in Virginia. July 29, 2022.

2McKinsey & Company. Global Energy Perspective 2022.

3IEA. 5 ways Big Tech could have big impacts on clean energy transitions. March 25, 2021.

4Bloomberg. Artificial Intelligence Is Booming—So Is Its Carbon Footprint. March 9, 2023.

5BloombergNEF. New Energy Outlook 2022.

6DatacenterDynamics. Dominion Energy admits it can’t meet data center power demands in Virginia. July 29, 2022.

The views in this update are subject to change at any time based upon market or other conditions and are current as of July 31, 2023. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering documents before investing. Investors should consult with their advisors prior to investing.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.