The Case for Global Real Estate

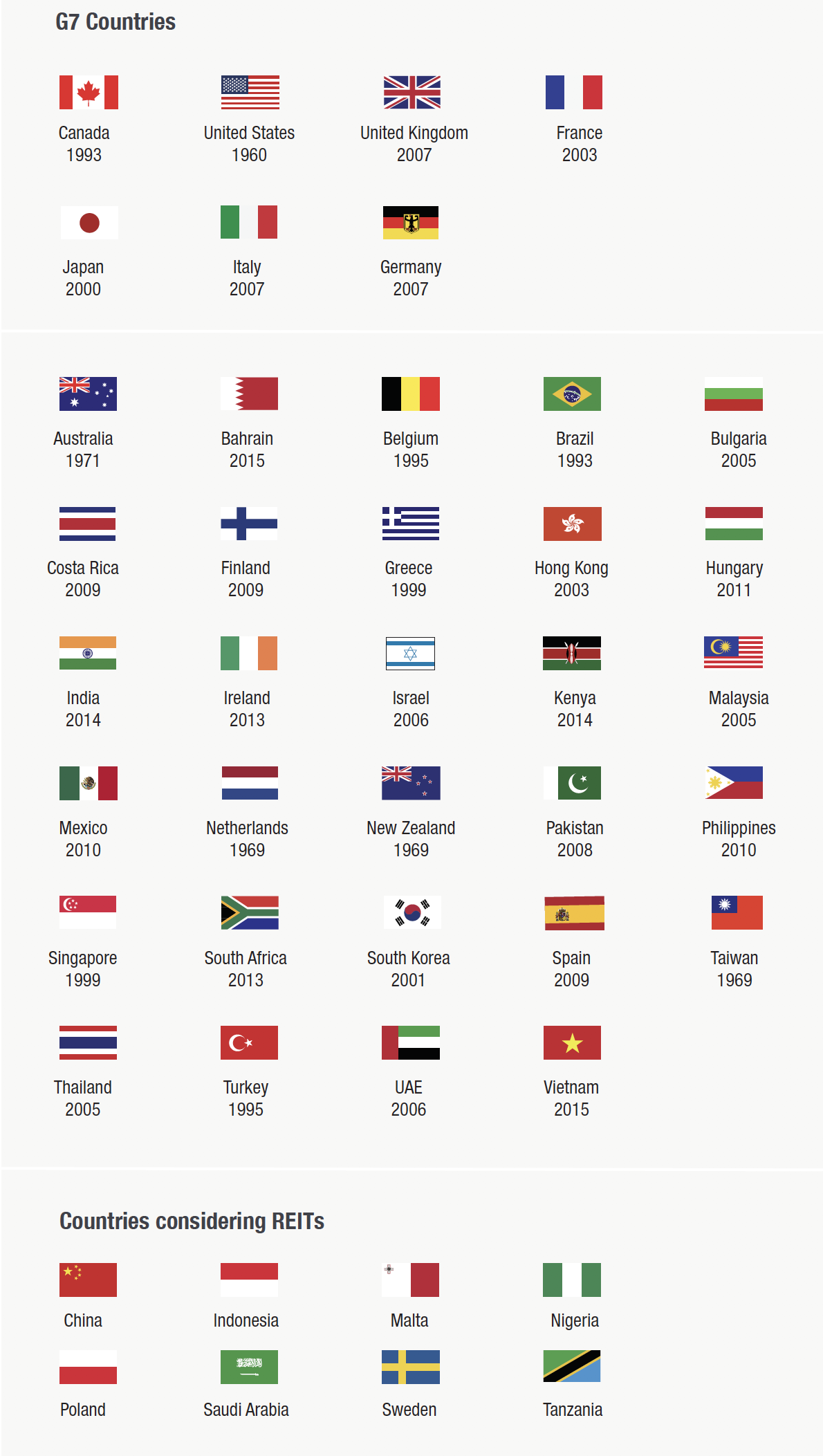

Countries that have adopted the REIT approach

In most countries in order to qualify as a REIT, a company must first meet two tests. First, the majority of the firm’s assets must be real estate (definitions and thresholds vary by country). Second, the firm must distribute most if not all of their earnings each year to investors. In some countries meeting the distribution test allows the REIT to avoid corporate income tax and distributions are paid out of pre-tax income.

Additional Information

Tax Illustration

| Corporation | REIT | |

|---|---|---|

| Revenue | $100.0 | $100.0 |

| Expenses | $70.0 | $70.0 |

| Pretax Income | $30.0 | $30.0 |

| Tax | $8.4 | — |

| Net Income | $21.6 | $30.0 |

| Distributions | $11.9 | $30.0 |

| Tax | $4.6 | $7.5 |

| Tax rate** | 39.3% | 24.6% |

| Net Cash Distribution | $7.2 | $22.5 |

Sources: E&Y Tax Calculators, company reports, Starlight Capital, Bloomberg LP.

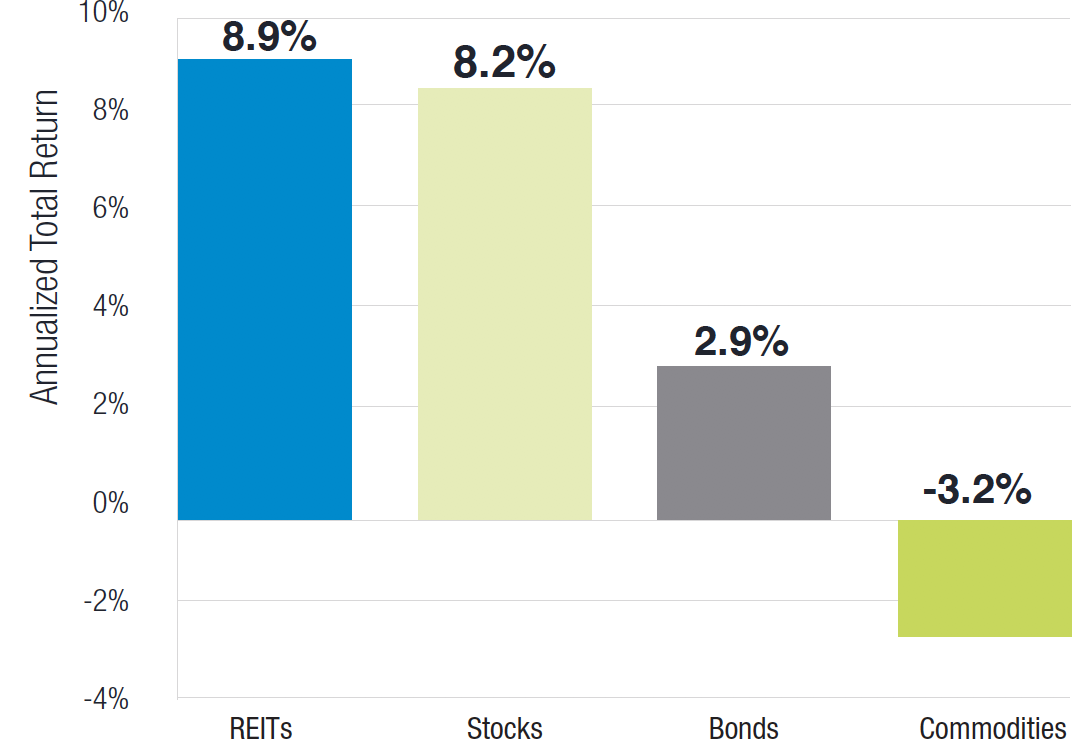

The outperformance of REITs over this time period is often linked to declining interest rates. However, it’s important to note that global equities outperformed global bonds during this time period. Global equities were also levered to falling interest rates and certainly to rising economic output. The outperformance of REITs during this time period is a function of their structure and the unique attributes of REITs.

After-tax yield comparison

| High Yield Bonds | Common Equity | Preferred Equity | REITs | |

|---|---|---|---|---|

| Yield | 5.88% | 2.82% | 3.87% | 5.62% |

| Tax Rate | 53.53% | 39.34% | 39.34% | 24.64% |

| A-T Yield | 2.73% | 1.71% | 2.35% | 4.24% |

| Inflation | 1.50% | 1.50% | 1.50% | 1.50% |

| A-T Real Yield | 1.23% | 0.21% | 0.85% | 2.74% |

Notes: High yield bonds represented by the Horizons Active High Yield Bond ETF, Common equity represented by the S&P/TSX Composite Index, Preferred equity represented by BMO Laddered Preferred Share Index ETF, REITs represented by the S&P/TSX Capped REIT Index. As of January 27, 2020. REITs distribution breakdown as for 2018 represented by the S&P/TSX Capped REIT Index.

*Based on Ontario top marginal tax rate as of January 2020.

REITs outperform other major asset

December 31, 2002 - December 31, 2019

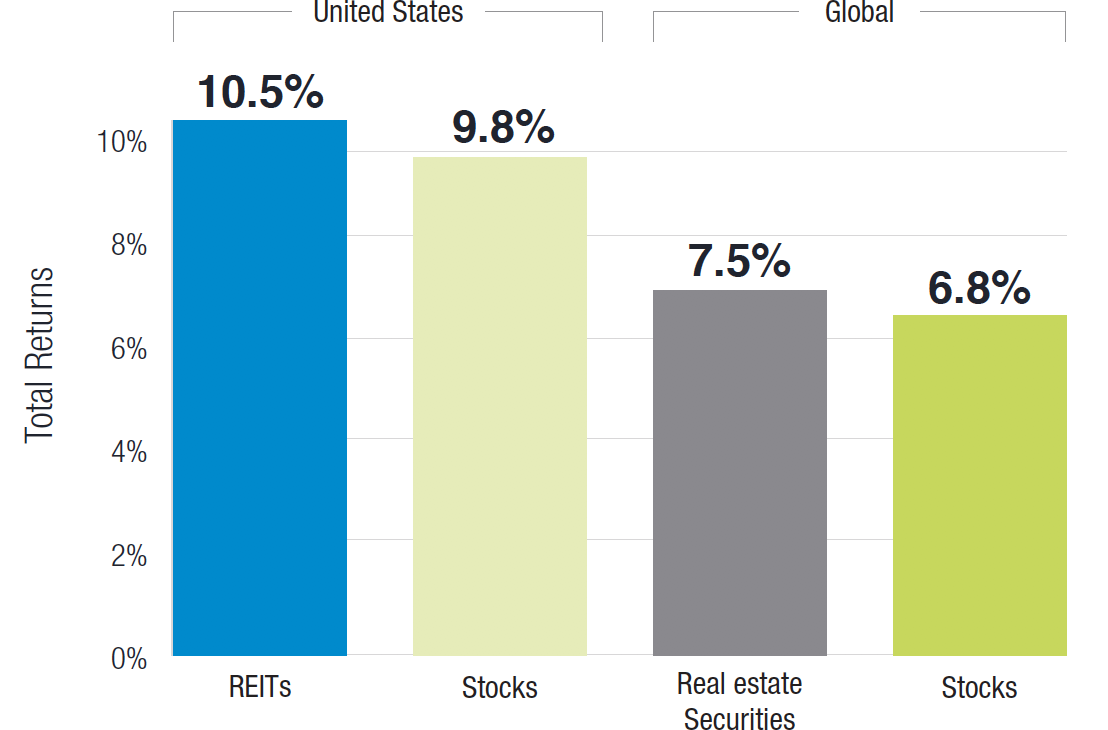

Because of the structure of REITs (mandatory high payout ratios), the total returns from REITs have a significant income component. Historically the total returns from REITs have been evenly split between capital appreciation and distributions. However, the distribution yield from REITs has historically been almost twice the dividend yield from common equity.

Contribution of reinvested dividends to total return

December 29, 1989 - July 31, 2018

quoted represents past performance, which is no guarantee of future results. The (rate of return or mathematical table) shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of a Starlight Capital investment fund (mutual fund, alternative investment fund or non-redeemable investment fund). The contribution of reinvested dividends is the difference between the total return and price return published by the index provider.

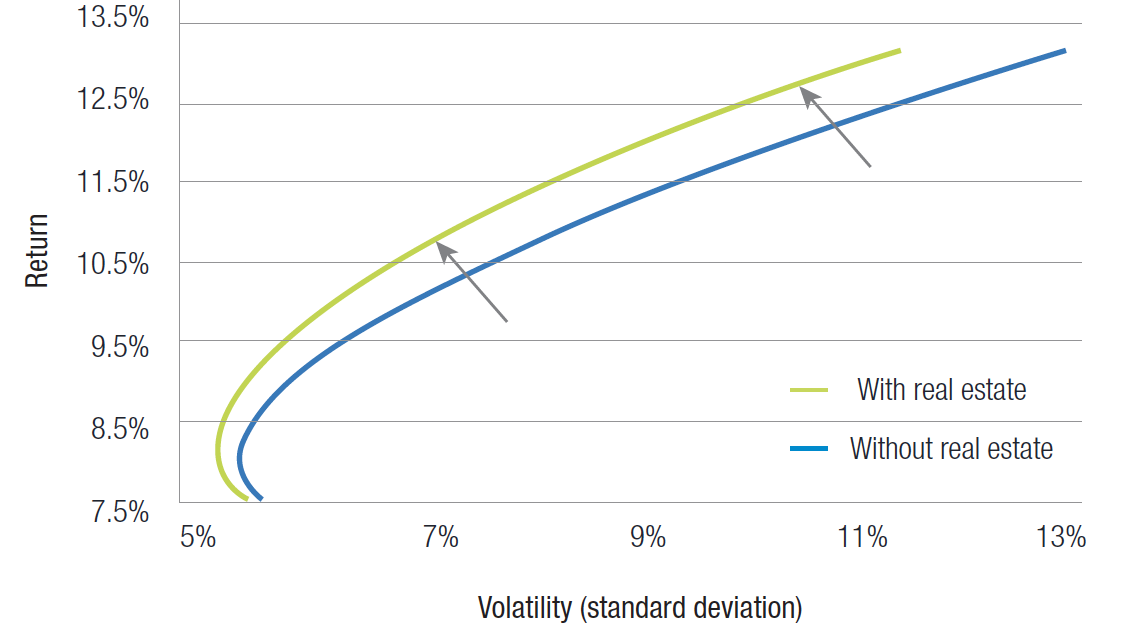

Efficient frontier with and without real estate

Many investors have done well investing in the S&P/TSX Capped REIT Index over the last several years. However, it’s important to note that Canadian REITs represent a very small fraction of the publicly-traded real estate available to investors. While the US still dominates at just over 52% of the FTSE EPRA NAREIT Developed Index (our benchmark), there is representation from over 20 different countries. At just 2.9% (19 total names), Canadian REITs are the seventh largest geographical allocation in this benchmark. By limiting themselves to Canadian REITs, investors are foregoing opportunities to own investment grade commercial real estate in world class cities such as New York, London, Paris, Singapore and Hong Kong. These are markets where supply is generally limited, and demand is usually robust, yielding rising real estate values and strong risk-adjusted returns. In addition, several global REIT sectors don’t exist in Canada (towers, datacenters, self-storage, student housing) and are only available to global REIT investors.

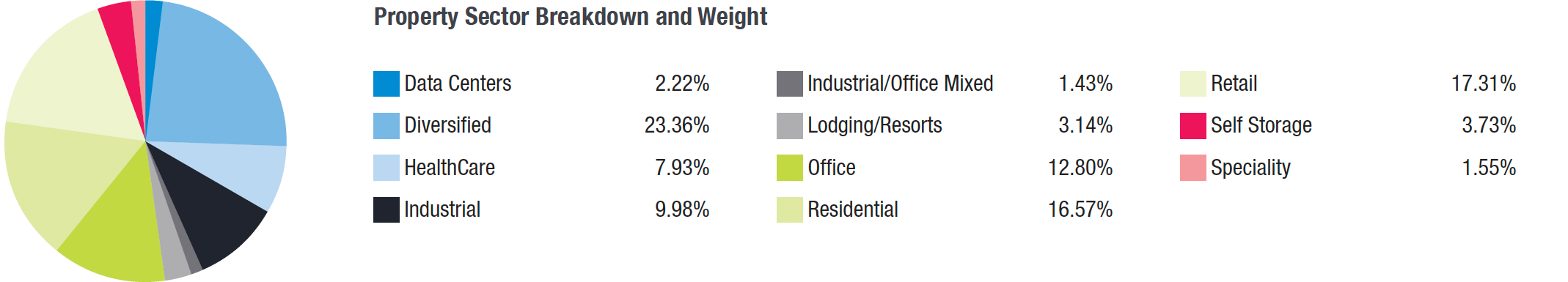

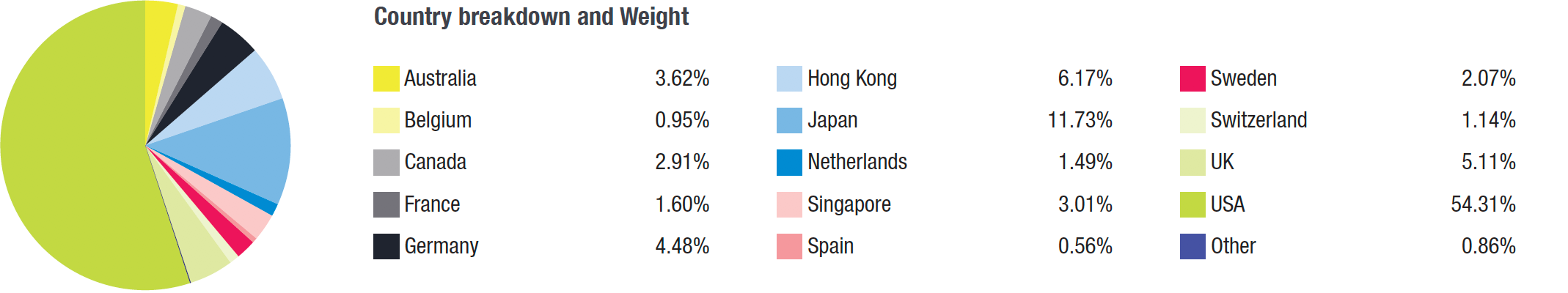

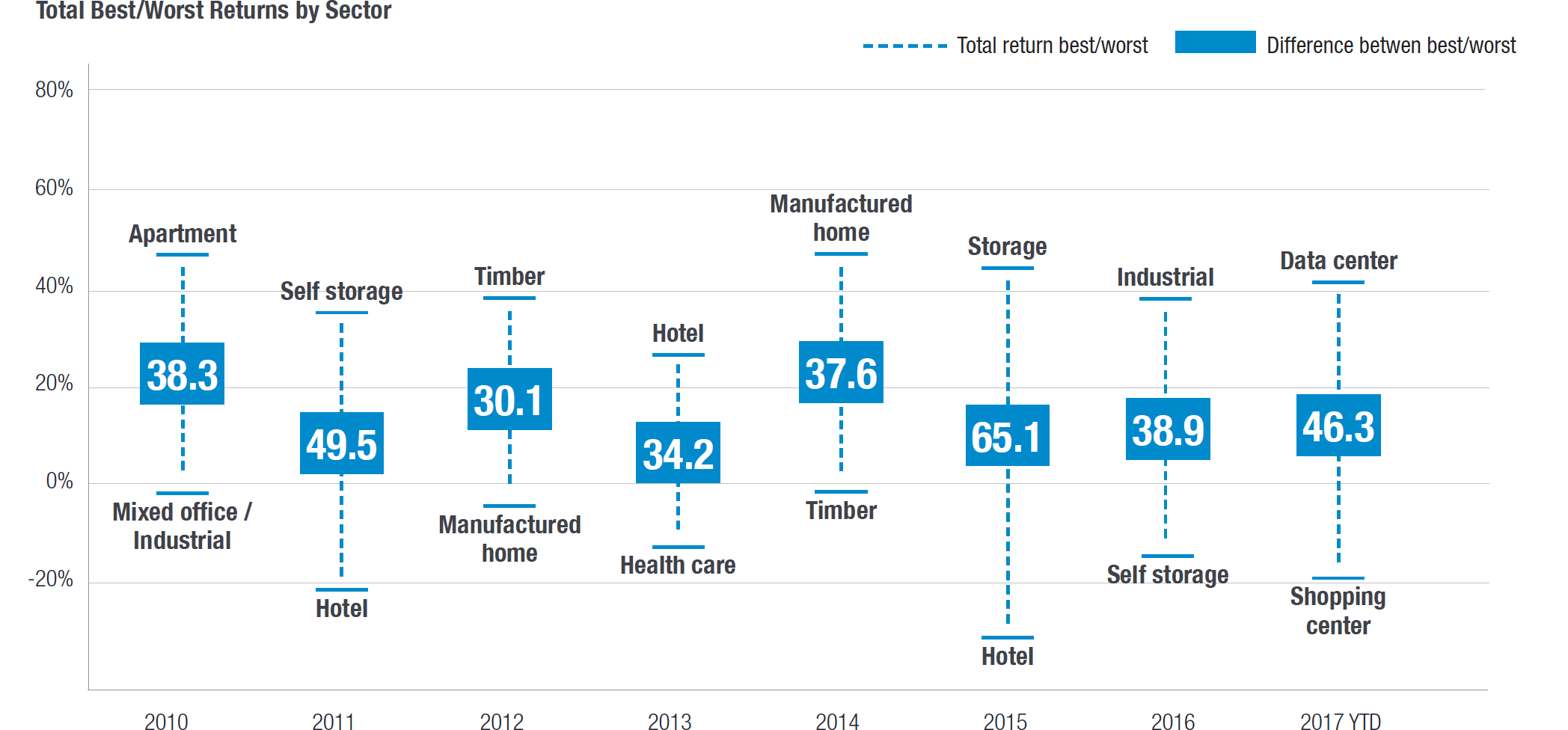

FTSE EPRA NAREIT developed index country and sectors

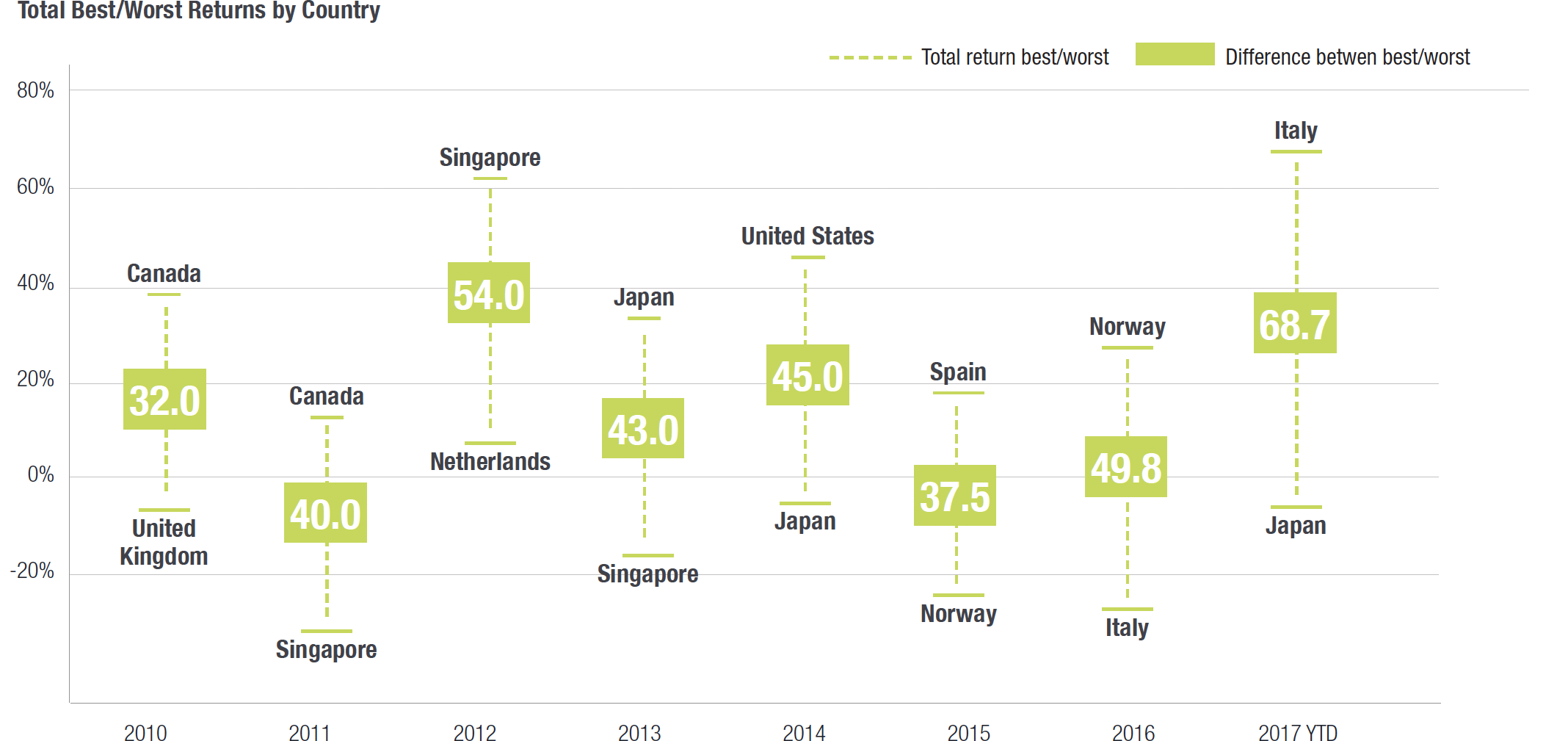

Annual global real estate returns dispersion

Data quoted represents past performance, which is no guarantee of future results. The information presented above does not reflect the performance of any fund or account managed or serviced by Cohen & Steers, and there is no guarantee that investors will experience the type of performance reflected above. Property sector returns based on FTSE NAREIT Equity REIT Index. Country returns based on FTSE EPRA/NAREIT Developed Real Estate Index. As at August 31, 2017.

Starlight Capital approach

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.