Deepseek or deep fake?

A CHINESE START-UP SAYS IT CREATED AN AI TOOL AT A FRACTION OF THE COST THAT WESTERN RIVALS PAID. IT SHOULDN’T BE A FATAL BLOW, BUT THE DEVELOPMENT SHOULD TRIGGER ANSWERS TO LINGERING INVESTOR CONCERNS ON RUNAWAY CHIP BUYING.

AI has been the stock market darling ever since OpenAI launched ChatGPT in November 2022. It has helped the Magnificent Seven largest US technology companies deliver big returns that have left most other businesses in their dust.

This AI wave has required a lot of computing power to teach large language models about our world and to refine how they answer prompts from users. To provide that computing horsepower, a massive amount of money has been poured into building data centres that can house stacks of high-performance graphics processors, like those made famous by chip designer Nvidia. These chips don’t come cheap. In the third quarter alone, almost $31 billion was spent on data centre chips. Often, companies are spending more in a single quarter than they used to spend on capital expenditure for a whole year pre-2020.

And then there’s the electricity needed to make them go. US bank Morgan Stanley estimates that global data centre power demand jumped from roughly 15 Terawatt-hours (TWh) to closer to 46TWh in 2024 alone. Another US bank, Wells Fargo, thinks electricity supplied to US data centres could be 16% of the current US total demand. Just last week, US President Donald Trump highlighted the ‘Stargate’ AI infrastructure investment joint venture between Japanese tech investor SoftBank, Emirati government investment arm MGX and US companies Oracle and OpenAI. While having headline funding of $500bn over five years, there was apparently no government money behind it.

The sheer cost of investment for AI caused a flurry of worry at the tail end of last year, but it was swiftly brushed off and most AI companies have continued to forge higher. Over the weekend, those concerns returned on news that a Chinese competitor, DeepSeek, has managed to develop a large language model for a fraction of the price.

DeepSeek published an academic paper setting out how its model can learn and improve itself without needing human supervision. It purportedly trained a model of comparable size to the giants of Silicon Valley using just 2,048 Nvidia H800 chips and roughly $5.6m. While a powerful chip in absolute terms, the H800 was released in early 2023 as an intentionally inferior product specifically for the Chinese market to comply with a US ban on top-range AI chip exports to China. It was about half the power of the version sold in the West. A chip made in March 2023 is ancient in AI terms: it has been superseded several times. The latest Nvidia GB200 Superchip is 30 times more powerful than the H100, of which the H800 was a handicapped version.

If DeepSeek can create a large language model with a fraction of the investment required by its American rivals, it raises questions about whether their competitive position is as unassailable as most imagine and also brings some doubt about whether assumed trends on power consumption and investment will play out as forecast. This has led to substantial drops in US AI companies ahead of the market open on Monday.

The market’s knee-jerk reaction takes this threat at face value; however, there are reasons to be sceptical. For example, China has claimed in the past to have cracked ‘extreme ultraviolet lithography’ which is the method required for manufacturing top-end semiconductor chips. That turned out to be false. Is it really conceivable that China has now managed to achieve on a shoestring budget what the leading US technology companies have had to spend billions on? US investment bank JP Morgan, for example, thinks this is highly improbable. And it’s also worth noting that the DeepSeek offering would appear not to be sufficiently accurate for proper commercial use. Moreover, it is almost certain that western companies and governments would be reluctant to use a Chinese solution owing to concerns about security.

It does feel as though a lot of investors have been looking for an excuse to take profits on, or bet against, the chip designers and makers after a very strong run. Even so, there’s a sufficient threat to US AI superiority to prompt some robust answers to these capital investment concerns, which, as we mentioned earlier, are not new.

Central bankers to the fore

In his first week in the Oval Office, Trump started pressuring US Federal Reserve (Fed) Chair Jay Powell to lower interest rates. Trump argued that he had “much better” knowledge on monetary policy than Powell and would like to see them come down “a lot”. The strict independence of monetary policy long been respected in the US, but Trump hasn’t followed the custom.

Investors weren’t too bothered about the risks that could come from a real breach of this doctrine – reduced central bank credibility and lessened surety about the soundness of money. At first the US 10-year government bond yield was relatively unchanged; in fact it actually traded a little higher, essentially shrugging off Trump’s comments as hot air.

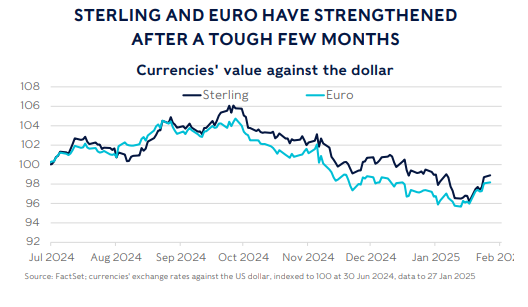

One market that did move, however, was the dollar. It’s impossible to determine short-term currency moves ahead of time and almost as difficult to divine what exactly caused their moves even after the fact. Yet the dollar did drop noticeably against most of its major trading partners after the President took office. To us, this seems most likely to be a reaction to some of Trump’s other comments, especially the lack of tariff pronouncements and his less-strident tone on China. If tariffs can be avoided, that would likely lessen the risk of a trade war pushing US inflation higher. That would, in turn, mean interest rates at a lower level than otherwise. A currency tends to fall when its interest rates are expected to fall relative to those of other nations and it typically rises when its rates are thought to be higher. That dollar fall continued in early Monday trading, helping boost the value of sterling and the euro, which have recovered quite a bit in January.

The Fed is expected to hold its benchmark overnight interest rate at the 4.25-4.50% band when it meets to discuss monetary policy this week, regardless of Trump’s prodding. US fourth-quarter economic growth will be released this week. It’s expected to moderate to 2.8% from 3.1%, however that’s just the first estimate. It is often revised. Another important piece of the jigsaw puzzle for the Fed is PCE inflation. Core PCE, which removes volatile food and energy prices, is the central bank’s favoured measure of inflation. It’s expected to remain at 2.8% for the third consecutive month, which leaves it at the highest level since April. The headline PCE number (which includes energy and food) is forecast to rise from 2.4% to 2.6%

A quarter-percentage-point cut is expected when the European Central Bank meets to discuss monetary policy on Wednesday and Thursday. That would take the Continent’s benchmark overnight interest rate to 2.75%. Euro Area fourth-quarter GDP will be reported on Thursday. It’s forecast to drop back to 0.1% from 0.4% (annualised, that’s 0.4% and 1.6%).

Then, a 25-basis-point cut is expected from the Bank of England next week on Thursday 6 February, which would take the rate to 4.5%. UK 10-year bond yields continued to drop last week in anticipation, albeit only modestly compared with the falls of the previous week. The unemployment rate rose 0.1% to 4.4% last week, but that’s well within a very high margin of error, so it’s impossible to know whether that move was real or just statistical noise.

The views in this update are subject to change at any time based upon market or other conditions and are current as of the date posted. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

This document was originally published by Rathbone Investment Management Limited. Any views and opinions are those of the author, and coverage of any assets in no way reflects an investment recommendation. The value of investments and the income from them may go down as well as up and you may not get back your original investment. Fluctuations in exchange rates may increase or decrease the return on investments denominated in a foreign currency. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.