A tough cop

DEVELOPED NATIONS HAVE AGREED TO A THREE-FOLD INCREASE TO CLEAN ENERGY AND CLIMATE MITIGATION FUNDING FOR POORER COUNTRIES, BUT WITH A 10-YEAR PHASE-IN. MEANWHILE, ADVANCED NATIONS ARE BATTLING SPIRALLING ENERGY COSTS – SOME MORE THAN OTHERS.

The 29th COP climate conference wrapped up in Azerbaijan last week with developed nations pledging at least $300 billion (£238bn) of funding each year to help poorer nations move to cleaner energy and to mitigate the effects of global warming. Although, they have another decade to get there.

While the amount is treble what was previously agreed, it’s far short of the $1 trillion that a panel of economists commissioned by COP 26 and 27 forecast would be required each year by 2030. And the pledged level of funding isn’t binding until 2035. Many emerging nations were angry with the amount agreed, but they accepted it because they felt they weren’t going to get much better once US President-Elect Donald Trump moves into the White House in January.

Azerbaijan was the third petrostate in as many years to host the annual summit for negotiating global climate change policies, so it was tough for the hosts to convince many that it was a serious affair. At times, the conference appeared close to completely breaking down as tempers ran high. It’s perhaps also pertinent to note that being a petrostate isn’t what it used to be. For many years, these countries made so much money from oil and gas that they could dole out lavish subsidies, direct payments to citizens and make big investments. That’s still true for some, but most now are no longer making enough from oil and gas exports at current prices to cover this largesse. Cash to help them change may be useful.

In a helpful breakthrough, China – which is still considered a developing market, despite being the world’s second-largest economy – agreed to make voluntary payments to the fund for other nations. That spreads the financial burden more widely, particularly helpful in a time when many advanced economies are in straitened circumstances because of higher borrowing costs and big debt piles. China also revealed for the first time how much climate change support it’s provided so far to other nations: $24.5bn since 2016.

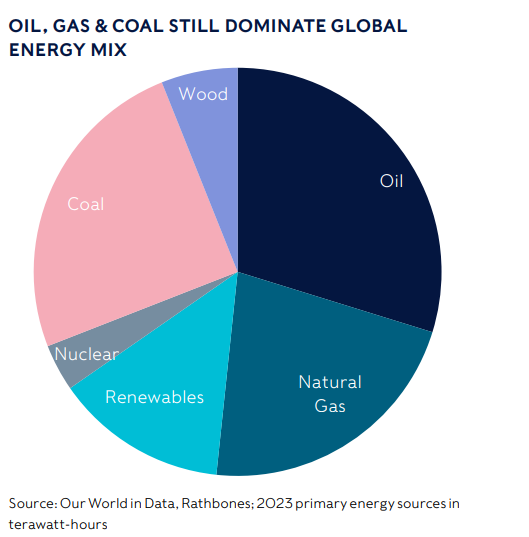

For the sheer weight of words written and spoken about renewable energy, carbon-heavy generation proliferates. There’s still an extremely long way to go if the world wants to wean itself from wood and coal, let alone the cleaner alternative of oil or best-of-a-bad-bunch gas (see chart). Carbon-free renewables and nuclear power account for less than 20% of the world’s energy

Energy is so ubiquitous, yet so important. Like water, you really, truly only value it when it’s suddenly not there. It’s an axiom that economic growth is simply energy converted. We are so much richer now than in the past because we have so many tools to boost what any one person can produce. As a very crude example, we can deliver information at nil cost to the other side of the world instantly using the phone in our pocket. Two-hundred years ago, it would require a ship, a crew, many months, and wind.

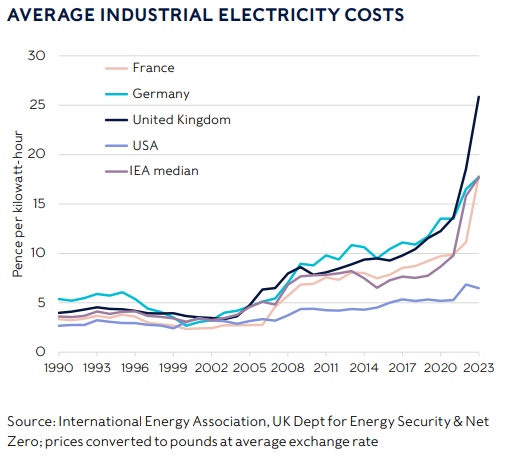

Yet there are other things that do cost a bit more in power today. Fridges, hot water, heating, industrial production lines and cars to name a few. The efficiency of all these applications is phenomenally higher today than in years and decades past, so we’re getting a greater living standard for the same amount of power. Yet we’re still susceptible to the fluctuations in the cost of this power – both at home and at work. Since the Ukraine war upended European energy markets, the UK now has the highest domestic electricity prices of the 31 members of the International Energy Association, with an average almost 60% higher than the median. And that’s with a price cap!

And while industrial customers have a much lower rate compared with households, it’s even more of an outlier against other countries, as you can see from the chart. It’s almost four times the average price paid in the US, which has become extremely restive based partly on a higher cost of energy. When electricity costs businesses so much more, it makes it harder to keep prices low and products and services competitive abroad.

A window into the Fed

We noted last week that UK GDP growth had fallen sharply in the third quarter and that inflation was ready to reaccelerate again in October as household energy prices were headed higher. That duly came to pass, with UK inflation rising by 0.1 of a percentage point more than expected to 2.3%, driven by a big rise in energy costs. This also pushed services inflation higher (electricity is classed as a household service), from 4.9% to 5.0%. Is UK growth getting squeezed out by the high cost of energy?

US President-Elect Trump made energy independence and lower costs a big deal on the stump. He pledged to halve the cost of energy within his first year. That’s a tough ask, but it’s enlightening to think that the US – one of the strongest economies in the world – has the lowest cost of electricity in the world and still thinks it’s too high. The same goes for gas and for petrol: the US is far and away cheaper than its developed peers. For balance, we should add that UK domestic gas prices are bang on the global average and industrial prices slightly below).

The US Federal Reserve (Fed) this week releases the minutes from its November interest-rate-setting meeting. It will be the first proper insight into the Fed committee’s thinking since Trump won the election (the meeting was held over the two subsequent days). Trump’s policies seem tailor-made to increase inflation, therefore reducing the ability of the Fed to cut rates by as much as was expected just a few months ago.

As Trump continues to fill out his Cabinet appointees (they still need to be approved by the Senate), investors are weighing day-to-day how radical he and his team may be in implementing his policy proposals. Mostly, this is flowing through the price of US Treasury bonds. The more that investors believe Trump’s more eye-catching policy planks (such as big tariffs on imports) will be used as bargaining stances to obtain concessions, rather than goals in and of themselves, the calmer they become: Treasury prices rise and their yield falls. With any hint that radical policies are more likely to make it on the books, Treasury prices fall and their yield rises. People will be very interested in how the Fed committee thinks they should position themselves. Although, don’t be surprised if they are super cagey about what they really think.

The views in this update are subject to change at any time based upon market or other conditions and are current as of the date posted. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

This document was originally published by Rathbone Investment Management Limited. Any views and opinions are those of the author, and coverage of any assets in no way reflects an investment recommendation. The value of investments and the income from them may go down as well as up and you may not get back your original investment. Fluctuations in exchange rates may increase or decrease the return on investments denominated in a foreign currency. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.