UK growth deflated

THE UK ECONOMY HIT THE WALL LAST QUARTER, WHILE INFLATION STARTED RISING AGAIN. IN THE US, EXPECTATIONS OF INTEREST RATE CUTS HAVE COOLED SINCE DONALD TRUMP WAS ELECTED PRESIDENT.

The British economy ran out of steam in the third quarter. GDP growth was just 0.1%, down from 0.5% in the summer, according to the first estimate from the Office for National Statistics.

Services, which make up the lion’s share of the economy, were the big drag. These businesses, which include labour-intensive industries like cafes, the law and finance, delivered just 0.1% more in the quarter. Three months earlier, they had increased output by 0.6%. Most of the slowdown was in business-facing areas, such as IT suppliers and administrative support. In contrast, those selling services to households – such as retailers, wholesalers and garages – held up much better. Worryingly (as it makes up 12% of the economy), finance and insurance output shrunk for the second quarter in a row. Another detractor was manufacturing, which fell 0.2%. Meanwhile, construction rebounded 0.8% after three quarters of falls. In terms of GDP per head, it slipped 0.1% over the quarter. That means the population grew faster than the overall economy.

Interestingly, given lingering concerns about the cost-of-living crisis, households were a bright spot in the growth numbers. Spending accelerated from 0.2% growth in Q2 to 0.5% in Q3. The average wage in Q3 was 4.3% higher than a year earlier. That’s down from previous quarters, but still offers a real increase in pay after inflation. Unemployment rose from 4.0% to 4.3%, although given the ongoing issues with the survey, it’s worth taking the reading with a pinch of salt.

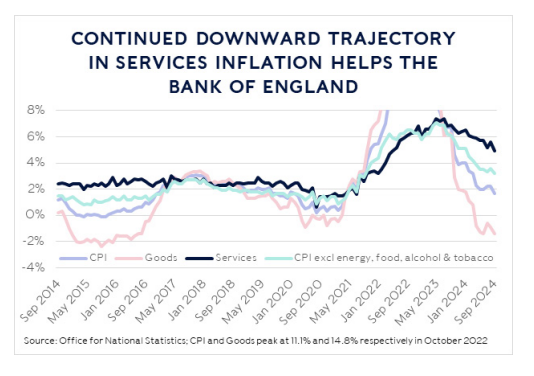

UK inflation for October is due on Wednesday. It’s expected to rise from 1.7% to 2.2% as the energy regulator hiked the cap on household bills by 9.5% in October. The core rate – which strips out volatile food and energy prices – is forecast to remain the same as the previous month at 3.2%. The Bank of England will be keeping an eye on how services inflation is faring. In September it dropped below 5% for the first time since May 2022. A continued downward trajectory will help encourage central bankers that they can keep cutting rates without issue. A reversal would give them pause.

Investors less sure on US rate cuts

US inflation also accelerated in October, rising from 2.4% to 2.6%. Like in the UK, this was expected. The cost of shelter accounted for more than half the increase and was 4.9% higher than a year earlier. Core monthly inflation was 0.28% higher than a month earlier, in line with market expectations. Yet the figure has averaged an annualised 3.6% over the past three months. That shows inflation is still sticky and that it’s still too early for the US Federal Reserve (Fed) to claim total victory.

US Producer Price Inflation, which captures changes in the wholesale price of goods and services sold to retailers, reaccelerated in October from 1.9% to 2.4%. The overwhelming driver was a large increase in the cost of services, especially transportation and warehousing.

Investors’ expectations of a 25 basis points (bps) Fed rate cut in December have shrunk significantly in the past month. There’s now a 60% chance of the benchmark overnight US interest rate (the Fed Funds rate) falling to the 4.25-4.50% band, compared with 80% in mid-October. As for the probability of rate cuts next year, fully two fewer 25-bps moves are expected compared with a month ago. The Fed Funds rate is now forecast to end 2025 at 4.0% instead of 3.5%.

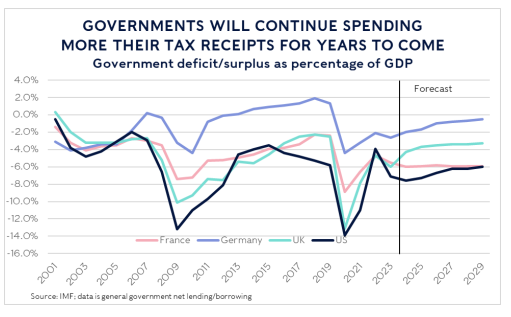

This uncertainty about inflation, in part due to the potential policies of a second Donald Trump presidency, is a good part of the reason why government bond yields have popped higher this month. Another part is the expectation of increased government deficits. Trump has enlisted serial entrepreneur Elon Musk and former Republican presidential hopeful Vivek Ramaswamy to launch a governmental efficiency office aimed at slashing spending. That would help offset big drops in tax revenue that would result from Trump’s plans to make big cuts to corporate and household taxes. It would also help turn around the big government spending deficit that has caught bond investors’ attention in recent months (and the US isn’t the only culprit, as you can see from the chart).

This work is harder than it sounds, given the huge vested interests in any sort of government spending. And that’s not just secretive corporate interests, but households too! In 2023, 76% of the $5.75 trillion of spending (after the interest costs of government debt) were transfer payments from one set of taxpayers to another (mainly social security), including tax credits and aid programmes to the states. So it’s impossible for Musk to trim anything like $2trn dollars without Congress slashing these programmes, which was not something Trump campaigned on. Musk has quipped that half of federal employees should be fired: 70% of the 2.3 million people working for the federal government are employed by the military, security agencies or veterans’ care providers. It’s not exactly clear Republicans want to see that cut. Ramaswamy told Fox News that he wanted to “delete” the Department of Education. US schools are run by states and local authorities, so it’s not as drastic as shutting down all state schools. In effect, it would simply reduce funding to the tune of 15% of total education spending, which is a very small part of federal outlays. That would disproportionately hit the poorest, however, given federal funding tends to be redistributive.

It’s not impossible to change course though. Indeed, sometimes it’s amazing to see how much different the future can be! Deutsche Bank research analysts have noted that in early 2000 the US Congressional Budget Office had expected all US government debt to be paid back by 2013 at the latest, given the trajectory and fundamentals of the time. It expected the US to have zero debt by 2025. America starts the new quarter-century in 2025 with $28trn more debt than expected and a debt total that’s roughly as big as the country’s GDP.

The views in this update are subject to change at any time based upon market or other conditions and are current as of the date posted. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

This document was originally published by Rathbone Investment Management Limited. Any views and opinions are those of the author, and coverage of any assets in no way reflects an investment recommendation. The value of investments and the income from them may go down as well as up and you may not get back your original investment. Fluctuations in exchange rates may increase or decrease the return on investments denominated in a foreign currency. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.