Mega moves for europe

AMERICAN THREATS TO HIT EUROPE WITH TARIFFS AND ABANDON NATO HAVE MAY HAVE SPURRED THE EU TO LOOSEN THE PURSE STRINGS AND INVEST HEAVILY IN INFRASTRUCTURE AND ITS OWN DEFENCE. CONTINENTAL STOCKS ARE RISING RAPIDLY IN ANTICIPATION OF A SEA CHANGE FOR EUROPE.

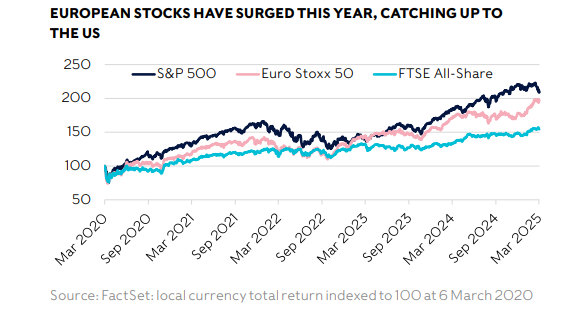

President Donald Trump’s whole schtick is “Making America Great Again”. But in the past week, you could be forgiven for thinking that he may actually be trying to Make Europe Great Again (MEGA?). Since Trump’s election, European stocks have roared higher – even the FTSE All-Share has gained to a lesser degree – while their American counterparts have tumbled (check out the chart below). What’s going on?

The second coming of Trump was widely expected to benefit American companies at the expense of the rest of the world, boost an already strong dollar and push US government bond yields higher. It’s a messy mix of policies though: higher tariffs on imports and deregulation of business should both be good for overall US share prices, the former would be inflationary and the latter deflationary. Tax cuts would spur spending and inflation, while slashing public spending would do the opposite. The administration’s business-friendly bent should give companies the confidence and tools to expand and invest, yet severely curtailing immigration starves them of the skills they may need to execute.

Whatever you think of Trump, you must admit that the force of his will is more powerful than we have seen in a world leader for many, many decades. Part of that is because he pays no heed to convention, etiquette or abstraction. Everything appears transactional and based on the threat or application of force, whether physical or economic. That has allowed him to do things that no one else in his position has ever dreamed of – both at home and abroad – let alone contemplated. In the modern era, at least. Depending on your politics, some of this will be refreshing, some of it horrifying, most of it mindboggling. It’s hard to believe that Trump has been back in the White House for only 50 days. He has all but ripped up the North American free trade arrangement that has greased the continent’s growth since 1994.He has tried to unilaterally shut down billions in public funding that should be the remit of Congress. He has thrown tariffs around like confetti, showering allies and enemies alike. He has launched a crypto token with a $2.6 billion market cap, netting himself $350 million into the bargain.

There’s just so much to keep track of, it’s exhausting! But, also, you don’t know which bits to pay attention to and which things will be delayed, scrapped, or forgotten altogether. And this is where – regardless of your politics – the drawbacks start to build up. Businesses tend to grumble about most things apart from regulation and tax cuts. Let’s be honest, anything else tends to mean more hassle or less profit. But they generally quieten down once the changes are embedded. It’s the change and the uncertainty of a new environment that really, deep down, they are concerned about.

Trump chops and changes so much that nobody is really sure what’s going to happen tomorrow, let alone next year or in five years when that factory you’re planning will finally be operational. This means you’re maybe less likely to go ahead with that new project, or to take advantage of some benefit that Trump has promised is coming down the pipe, say more oil and gas supply, or tax breaks or incentives to invest.

More than anything, businesspeople hate uncertainty.

Can power be spent?

Meanwhile, America’s more aggressive, transactional foreign policy is causing massive shifts in geopolitics. Certain immutable facts and alliances, built up over decades, have fractured almost overnight.

The main one is NATO, a collective security pact that relies on its 32 members being adamant that any attack on one would trigger immediate retaliation by the rest. The US’s equivocation on this point has badly damaged it, perhaps irreparably. But Trump has done more than just put the sledgehammer to an ageing bulwark against the shadow of a Cold War superpower. He has threatened, insulted or economically attacked almost every major nation his country deals with.

This raises a question about the substance of global power. Is America’s heft on the world stage intrinsic and enduring regardless of what it does? Or does it derive its power from being the pre-eminent economy with legions of other, still powerful friends that owe it deference, favours and respect for past aid, shared struggles and common ideals? If America’s power is solely because it’s the biggest fish, Trump is finally making use of that power in his nation’s interest. But if not, he may be drawing down on that power like cashing out an investment built up over many decades. Because few nations are likely to forget Trump’s second term in a hurry, especially if it continues in the same vein as the first 50 days.

How the rest of the world reacts to the US could cause seismic shifts in geopolitics, national objectives and government spending, and trade. This all matters for businesses because it tends to widen or narrow the pool of partners you can work with, the regions you can operate in and the flows of investment you can capture or must contend with.

For instance, German Chancellor-in-waiting Friedrich Merz has proposed to amend the constitution and scrap the country’s debt brake, allowing the creation of a 10- year €500bn infrastructure and rearmament fund. If approved, this river of money could flow into a nation that has parched itself of infrastructure investment for years because of a commitment to straitened government finances. Along with rearmament, it could help revitalise the German ‘mittelstand’, a network of small industrial parts manufacturers that has faded since the Global Financial Crisis. This engine room of the German economy was particularly badly hit when the Russian invasion of Ukraine sent energy prices soaring.

The EU has also stepped in to incentivise its members to spend more on national defence. It proposes allowing nations to spend 1.5% more of their GDP on their military while not including it in rules that limit countries from spending more than they receive in taxes to the tune of 3% of GDP. The European Commission estimates that would free up roughly €650bn over four years. It’s then up to individual nations as to whether they take advantage.

If passed, these policies would amount to a complete change in direction for Europe, which has been saddled with underinvestment, anaemic economic growth and ultra-low interest rates relative to the rest of the world. Excitement about this is why European stocks have skyrocketed in the past couple of weeks. Expectations for greater government spending across the bloc – particularly in Germany – sent the yield on 10-year German bonds soaring from 2.36% at the beginning of the week to 2.85% by the end. It’s hard to explain just how massive that move is.

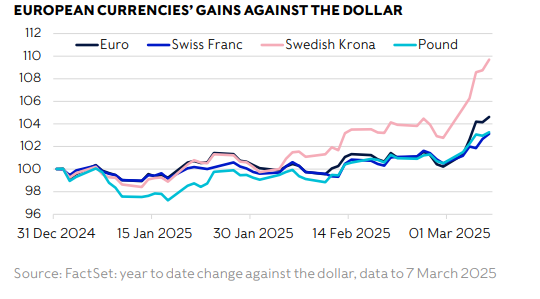

Ironically, this sea-change has coincided with the European Central Bank cutting its benchmark interest rate by 0.25% to 2.5% in an attempt to relieve the beleaguered economic bloc today. Yet the flow of money to Europe driven by this expectation of stronger economic growth, better company profits and higher-yielding government bonds has punctured dollar strength and sent European currencies higher.

Is this really a turning point for Europe, or a false dawn?

The views in this update are subject to change at any time based upon market or other conditions and are current as of the date posted. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

This document was originally published by Rathbone Investment Management Limited. Any views and opinions are those of the author, and coverage of any assets in no way reflects an investment recommendation. The value of investments and the income from them may go down as well as up and you may not get back your original investment. Fluctuations in exchange rates may increase or decrease the return on investments denominated in a foreign currency. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.