Preparing for a tough budget

LABOUR WILL DELIVER ITS FIRST BUDGET IN ALMOST 15 YEARS THIS WEEK. WITH LITTLE WIGGLE ROOM AND A SHOPPING LIST OF PROBLEMS, IT WILL BE HARD FOR THE CHANCELLOR TO PLEASE ANYONE.

Only one person is allowed to drink in the chamber of the House of Commons and then only on one occasion: the Chancellor of the Exchequer at the Despatch Box on Budget Day. New Chancellor Rachel Reeves may need to take advantage on Wednesday.

After the longest wait for a new government’s first Budget in more than 50 years, Reeves will set out her plan to boost growth, invest in creaking public services and infrastructure, and balance the books. All while trying not to spook the bond market and encourage an exodus of the wealthy. May need to make it a double…

It will have been 117 days since Labour took power with arguably the most tepid landslide victory ever recorded. Governments typically lose elections rather than Opposition parties winning them, but this year’s election took it to a new level. Big defections from the Conservatives to Reform (and the annihilation of the Scottish National Party) split the vote on the right and helped Labour scoop up hundreds more seats. Yet almost one in every five MPs squeaked through with a margin of less than 5%, a record going back to at least 1992.

In a nutshell, people were fed up with the Conservative government after 14-odd years, but they weren’t too enthused about what Labour was promising. In fairness, all Labour promised were no hikes on Income Tax, National Insurance or VAT. That and a vow to be more competent. Given the big vote swing to Reform, which offered big unfunded tax cuts, you can see why Labour might have thought that a detailed manifesto of tax changes to increase revenue wouldn’t have got them elected. Unfortunately, now elected, these promises to avoid the biggest tax levers give the government much less room for manoeuvre.

There are only two ways to make a government’s numbers add up: raise more tax and cut spending. Of course, this simplicity hides a range of complications. Cut spending too much and the economy will choke, leading to less tax revenue. Raise taxes too much and you will discourage people from working harder and investing more, reducing economic growth and your tax take over the long run.

It’s well known that UK taxes are skewed overwhelmingly towards those with the highest incomes. The Institute for Fiscal Studies (IFS) estimates that 80% of all taxes are paid by the top half of UK taxpayers by income. The independent thinktank’s work includes Income Tax, National Insurance Contributions, VAT, excise duties and Council Tax, which account for roughly three-quarters of all receipts. With the biggest, broadest-based taxes off the table, the only options left are those that fall on the wealthiest. French King Louis XIV’s finance minister colourfully described the problem: “The art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest possible amount of hissing.” What exactly is too much? That’s the dangerous unknown that the government needs to determine

As for borrowing, the government has a lot of it – more relative to GDP than it has had since the 1960s. Many argue that it would be irresponsible for it to take on more. However, that’s not especially true. If a government can borrow to invest and boost economic growth by more than the borrowing costs, that makes more sense than loading up on taxes today that discourage private enterprise investment. The hard part is that you can’t know ahead of time that money invested will deliver what you hope years down the line. And neither can bondholders, who have to trust that the government will be able to repay them. About a quarter of UK government debt is owned by overseas investors, so our bond market is particularly sensitive in this regard. If they get spooked, they can sell and walk away, sending the price of UK government bonds lower and therefore pushing the yield – the cost of borrowing – higher. As former Bank of England Governor Mark Carney used to say, Britain relies on “the kindness of strangers” to fund its spending shortfall.

Late last week, Chancellor Reeves said that she would adjust the fiscal rules inherited from the last government to allow greater borrowing for investing in public services. One of those rules is that the nation’s debts relative to GDP must fall over the five-year parliamentary term. By using a broader measure of net public debt (all the nation’s liabilities less its assets) that includes relatively more assets – like, for instance, student loans, public sector pension funds and equity stakes in private companies – than it does extra liabilities, it creates more headroom to borrow. It’s believed that this should increase the ability to borrow by £40 billion. The rumours are that most of this will remain unused as a show of restraint to ease bondholders’ nerves. We will have to see – the benchmark UK government 10- year bond yield has increased noticeably in recent weeks, from a range of 3.8%-4.0% to 4.0%-4.3%. In part, this is a global trend, but gilt yields have risen by more than those of European bonds, albeit less than US bonds, as we note below. Meanwhile, IFS director Paul Johnson claims this could be “one of the biggest tax raising Budgets in history”. We all might need a stiff drink on Wednesday then.

We will release our views on the Budget along with how it could affect markets and your finances on Wednesday evening. Look out for our updates here.

Yielding to reality

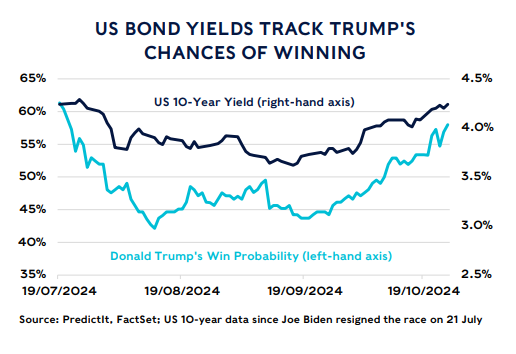

Government bond yields are on the rise in the US too. As are the chances of Republican Donald Trump taking back the White House, according to PredictIt, a betting website.

The benchmark US 10-year government bond yield, having dipped during the height of Democrat Kamala Harris’s initial surge in popularity in the summer, has risen above 4.2%. The last time it was that high was when Trump was the odds-on favourite, pitted against President Joe Biden. This could be a coincidence, yet Trump’s policy platform is highly inflationary and would likely exacerbate already high American federal deficits.

There was quite a bit of funny business going on in prediction markets – some big trades made by one or two anonymous traders. And some seemed to be trading with themselves, what’s known as a ‘wash-trade’, a way to manipulate market prices. Yet, broadly, the probability of Trump winning has tallied with his gaining ground in the all-important swing states. As of Monday, Trump leads in all seven of the most-watched states: Arizona, Nevada, Wisconsin, Pennsylvania, North Carolina and Georgia.

A greater risk of inflation, more government spending and less revenue as the result of big tax cuts make bondholders uneasy as they eat into expected returns. Whether Trump will actually follow through on some of his more bombastic election pledges is hard to say. Many of the things he’s said on the stump – big increases in tariffs, winding down infrastructure spending, for example – would hurt his base the most. Yet the fact that he may adds to the margin of safety that investors need to compensate them for the vagaries of the future.

That means higher yields on US government bonds, so higher borrowing costs. Which makes the deficit spending that bit worse. Meanwhile, the can that is forever being kicked down the road is only a few more footsteps ahead: the US debt ceiling needs to be lifted by 1 January. This is a strange legislative issue that often becomes a game of chicken among lawmakers. While Congress has agreed to spend the money that will need to be borrowed, there’s an arbitrary limit on how much debt the country can issue. If the spending goes above that ceiling – which it will, and Congress has literally planned that it will – the US government cannot issue more debt. There are workarounds and accounting gymnastics that can keep the wheels turning for a small while. But soon the US government would have to stop spending, send its employees home without pay, and generally shoot itself in the foot.

This could not come at a worse time. In January, President Biden will be a lame duck, as the next President will already have been elected but not inaugurated. If it’s Harris and control of Congress is split between Democrats and Republicans, you can see disgruntled Republicans refusing to play ball. Similarly, if Trump is President-Elect, Democrats may just be bloody-minded enough to throw a stick in the spokes of government.

Now, these showdowns have always sorted themselves out before, without causing too much damage. We believe that will happen again this time – lawmakers know the gravity of the situation. The potential fallout is so large and the trigger effectively a pointless rubberstamping of already-agreed fiscal plans. Yet the closer the cliff-edge comes, the more volatility you are likely to see in US government bond markets.

The views in this update are subject to change at any time based upon market or other conditions and are current as of the date posted. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

This document was originally published by Rathbone Investment Management Limited. Any views and opinions are those of the author, and coverage of any assets in no way reflects an investment recommendation. The value of investments and the income from them may go down as well as up and you may not get back your original investment. Fluctuations in exchange rates may increase or decrease the return on investments denominated in a foreign currency. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.