E-commerce helps industrial REITs deliver total returns of 30%

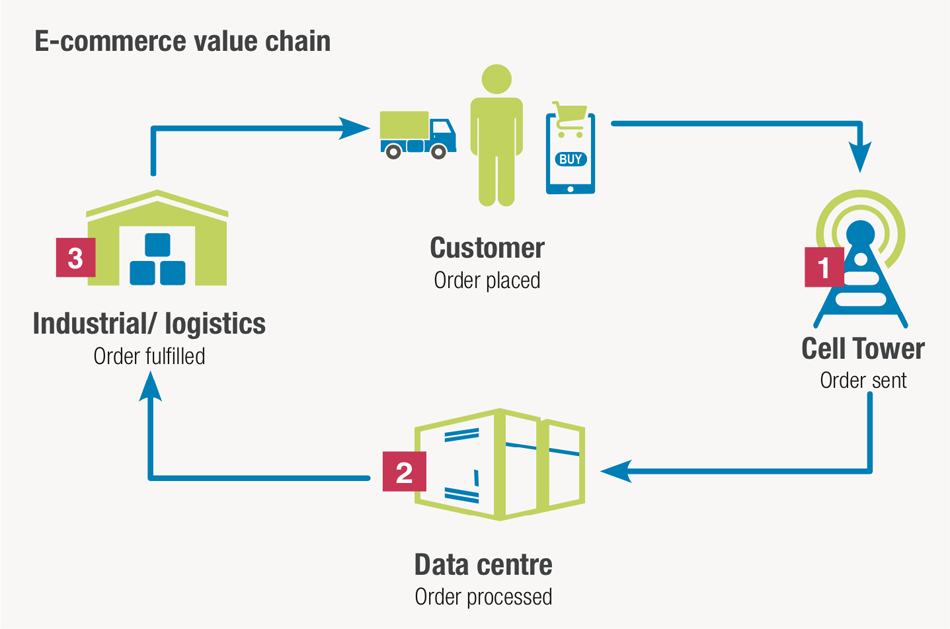

Industrial REITs own warehouses that are generally used to house goods that are ultimately delivered to a store or directly to the end consumer. Industrial REIT tenants are usually retailers selling goods to consumers and businesses (i.e. Amazon, Home Depot) or logistics companies facilitating these transactions (i.e Fedex, UPS). Typical growth drivers of occupancy for industrial assets include personal consumption (either e-commerce or brick & mortar sales) and global trade (cargo volumes). More recently, supply chain modernization and rising middle class affluence in emerging markets has supported increased development of logistics assets. Globally, industrial rents have risen while industrial cap rates have compressed providing for increased cash flow and capital appreciation from industrial REITs.

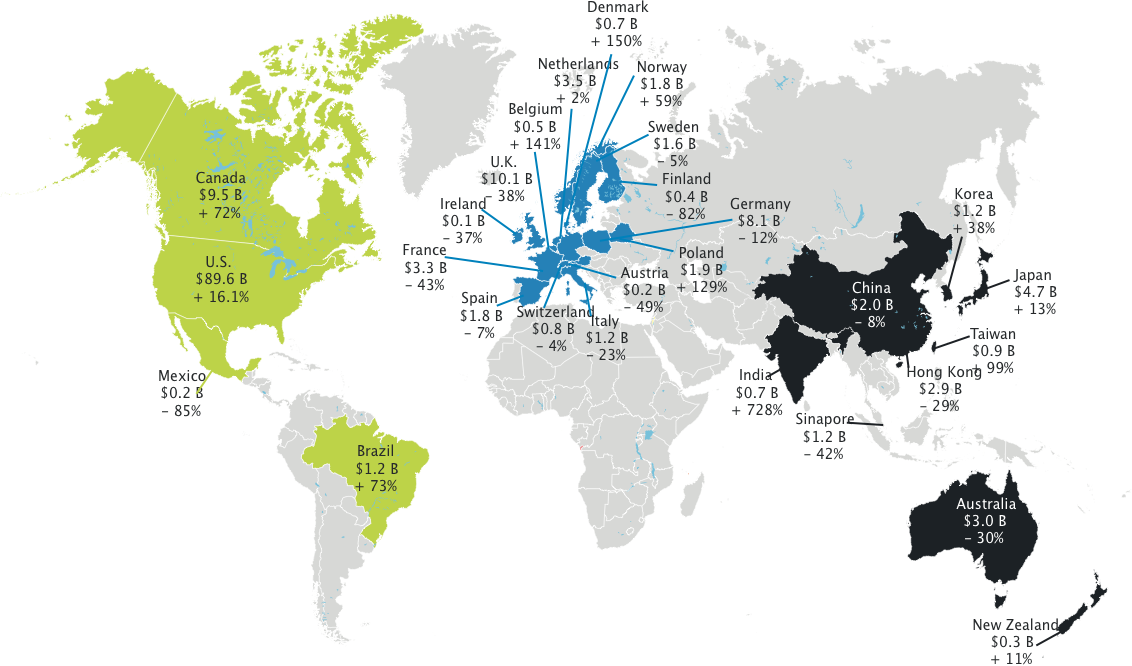

Global industrial sales volumes and annual change, 2018 (US$ Billions)

Source: CBRE Research, RCA. For Canada, the following sources were used: Altus Data Solutions, RealTrack Limited, Collette Plante, JLR Land Title Soltions, Q4 2018.

According to The World Bank, global trade as a percentage of GDP has risen from 23.8% in 1960 to 57.9% in 2017. This evolution has driven the demand for more modern logistics and distribution facilities across the globe. Much of this has been traced back to the rise of firms like Amazon and Alibaba and the embrace of on-line retailing by firms like Costco and Wal- Mart. In recent years, investors have grown concerned that Brexit and the US/China trade war would weigh on demand for logistics and distribution facilities. However, strong property fundamentals continue to attract global investors to high-quality industrial real estate. CBRE’s 2019 Global Investor Intentions Survey found that 29% of investors consider industrial & logistics the most attractive property sector, compared with 26% for office and 27% for multi-family.

Institutional investors continue to allocate capital to the industrial space. Brookfield Asset Management closed its third private real estate fund in January of 2019, surpassing their US $10 billion target by securing US $15 billion. Not to be outdone, in September 2019, Blackstone closed the largest real estate fund ever at US $20 billion. Blackstone intends to use this fund to close the acquisition of the largest-ever private real estate transaction globally - the acquisition of 179 million square feet of industrial assets from three of GLP’s U.S. funds for US $18.7 billion. This is in addition to their acquisition of Pure Industrial REIT in 2018 for C $3.8 billion, their acquisition of Dream Global REIT in 2019 for C $6.8 billion and their US $5.9 billion acquisition of logistics assets from Colony Capital Inc.

Institutional investors continue to allocate capital to the industrial space. Brookfield Asset Management closed its third private real estate fund in January of 2019, surpassing their US $10 billion target by securing US $15 billion. Not to be outdone, in September 2019, Blackstone closed the largest real estate fund ever at US $20 billion. Blackstone intends to use this fund to close the acquisition of the largest-ever private real estate transaction globally - the acquisition of 179 million square feet of industrial assets from three of GLP’s U.S. funds for US $18.7 billion. This is in addition to their acquisition of Pure Industrial REIT in 2018 for C $3.8 billion, their acquisition of Dream Global REIT in 2019 for C $6.8 billion and their US $5.9 billion acquisition of logistics assets from Colony Capital Inc.

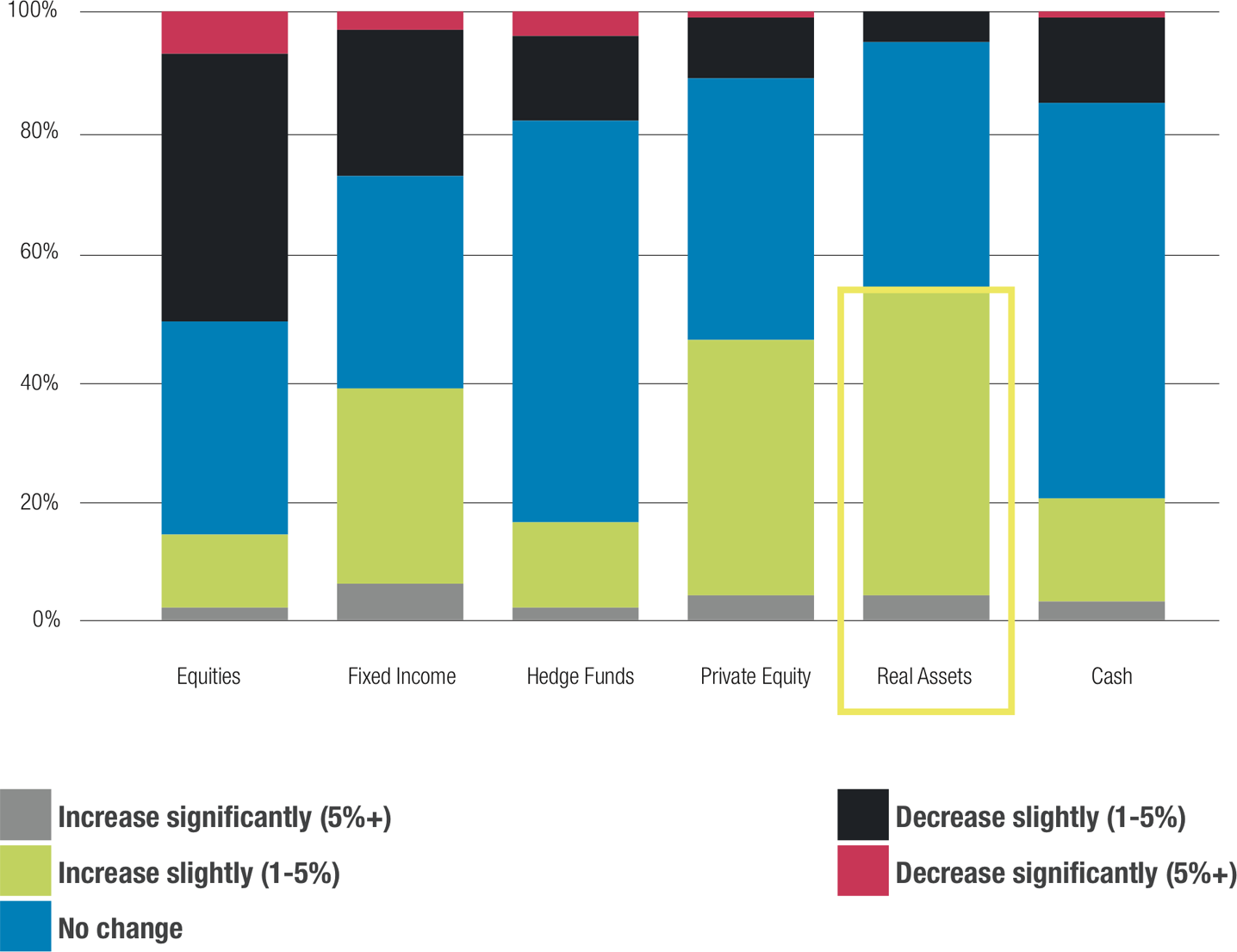

According to the Pension Investment Association of Canada, the largest 100 pension plans in Canada now hold 12.8% of their assets in real estate, up 44.4% from 2010.

Allocation outlook - Real assets lead BlackRock’s 2019 annual institutional rebalancing survey

Source: BlackRock, as at December 2018. Net percentages represent a net percentage intending to increase or decrease allocations to each asset class. (Calculation: % of firms intending to increase - % of firms intending to decrease) Base sizes: Total (230); Equities (225); Fixed Income (230); Hedge Funds (133); Private Equity (188); Real Estate (203); Real Assets (173); Cash (223). For illustrative purposes only. The figures/ net change represented in percentages are illustrative in nature and do not express a forecast. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. No analysis of their suitability was conducted and no statement of opinion in relation to their suitability is provided.

Historically, industrial assets have been located near transportation hubs such as airports, marine ports or highways. However, the rise of global trade and e-commerce is structurally changing the global industrial real estate market. Industrial REITs and landlords are now building facilities closer to population centers, allowing businesses to deliver goods to consumers faster and often cheaper. As developable space close to consumers becomes scarce, and with the growing premium on timely, last-mile delivery, Industrial REITs have begun to introduce multi-story logistics facilities in urban centers to improve the local supply chain dynamics.

Prologis Inc., is leading the charge with their “Georgetown Crossroads” asset in downtown Seattle. It is the first three-story logistics asset with a second floor serviceable by tractor-trailer trucks. This asset has 590,000 square feet of warehouse space and offers more than double the capacity of what would have been possible for a one-story building. Importantly, the site’s central location in a metropolitan area of nearly four million people is just a few miles from Seattle’s ports.

Prologis Inc. (“Prologis”, NYSE: PLD) is the largest industrial REIT in the world with interests in 786 million square feet of real estate in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,100 customers with a focus on high-barrier, high-growth markets. This focus has allowed Prologis to experience high occupancy (96.8% from Q2/19 results) and rent growth (12.3% cash rent growth in Q2) driven by demand outstripping new supply. As a result, cash same-property Net Operating Income growth of 4.6% continues to drive Funds From Operations per Share growth of 8.5% and supports the REIT’s continued strong total returns (46.4% total return year to date). Prologis even managed to complete a US $4 billion accretive acquisition during the year. Given the continued strong demand for modern logistics facilities and Prologis’ unmatched global footprint we feel comfortable continuing to hold the position as one of our larger weights in the Starlight Global Real Estate Fund.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.