The case for real estate in your portfolio

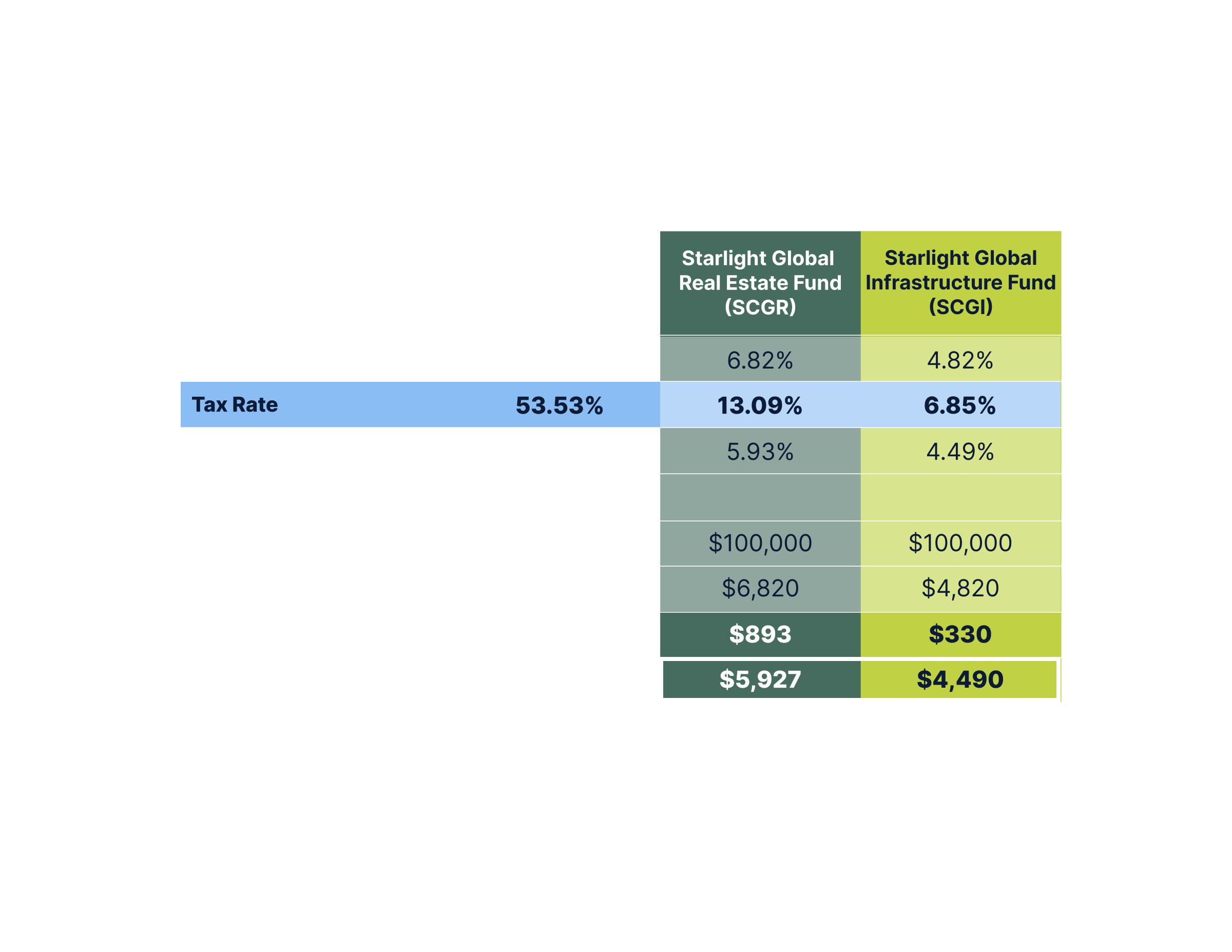

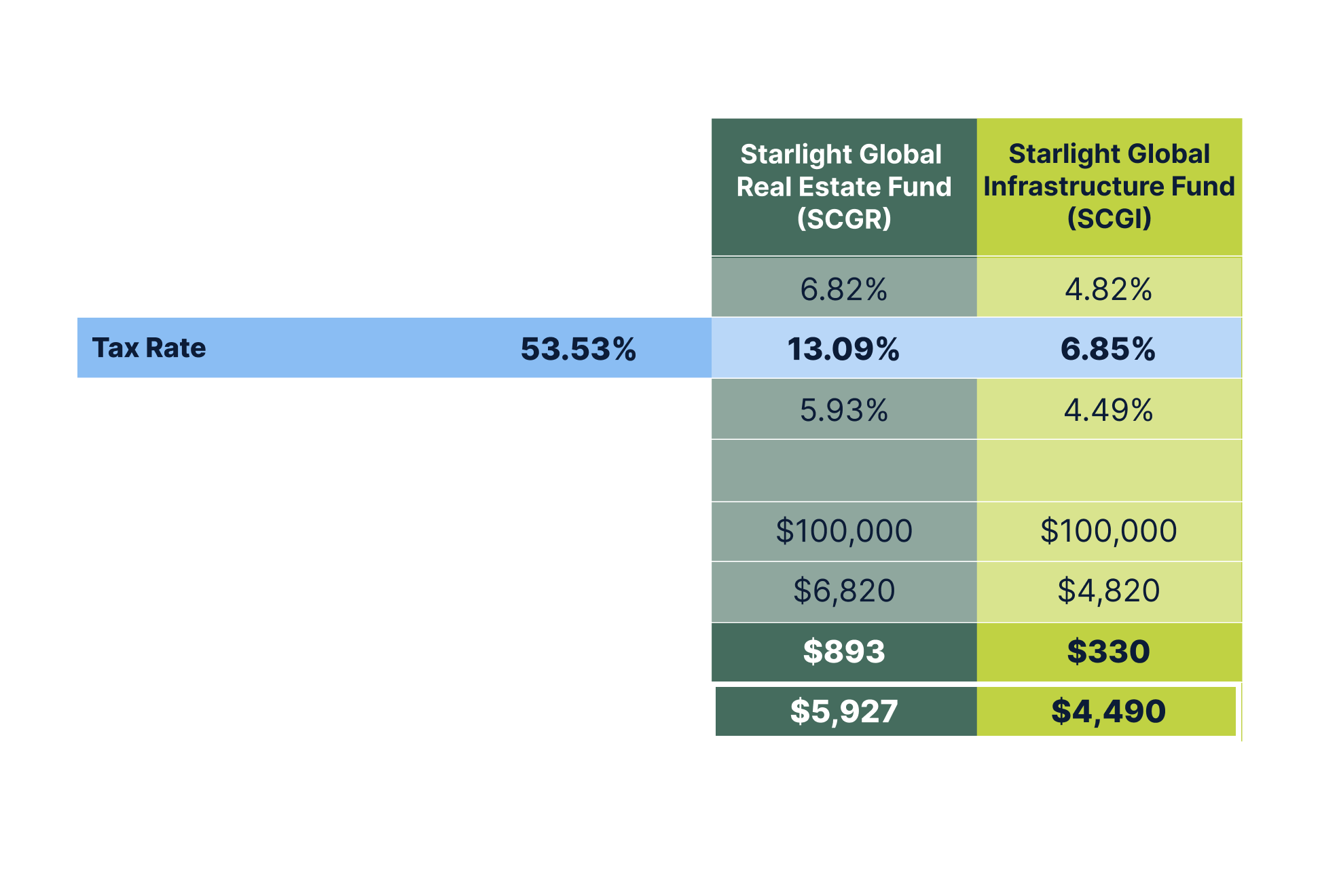

Real estate assets can generate tax-advantaged income and capital appreciation over the long term.

Learn more about real estate and our investment solutions.

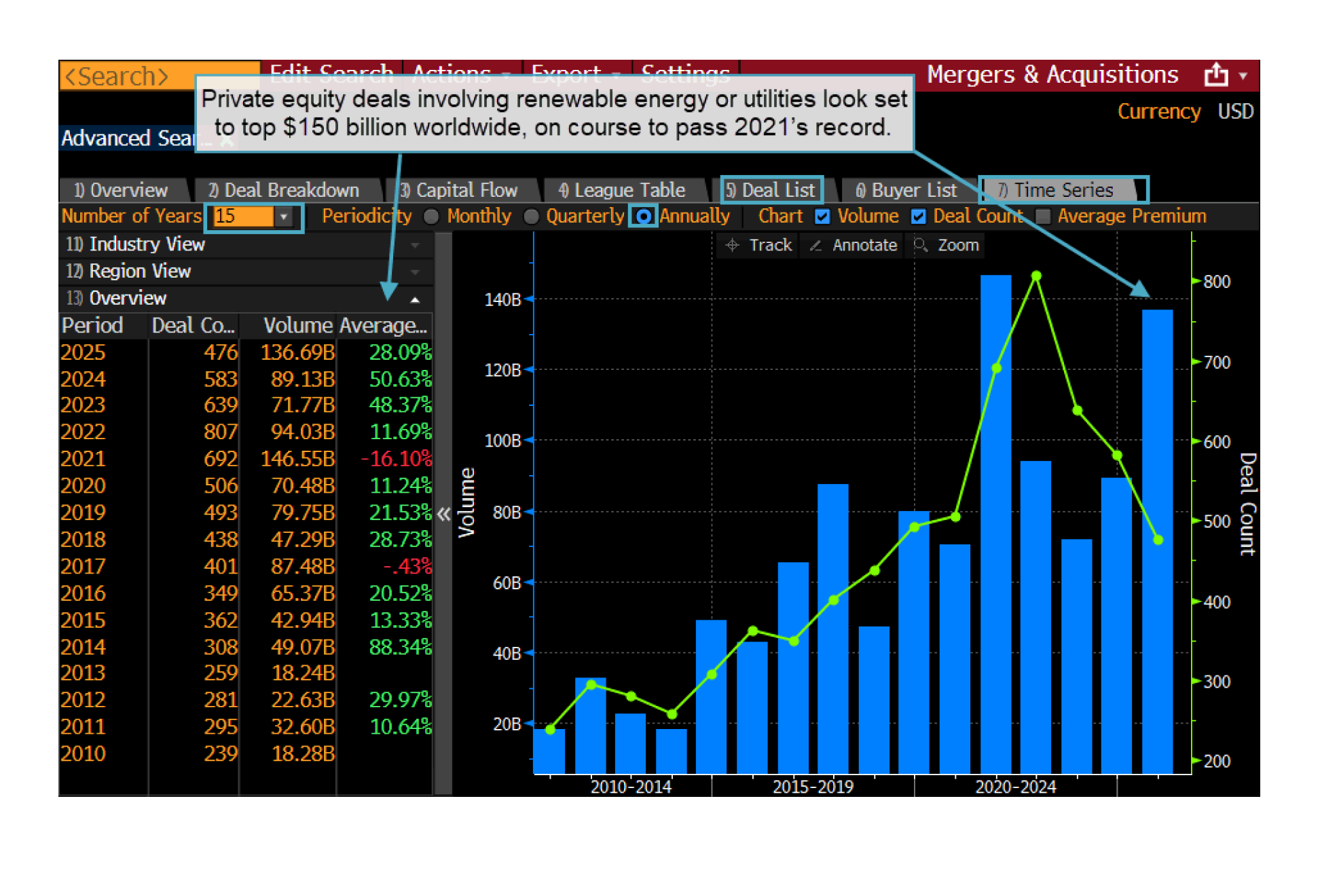

The case for infrastructure in your portfolio

Infrastructure assets generate dividend growth and capital appreciation over the long-term.

Learn more about infrastructure and our investment solutions.

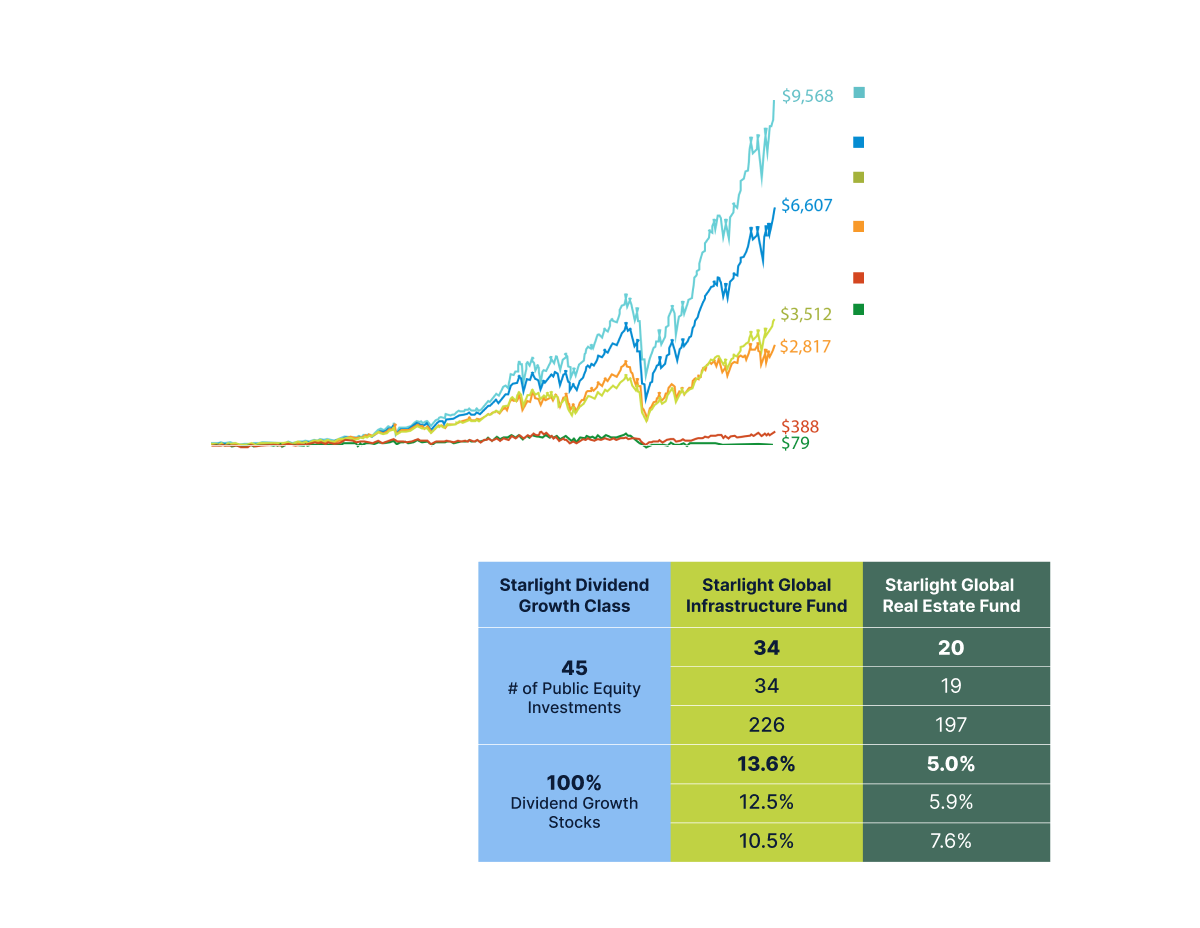

Dividend growth with Starlight Capital

Over long periods of time, total returns are dominated by the dividends and growth the company generates.

Learn more about dividend growth and the Starlight Dividend Growth Class.

About Us

At Starlight Capital, we are investment-led and client-focused. Our goal is to deliver superior, risk-adjusted returns for investors by using our disciplined approach of Focused Business Investing. We build concentrated portfolios of high quality businesses when they offer us enough return for the risk we are exposed to. Learn more about our story, our people and our Focused Business Investment philosophy.

The Latest from Starlight Capital

Thought Leadership

Securing Recession-Proof and Resilient Returns in Waste Management

Hisham Yakub, Senior Portfolio Manager, Starlight Global Infrastructure Fund, explains why waste management is a component of the Fund. Within the Starlight Global Infrastructure Fund, exposure to AI-driven infrastructure demand is balanced with defensive infrastructure sectors such as waste management.

Learn MoreMedia Spotlight

Come to Sleigh by Shine Foundation

Starlight Capital joined Starlight Investments for the second annual Sledge Hockey Tournament supporting Shine Foundation’s mission to empower kids and youth living with severe physical disabilities across Canada.

Learn MoreOur People

Dennis Mitchell joined Starlight Capital in March 2018 as Chief Executive Officer and Chief Investment Officer. He has over 20 years of experience in the investment industry and has held executive positions with Sprott Asset Management, serving as Senior Vice-President and Senior Portfolio Manager, and Sentry Investments, serving as Executive Vice-President and Chief Investment Officer. Mr. Mitchell received the Brendan Wood International Canadian TopGun Award in 2009, 2010, and 2011 and the Brendan Wood International 2012 Canadian TopGun Team Leader Award. He also received the Afroglobal Television Excellence Award for Enterprise in 2020 and the Black Business and Professionals Association’s Harry Jerome President’s Award in 2021. Mr. Mitchell holds the Chartered Financial Analyst and Chartered Business Valuator designations and earned a Master of Business Administration from the Schulich School of Business at York University in 2002 and an Honors Bachelor of Business Administration degree from Wilfrid Laurier University in 1998. Mr. Mitchell currently sits on the Board of the Toronto Foundation and is Co-Founder and Director of the Black Opportunity Fund.

Graeme Llewellyn joined Starlight Capital in March 2018 as Chief Financial Officer and Chief Operating Officer. He has over 20 years of experience focused on asset management and the creation, operation and financial reporting for mutual funds, and has held executive positions with Sentry Investments, where he served as Vice-President and Chief Operating Officer, and Deloitte & Touche LLP.

Mr. Llewellyn has a broad range of experience across the business with extensive experience in project management, information technology, and the creation, operation and financial reporting for mutual funds, closed-end funds, offering memorandum funds, separately managed accounts and hedge funds. He was an integral part in the growth of Sentry Investments.

Mr. Llewellyn is a Chartered Professional Accountant and has a Bachelor of Commerce degree from the Rotman Commerce Program at the University of Toronto.

Lou Russo joined the Starlight Capital Executive Team in June 2018 as Senior Vice-President, National Sales and Distribution. He has over 25 years of experience in the investment industry focused on sales, sales management and strategic institutional relationships.

Mr. Russo most recently held an executive position with Fiera Capital where he served as Senior Vice-President, Retail Markets and played an integral role in the growth of Fiera Capital’s retail distribution. Prior to that, he held senior positions with industry leaders Dynamic Funds, Fidelity Investments and Franklin Templeton Investments.

Mr. Russo holds the Chartered Investment Manager (CIM®) designation and has completed the Fundamentals in Alternative Investments Certificate Program from the Chartered Alternative Investment Analyst Association (CAIA). He has also completed numerous industry courses including Portfolio Management Techniques, Professional Financial Planning and Canadian Investment Management courses.

Mr. Russo is a member of the Canadian Association of Alternative Strategies & Assets (CAASA) and the Canadian Professional Sales Association (CPSA).

Sean Tascatan joined Starlight Capital in January 2023 as Senior Portfolio Manager. He has over 10 years of experience in the investment industry.

Mr. Tascatan most recently held a position at a Canadian independent asset management firm as the lead portfolio manager of numerous dividend funds, including a U.S. Dividend Growth Fund where he specialized in high-quality, dividend paying U.S. equities. Prior to that, he worked at Sentry Investments where he was a key member of an award-winning Equity Income team that garnered multiple Lipper Fund and Morningstar Investment Awards. There, he was the co-manager of a $3B U.S. Growth and Income Fund and a $500MM Diversified Equity Fund.

Mr. Tascatan holds the Chartered Financial Analyst designation and has completed the Options Licensing Course and has an Honours Bachelor of Arts degree in Economics and Financial Management from Wilfrid Laurier University.

Hisham Yakub joined Starlight Capital in February 2023 as Senior Portfolio Manager. He has over 10 years of experience in the investment industry.

Mr. Yakub most recently held a position with a boutique Toronto-based investment management firm as an Investment Analyst and Portfolio Manager. He also spent the first six years of his business career focused on developing software tools for portfolio management applications. He progressed through several roles across the industry and finished his pre-MBA career at CPP Investment Board.

Mr. Yakub holds the Chartered Financial Analyst and Financial Risk Manager designations and earned a Master of Business Administration from the Rotman School of Management at the University of Toronto in 2013 and an Honours Bachelor of Business Administration degree with a specialization in Information Systems from York University.

Harry Tashakori joined Starlight Capital in September 2022 as a Research Analyst.

Mr. Tashakori most recently held a position with Stone Asset Management (“SAM”) as a research analyst and has contributed significantly to both the quantitative and fundamental aspects of SAM’s investment process. Prior to SAM, he held a position at CI Global Asset Management as a senior analyst where he was responsible for portfolio performance measurement and attribution, risk analysis and reporting for institutional businesses. Prior to that, he worked at MAPNA Group, a conglomerate of 42 companies and top player in power, oil & gas, and railway transportation industry in the Middle East as a senior infrastructure investment analyst.

Mr. Tashakori holds the Chartered Financial Analyst designation and has completed the Certificate in Investment Performance and Measurement (CIPM) with the CFA Institute and has a Master of Finance from Smith School of Business at Queen’s University.

Shay Turk joined Starlight Capital in September 2023 as a Research Analyst and has over two years of experience in the investment industry.

Ms. Turk has focused on the analysis of real estate investments for the duration of her career. This includes both publicly-listed securities and private investment assets and funds, across a number of geographies, strategies and sectors. In addition to modelling real estate businesses and funds, Shay has travelled extensively to view and appraise investments and assets.

Ms. Turk is a CFA Level II candidate and she has an Honors Bachelor of Business Administration and Financial Mathematics degree from Wilfrid Laurier University.

William Seto joined Starlight Capital in August 2018 as Senior Investment Administrator and Trader. He has over 20 years of experience in the investment industry.

Mr. Seto, building on his progressive career from Operations Analyst to Portfolio Administrator to Senior Trader, believes in the value of creating exceptional operations and client experience from the ground up and brings with him a broad range of successful investment operations experience from asset management companies including Excel Funds, Hansberger Growth Investments, Sentry Select Capital, and Laketon Investment Management.

Mr. Seto has an Honours Bachelor of Science degree from the University of Toronto.

Sabrina Teed joined Starlight Capital in September 2022 as a Business Development Associate, partnering with Lou Russo, servicing clients in Ontario and Quebec.

Ms. Teed, drawing on her experience in financial services, prioritizes client service and relationship development. Her goal is to partner with advisors to find creative solutions for portfolios. Prior to joining Starlight, she worked at Picton Mahoney Asset Management as a Business Development Associate managing relationships across Canada.

Ms. Teed holds the Canadian Securities Certificate (CSC) and has an Honours Bachelor’s degree in Psychology from the University of Guelph.

Connor Chalk joined Starlight Capital in October 2023 as a Business Development Associate, partnering with Lou Russo servicing clients in Atlantic Canada and Ontario.

Mr. Chalk is an accomplished finance professional with a proven track record in capital markets, financial consulting, and the Canadian banking sector. His deep knowledge of research methodologies and asset management strategies equips him with a unique perspective for navigating complex retail and institutional investments. He takes a consultative approach when partnering with advisors to cultivate relationships based on trust, knowledge, and dedication to their portfolios. Prior to joining Starlight, he worked at Henon Capital as an Associate Director of Business Development.

Mr. Chalk holds the Canadian Securities Certificate (CSC) and has an Honours Bachelor of Commerce, Finance and Economics degree from the University of Guelph.

Pawan Mahal joined Starlight Capital in October 2023 as a Business Development Associate, partnering with Lou Russo servicing clients in Ontario.

Mr. Mahal, drawing upon his background in capital markets, places a strong emphasis on client services and fostering relationships. His primary goal is to collaborate with financial advisors to identify innovative portfolio solutions that meet their specific needs. Prior to joining Starlight, he served as a Senior Account Specialist at Hybrid Financial, where he excelled in building key relationships within the financial services industry.

Mr. Mahal holds the Canadian Securities Certificate (CSC) and has a Bachelor’s degree in Management, Economics and Finance from the University of Guelph.

Halcyon Mclntosh joined Starlight Capital in April 2018 as Director, Finance and Fund Services and has progressed to her current role as Vice-President, Finance and Fund Services. She has more than 20 years of experience in the asset management industry focused on fund administration, accounting, investment operations and client service in both Canada and the US.

Ms. Mclntosh most recently held a leadership role at Sentry Investments as Director, Fund Administration and Client Service where she was instrumental in building and developing the fund accounting and fund administration teams contributing significantly to the growth and operational success of Sentry Investments.

Ms. Mclntosh has a Bachelor of Business Administration degree in Accounting from the City University of New York – Baruch College.

Marco Drumonde joined Starlight Capital in April 2018 as Director, Advisor and Investor Experience and has progressed to his current role as Vice-President, Advisor and Investor Experience. He has more than 15 years of experience in the investment industry focused on operations and client service within both the investment manager and various distribution channels.

Mr. Drumonde most recently held a senior position with Sentry Investments where he served as Associate Vice-President, Advisor and Investor Services. He has a comprehensive range of experience across the financial industry with extensive knowledge in mutual funds, dealer operations and high net worth investment products and played a central role in revitalizing Sentry Investments’ client service and operational excellence. Prior to that, he worked at CI Investments as Manager, Private Client Service and Operations.

Mr. Drumonde has a Financial Planning Management Diploma from George Brown College.

Kristen Wallace joined Starlight Capital in April 2018 as Executive Assistant and has progressed to her current role as Manager, Business Operations. She has more than 15 years of experience supporting C-Suite Executives, including more than 12 years of experience within the financial industry.

Ms. Wallace has held key support roles at Sprott Asset Management and Altacorp Capital, where she most recently served as Executive Assistant to the President & CEO. In this capacity, she was instrumental in implementing organizational processes for Executives, overseeing executive reporting, and planning and managing strategic marketing campaigns and client events.

Ms. Wallace is a licensed Paralegal and a member of the Law Society of Ontario. She has a diploma in Paralegal Education and a certificate in Alternative Dispute Resolution from Seneca College.

Lotty joined Starlight Capital in November 2022 as Manager, Marketing.

Ms. Lin is a marketing professional with a finance and marketing background. This combination of skills makes her a well-rounded marketing professional in the finance industry. She most recently held a position at a boutique Toronto-based investment management firm leading brand and digital marketing, and prior to that at Tricon Residential supporting rebrand, communications, and digital marketing, at Foote, Cone & Belding New York on a creative project for the U.S. Food and Drug Administration, and at the United Nations New York Headquarters as an analytics and business intelligence summer intern.

Ms. Lin holds the Canadian Securities Certificate (CSC) and has a Bachelor of Commerce degree in Finance and Economics from the Rotman Commerce Program at the University of Toronto and a Master of Science degree in Integrated Marketing, Marketing Analytics from New York University, from both of which she graduated with high distinction.