A tale of two markets

EQUITY AND BOND INVESTORS HAD OPPOSITE REACTIONS TO THE US ELECTION. BUT TRUMP 2.0 MAY HAVE LESS INFLUENCE THAN INVESTORS FIRST HOPED OR FEARED.

The market response to Donald Trump’s decisive reelection victory last week, and the Republican party’s likely clean sweep of Congress, was equally unequivocal. The S&P 500 finished the week up 4.8%, probably driven in large part by hopes for another round of corporate tax cuts under President Trump and a Republican Congress. Tenyear US government bonds (Treasuries), the benchmark for US and global borrowing costs, moved in the opposite direction, pushing yields higher. However, we don’t think the longer-term outlook for stocks or bonds is so clear cut.

Looking at Trump’s plans in the round, widespread tax cuts, higher tariffs and restricted immigration could add up to higher inflation and interest rates – anathema for bond investors. But after a challenging week, the start of the new one has brought some much-welcomed calm to government bond markets. This may be an acknowledgement that there are still a few months before Trump even sets foot in the Oval Office (inauguration day is 20 January), but we’ll have to wait and see if this is just a temporary reprieve.

While corporate tax cuts under Trump could strengthen economic growth in the short term, inflation is likely to be higher, as we noted in our US election update on the day of Trump’s victory. US government bond yields could also go up in response to a widening deficit. Growth would likely weaken in the longer term, restrained by higher rates and potential government belt tightening.

For context, one of the flagship pieces of legislation during Trump’s previous term as president was the 2017 Tax Cuts and Jobs Act (TCJA), which cut the headline rate of corporate tax from 35% to 21%. The TCJA is due to expire at the end of 2025, and Trump has proposed not only making these cuts permanent, but going a step further with a reduction to just 15%.

We estimate that this would increase annual post-tax earnings by 8% for a company paying the headline rate of corporate tax. Given the long-term growth rate of earnings is 7% in the US, that’s more than a full year’s worth of typical growth added on top.

US equity investors have generally cheered Trump’s return, but the mood was different in the rest of the world. Not only would non-US stocks not have any direct benefit from lower US corporate taxes, but they face the spectre of ‘universal tariffs’ under Trump 2.0.

Increased tariffs could be a problem for US equities too. If anything close to Trump’s full ‘universal tariff’ is implemented, inflation could be pushed temporarily higher (analysis in our pre-election report suggested by one percentage point or more), while economic growth would be temporarily weaker. By how much depends on how much other countries retaliate, how tariff revenue is used, and how the Federal Reserve reacts.

There is considerable doubt about both Trump’s willingness and his ability to implement his plan. And one question we’ll be pondering is whether Trump’s mooted tariff increases are more of a negotiating tactic than a definite plan.

Follow the clean-energy money

As we look ahead to the reality of a second Trump presidency, the immediate reaction of stock investors at a sector level may also prove to be short-lived. Taking the energy sector as an example, on the surface Trump’s policies seem very positive for oil and gas stocks, and negative for clean energy investments. Trump’s energy policy can be summed up in his ‘Drill, baby, drill” mantra.

As you might expect, among the biggest losers on Wall Street last week were American solar-panel manufacturers. But if we take a step back from the headlines and rhetoric, and follow the money, maybe it’s not all doom and gloom for clean energy in America after all.

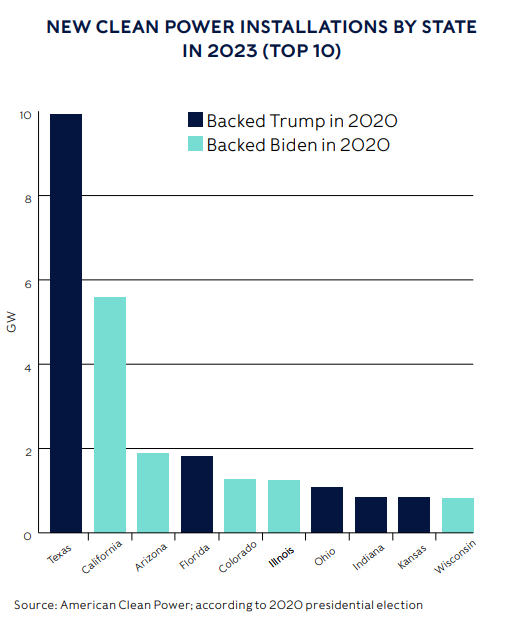

Trump intends to change the direction of US energy policy fundamentally, rowing back on the Biden administration’s support for clean energy and goals for ‘net zero’ carbon emissions. Parts of this agenda could be implemented easily by executive order, such as leaving the Paris Agreement and UN climate bodies, or rescinding Biden-era orders restricting fossil fuel leases on federal land. But other elements may prove much harder even in a Republican controlled Congress. Even though congressional Republicans universally voted against the passage of Biden’s misleadingly named Inflation Reduction Act (which is first and foremost a landmark piece of climate legislation), many may be unwilling to vote for its repeal. The key reason is that funding for clean power from the Act has disproportionately benefitted Republican areas of the country (see chart below).

Remarkably, more than 80% of all large commercial wind farms, solar farms, and battery projects currently under development are in Republican-held congressional districts. Republican Texas, famed for its oil industry, installed more than twice as much clean power capacity as any other state in 2023. Most of the states generating the highest share of their electricity from renewables are Republican too, including Iowa, South Dakota and Kansas.

In this context, it’s still possible that a Republican administration would chip away at parts of the Inflation Reduction Act’s climate provisions, but many Republican lawmakers have strong incentives to vote against a broader repeal.

Although it might sound strange, it’s plausible that a Republican-controlled Congress would simultaneously support the deregulation of the fossil fuel industry which Trump favours, while maintaining most of Biden’s clean energy subsidies. This could be framed as matching Trump’s ambition to have the “lowest-cost energy and electricity in the world” and supporting his aim of “American energy independence”.

We shouldn’t downplay just what a seismic historical event Trump’s return is. But if there’s one thing the last few years in markets have shown clearly, it’s that the most important drivers of investment performance are things beyond the direct control of any US president.

For long-term investors, it’s vital to maintain that broader perspective as markets react to the election result, particularly when it comes to the choice of individual stocks and sectors

The views in this update are subject to change at any time based upon market or other conditions and are current as of the date posted. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

This document was originally published by Rathbone Investment Management Limited. Any views and opinions are those of the author, and coverage of any assets in no way reflects an investment recommendation. The value of investments and the income from them may go down as well as up and you may not get back your original investment. Fluctuations in exchange rates may increase or decrease the return on investments denominated in a foreign currency. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.